Market Overview: DAX 40 Futures

DAX futures went sideways with a Low 1 in a Bull Microchannel. It was a failed breakout above the prior trading range, but most traders expect more now or after a short pause. Because bulls have a higher probability, their stop is far away, and they need a higher low to move it up. Bears their higher low to fail and get a failed High 1 move back to the MA.

DAX 40 Futures

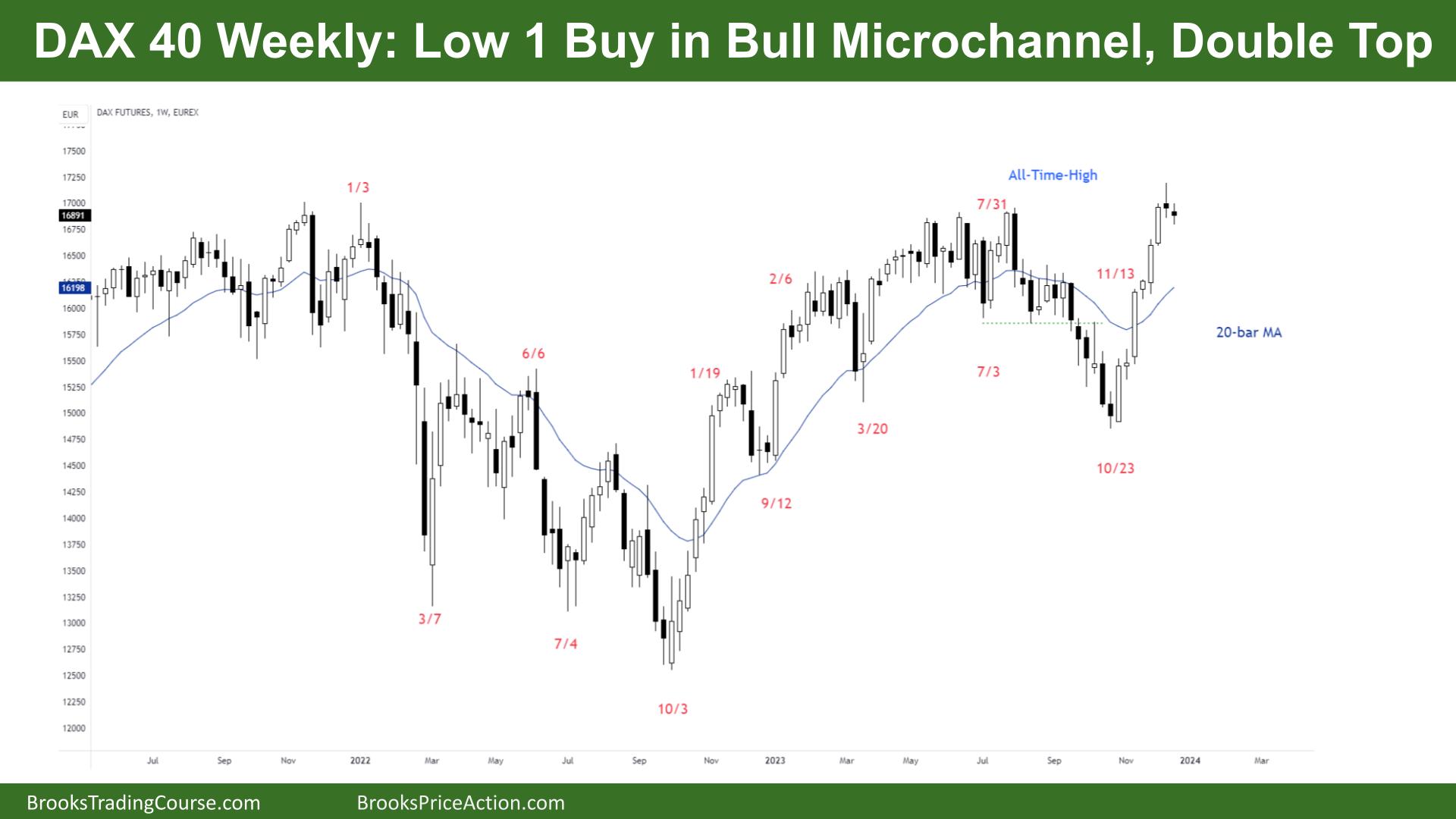

The Weekly DAX chart

- The DAX 40 futures went sideways last week with a Low 1 buy in a bull microchannel.

- We got a new all-time high – ATH – and might need to go sideways for traders to decide if this is a breakout and measured move up or test back down.

- We are always in long, so it is better to be long or flat.

- Some traders see a parabolic wedge top. Three pushes with small pauses between. Traders will expect two legs sideways to down, and then trend resumption is likely.

- But bears see an expanding triangle. So, they are expecting High 1’s to fail. Most traders should not sell until bears close a gap or get a reasonable second entry short.

- Bulls see a tight channel up and open gaps. So very high likelihood of a second leg up.

- Bulls want a tail below to get in more bulls and start a move up, but it is a weak High 1 buy now. Some bulls will wait for the High 2 to set up or a bull bar to buy above.

- Weak sell below the Low 1 and weak buy above the bar, so probably sideways next week.

- Bears want a give-up bar down to the low of the big bull bar to the left. That would encourage bears to scale in above.

- Long traders needed an opposite bar to take profit, but last week was not strongly down. They might take profit under this week.

- Some limit order traders will expect faders to get disappointed. So they will enter within a 1:1 of that bear bar to get a discount.

