Market Overview: DAX 40 Futures

DAX futures went higher forming a High 1 from a reversal up from 18000. Such a strong spike needed a correction and the pullback was deep. It might need a second leg sideways to down before bulls buy again. The moving average is just below and there are likely buyers in the area as well if we get there.

DAX 40 Futures

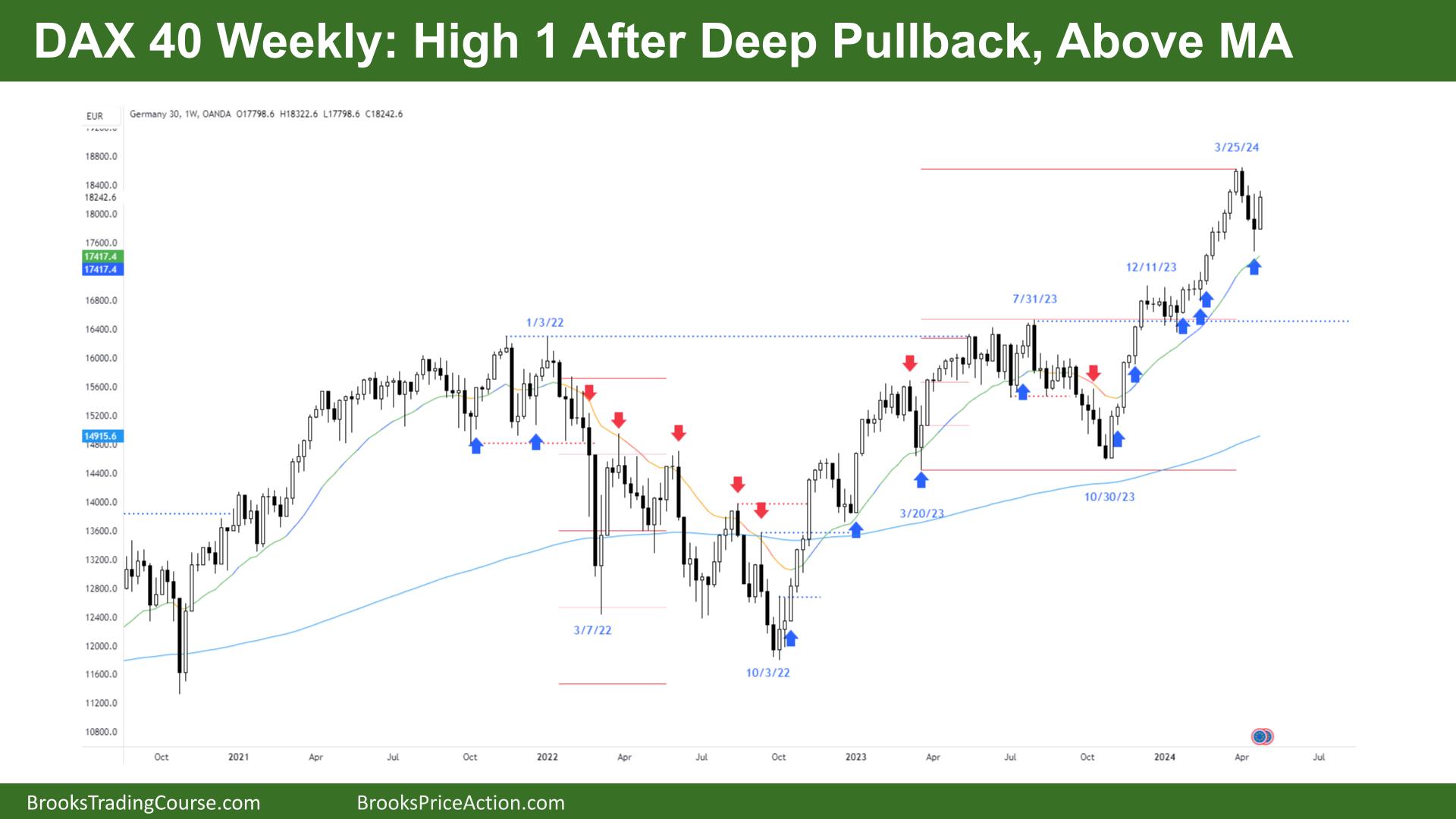

The Weekly DAX chart

- The DAX 40 futures went higher last week with a High 1, a strong bull bar that went above last week’s high but did not close above it.

- It was a strong pullback down from the ATH. Three consecutive bear bars are unusual in a strong bull trend, so we might transition into a trading range up here.

- With such a tight channel, the first reversal should be minor. But big enough now for a second leg sideways to down.

- The bulls see a huge breakout and a buy climax. The trend was likely exhausted. Most bulls want two legs sideways to bring their stops up and look for another move.

- Other bulls had hit the three measured-move targets up here, so it was mostly profit-taking that took the price back down.

- Last week, we said that bears would likely sell the High 1 above that bear doji. We will see if they make money next week.

- A High 1 in a late-stage spike is not a high-probability entry, so I think most bulls will look to buy lower.

- We might need to get back to the MA.

- The bulls want a good follow-through bar next week to trap any bears and test back to the highs. I think we are going back there; the question is whether it is right now or after we go sideways first.

- Bulls who bought under the low of the last strong bar in the bull microchannel made money. They scaled in lower, getting a break-even on their first entry and making money on their second.

