Market Overview: DAX 40 Futures

DAX futures this week was consecutive bars, a bear surprise after such a tight bull channel. Although it is outside down, the bulls will expect a second leg up, so it might be a bear trap. The bears will probably get a second leg sideways to down to the breakout point below before traders decide. We would then be in the middle of the trading range again.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures chart was consecutive bars, a bear surprise bar closing on its low, so we might gap down next week.

- It is the second of consecutive bear bars, high in a trading range, so it is a surprise, and most traders will expect a second leg sideways to down.

- It is an outside down bar, a form of a tight trading range, which can trap traders.

- The bulls see a pullback after a 9-bar tight bull micro channel. Traders bought below last fortnight and sold above for a micro double top. They want two legs to test the BO point on Oct 13th for a larger second leg up. Trading ranges often test swing points, so this is reasonable.

- Bears see a double top with June and were quick to sell, hoping for a move to the lows of the range. The bull leg is strong, so it is likely to find buyers on the way down and might form a wedge bottom.

- Bears want a break below the October swing BO test – the moves to the left have been very fast, so this is also reasonable.

- Most traders should be short or flat. Always in bulls exited below last week.

- Bulls want this to be a sell climax and a bear trap to buy below and break above these highs to a trading range above.

- Bears want a measuring gap to move down – they know many bears sold the previous double top below this week and are currently trapped. They want to exit with a breakeven / avoid a loss and make a profit on their second entry.

- Most traders expect a second leg sideways to down, so either we continue down next week or go sideways first.

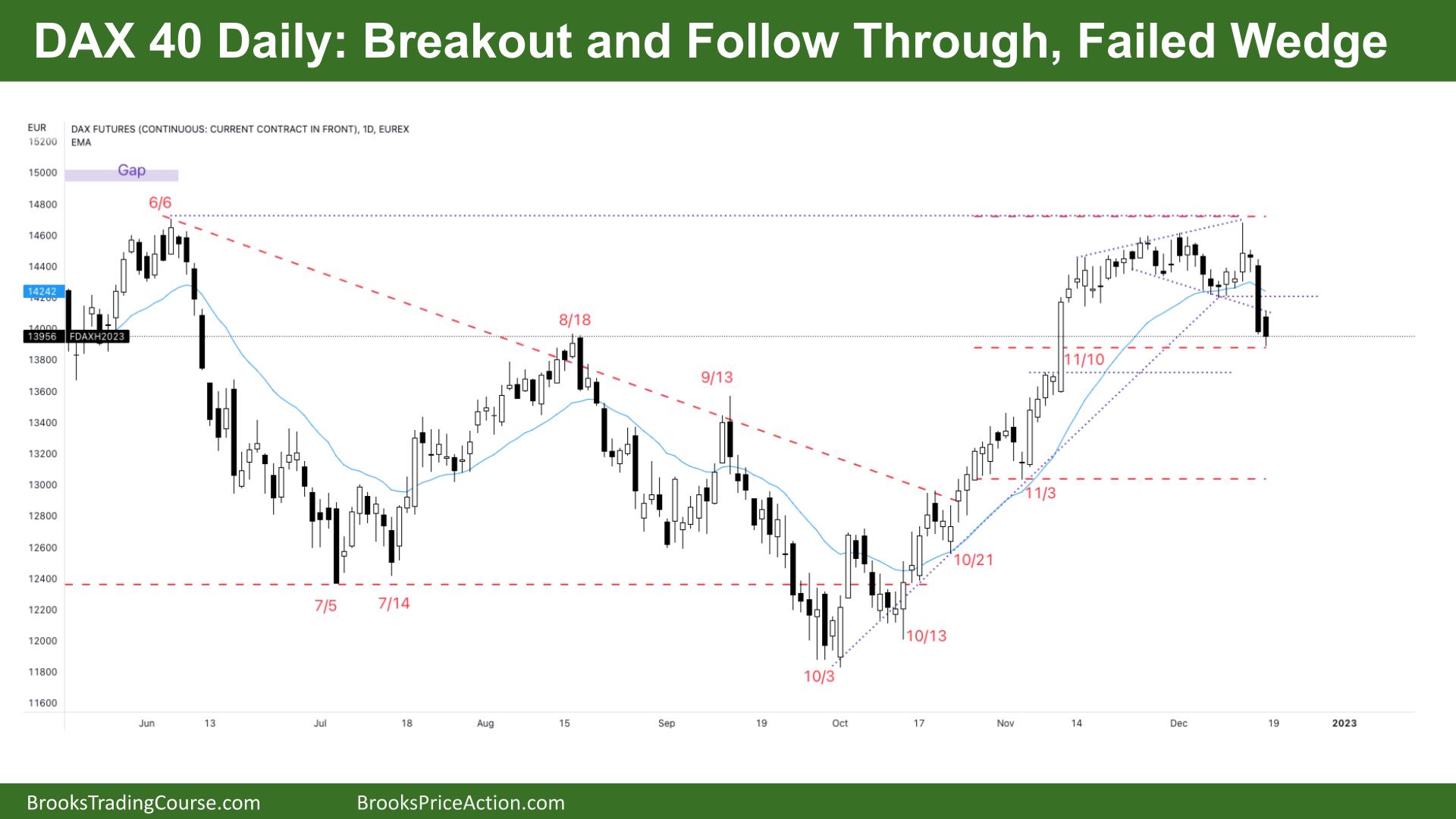

The Daily DAX chart

- The DAX 40 futures was a bear bar with a small tail below.

- It had a slightly lower close than Thursday’s big bear bar. So it is consecutive bear bars, a breakout with follow-through, so an always in short signal.

- The bulls see a small pullback bull trend and a deeper pullback to a prior breakout point. That makes this a test to form a channel, a double bottom bull flag and continuation.

- The bears see a wedge bull flag and a breakout down, with follow through, so they see a continuation to the short side, to the lower channel line on Nov 3rd.

- So who is correct? Both sides can be correct in a trading range. We are likely to test all the BO swing points.

- The math favours bears selling in the top third of the trading range, so a sell below here is reasonable. The problem is with such a strong trend it might need to create a lower high before reversing down.

- The bulls will look to create a deeper wedge and form a trading range before it reverses.

- Most traders should be looking for stop entries, but in trading ranges, they can often signal traps and reversals. It is better to wait for the second entry.

- The bears want a lower high and consecutive big bear bars like in June. They probably wont get it.

- The bulls want a moving average gap bar buy setup and a a bear trap for trend resumption. There are probably trapped bulls above last week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.