- We are also far away from the MA. We never returned to it six weeks ago, and traders might wonder if we need to return there first.

- Some bears got stuck fading the move up and scaled in higher. They want it to return to the 50% point between their two entries. But they don’t have a good signal to fade yet. The pain trade would be higher.

- Bears see an expanding triangle, and selling above here was profitable three times previously.

- They will likely continue doing it until they get stuck fading the highs of this range.

- Expect sideways to up next week.

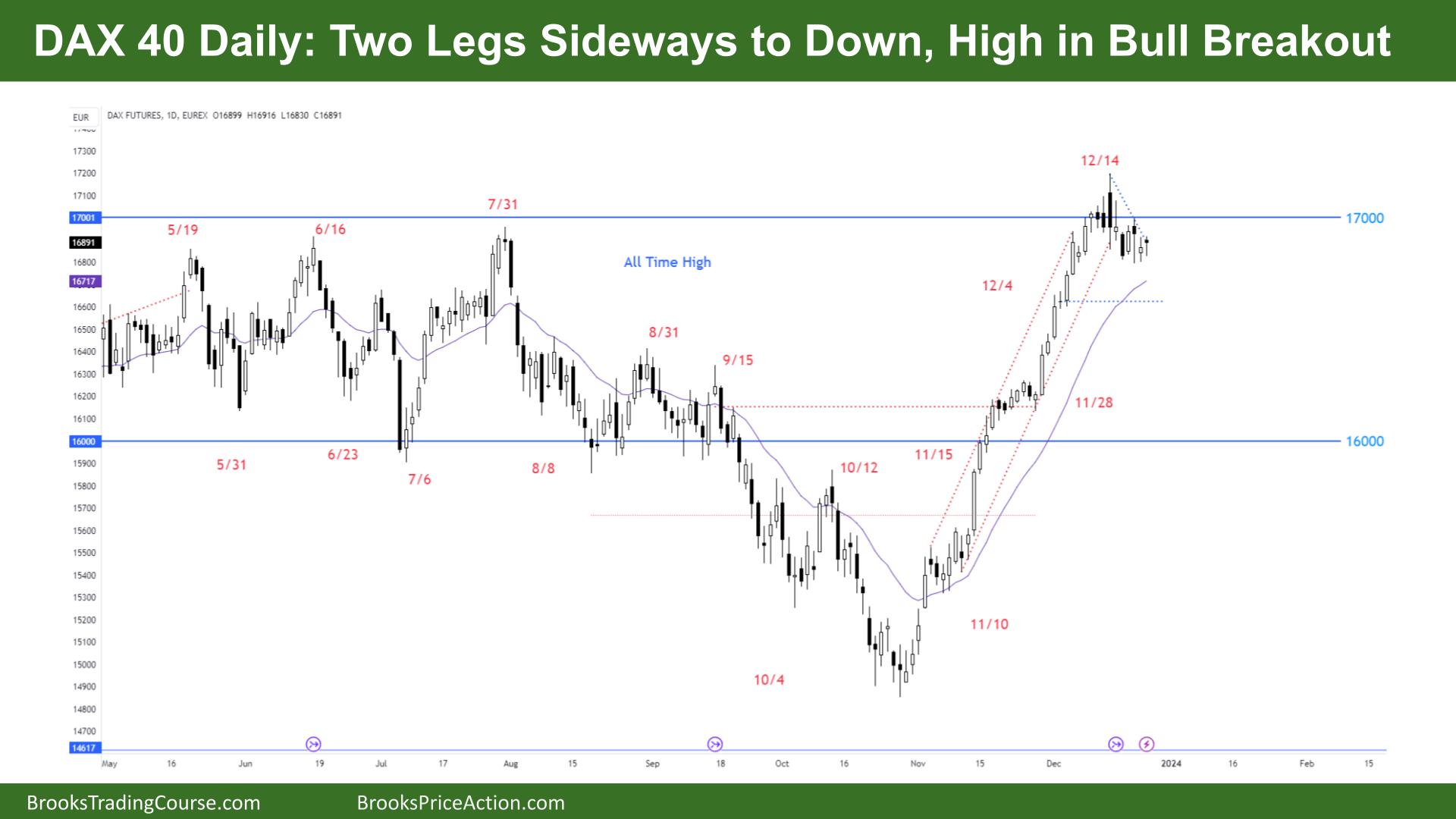

The Daily DAX chart

- The DAX 40 futures went sideways with a pair of dojis to end the week.

- After such a strong breakout traders expected to go sideways once reaching the 17000 Big Round Number.

- It is a very tight channel for the bulls, and for the first time, it made sense to take profit in many bars.

- Some bulls were looking for a place to buy below but were forced to buy higher than they would like.

- Other bulls want a chance to buy the MA and might get a chance next week.

- The bears see the top of a trading range and have many open gaps below. They want a good bear bar to sell above and a reasonable sell signal to trigger. So far, they haven’t got anything significant.

- With such a strong move, most traders will expect a double top to form before counter-trend traders get a chance to get a good position.

- Bears broke a trendline, so a test of the highs is likely to follow next. 75% chance the bear channel breaks back up.

- The bull move was so climactic that the bears wanted a big move back down. But it is more likely there will be buyers at the MA.

- Several inside bars and outside bars, so we might have begun a trading range for 10 – 20 bars.

- Most traders should only be looking to get long or stay flat.

- Expect sideways to up next week with a test of the MA.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.