- Bears will probably do the same above this week and make money, also.

- Still always in long, meaning I wouldn’t be selling below anything. But it’s likely that the bulls got out and are looking for a new entry.

- Expect sideways to up next week.

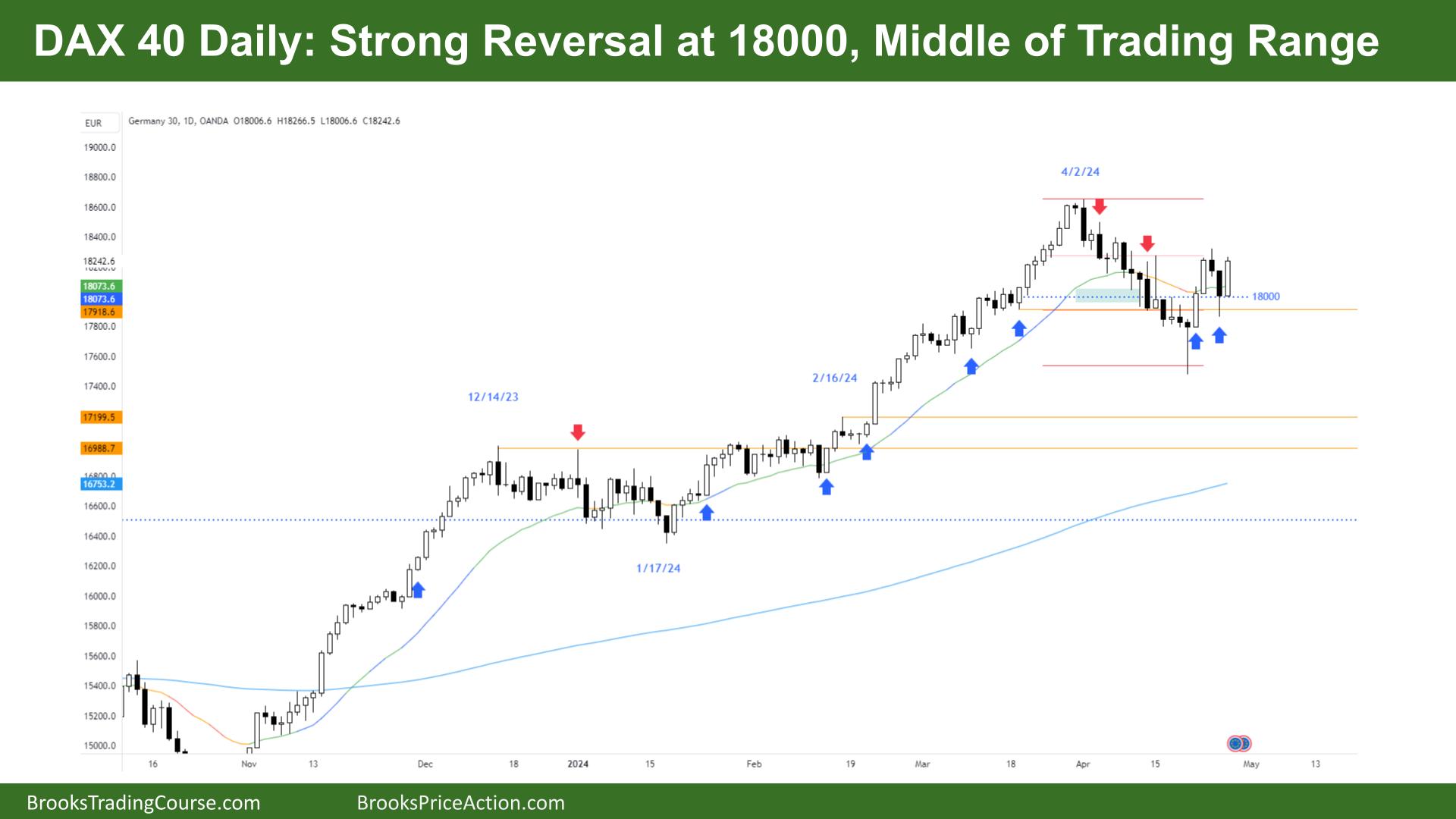

The Daily DAX chart

- The DAX 40 futures on Friday was a strong bull bar closing on its high, so we might gap up on Monday.

- The bears had three pushes down in a wedge bull flag and we broke out of the channel down and now tested the breakout point.

- The bulls see strong bull bars above the MA, but it is forcing you to buy high in a lot of trading range PA lately.

- It might be better to buy the midpoint or below the bar.

- There is a chance the low of the trading range is that bear tail below from last week.

- And so scaling in the lower third is a safer way to trade it long.

- Bears see it as a sell zone in a trading range but might wait for tails above the bars before shorting it for more confirmation.

- The bears wanted more bars below the moving average but were surprised by consecutive strong bull bars closing on their highs and above the MA.

- For some traders, that move puts the market back into always in long.

- But I think it is better to trade it like a channel, expecting pullbacks to be deeper than you would like and expect to scale in.

- A High 1 above a bear bar is lower probability than above a bull bar, so it Friday gets follow-through that would be a better trade.

- The bears wanted a second entry sell signal at the MA for a bigger correction down but were surprised. They will have to sell higher.

- It is probably always in long on this timeframe, so it is better to be long or flat.

- Expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.