Market Overview: DAX 40 Futures

DAX futures have been on a DAX 40 bull streak high in a trading range. Traders will expect the pullback to be minor, but the risk is large for bulls who, up until now, have been buying above bars. The bears see the streak as a bull leg in a trading range and a breakout test of March. It might be a buy climax, and bears are unwilling to sell here when they can sell at the top of the range.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures was a bull bar closing near its high so that we might gap up on Monday.

- It is a bull streak, the 9th consecutive bull bar in a micro channel which is climactic and unsustainable. There have only been ten consecutive weekly bull bars once in 10 years. So if next week is bullish, expect the 11th week to be a bear bar.

- The channel is tight for the bulls, so they will expect to buy any pullback. They expect the first reversal to be minor.

- The bulls want to create a higher high above June 6th but want to break above March 28th.

- The bears see this channel as a bull leg in a trading range and a breakout test of March.

- They also see less than 20% of the bars this year have been closing above the moving average. So the best the bulls can get is a trading range. In which the bears are happy to sell high, looking for a Low 1 or Low 2 sell signal.

- This week is a buy signal, and we are always in long, so better to be long or flat.

- We are far above the moving average, and traders will expect more buying there when we get back there. We can go sideways or down to get there.

- The bears know the most climactic moves this year have been short-selling, so they want a weekly doji or a bear bar closing on its lows. They want to get back to the Aug 22nd breakout point, which is 50% of the range.

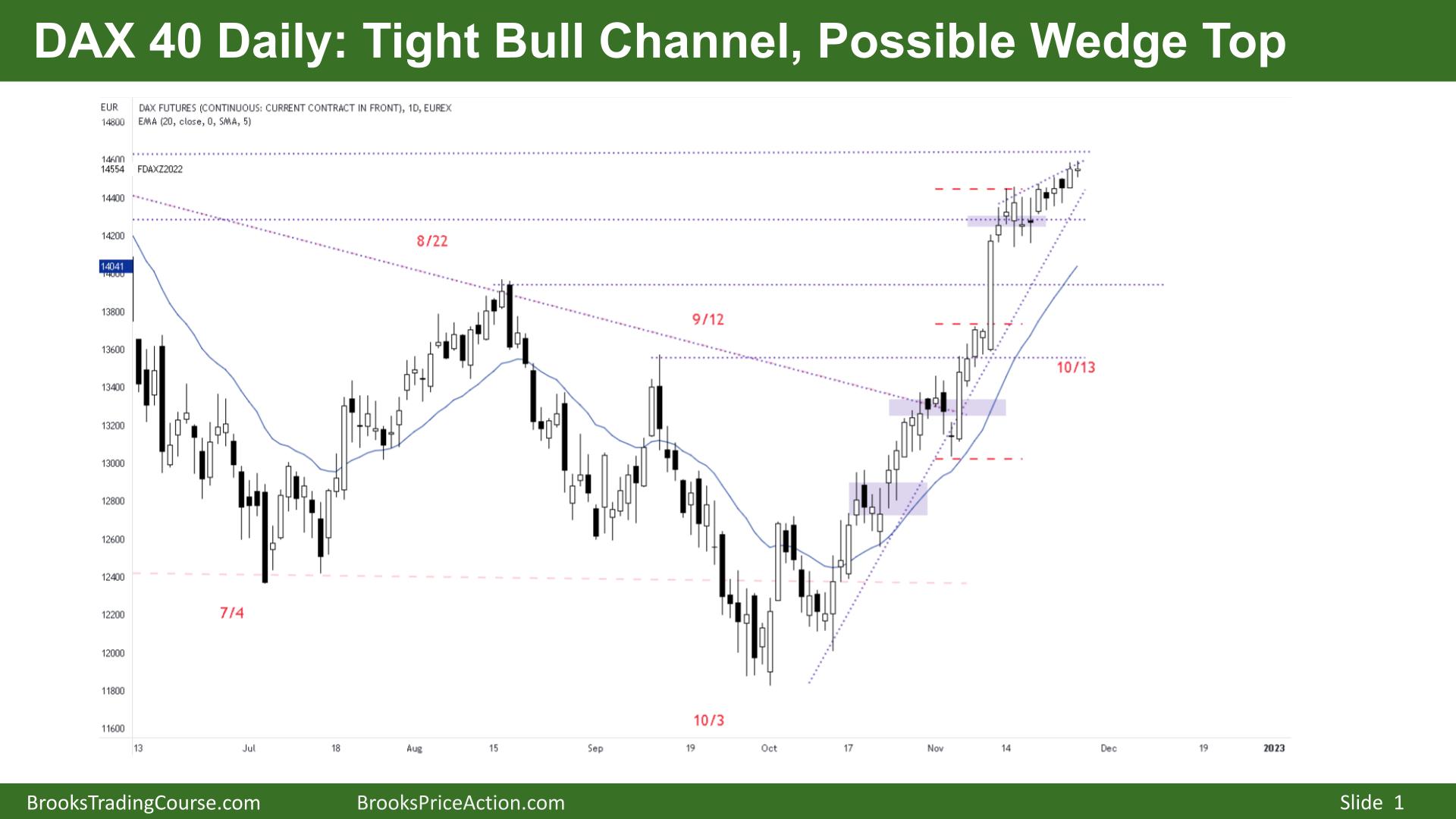

The Daily DAX chart

- The DAX 40 futures was a bull doji which is reasonable considering the Thanksgiving holiday in the US.

- Traders see the channel is tight. It is a bull streak. Bulls are starting to buy below bars instead of above which might mean we are soon going to transition into a trading range.

- The bulls see a small pullback bull channel, always in long and need a wider stop below the wedge. They see open gaps and failed bear stop entries, so they will continue to buy, trapping bears into bad sells.

- The bulls want to test the breakout point in March, but it is unlikely they can do it in one leg up.

- Bears see a trading range for 9 months and a strong bull leg. They are willing to short, knowing the probability is low, but the risk/reward makes the trade have a positive trader equation.

- The bears need a sell signal. They want a failed breakout above a wedge top and a reversal down to the moving average. But the streak is tight, so they will probably scalp until consecutive decent bear bars appear.

- The best the bears might get here is a double bottom bull flag, and bulls will look for a High 2 buy setup and a measured move to create the next leg.

- There may have been trapped traders buying up here in March unprepared for such a substantial move down, so when they sell, bears will also sell, creating a double top.

- Most traders in a bull streak should be long or flat.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.