Market Overview: DAX 40 Futures

DAX futures moved lower last week in a bull flag with a bear doji. Sideways price action after a big move up. Price had a hard time getting through 17000 last time. The bulls want a good double bottom here to move higher. It’s still above the 200, so most bear moves should be pullbacks on the monthly chart. Expect more buyers at the MA for a test of the high. The bears want to disappoint them and break out below.

DAX 40 Futures

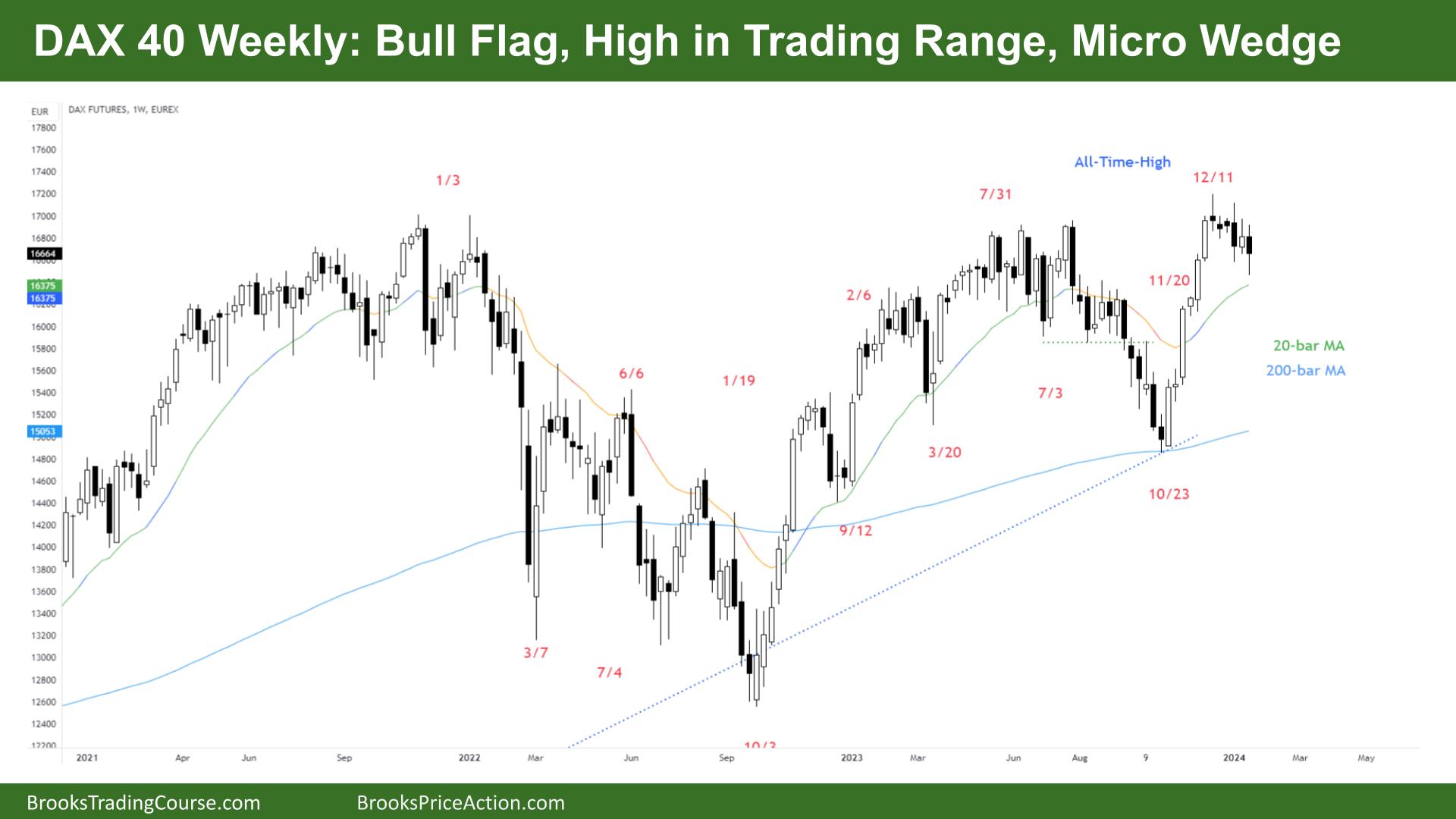

The Weekly DAX chart

- The DAX 40 futures went lower last week in a bull flag with a bear doji.

- Tails above and below, so sideways, were expected after such a strong move up.

- The bulls see a tight bull breakout, a parabolic wedge top. Most traders wanted two legs sideways to down, perhaps back to the moving average.

- It is three pushes down on a LTF, a micro wedge pattern.

- It is a Low 2 currently, so a buy above would be a High 2 buy. But the bear doji is a weak signal bar. Most bulls will wait for a good signal bar.

- Limit order bulls have been scaling in and will likely do so all the way to the MA.

- The bears see a double top, a test of a wedge top. An expanding triangle – many ways to see it. The problem is the all-time high.

- Now that the bulls have a new high, the bears must work to ensure they can create a lower high. Most HH DT are followed by LHDT.

- The bears see it as a major trend reversal – break trendline, new high and now reversal – but the signal bars are not great. The move up was so strong traders will expect a second piece to it.

- Always in long, but ok for those bulls to have exited below these bear bars and wait for another buy signal.

- Other traders are waiting for it to get back to the top, the sell climax from September. We raced past and trapped bears there. We should let them out.

- Expect sideways to down next week.

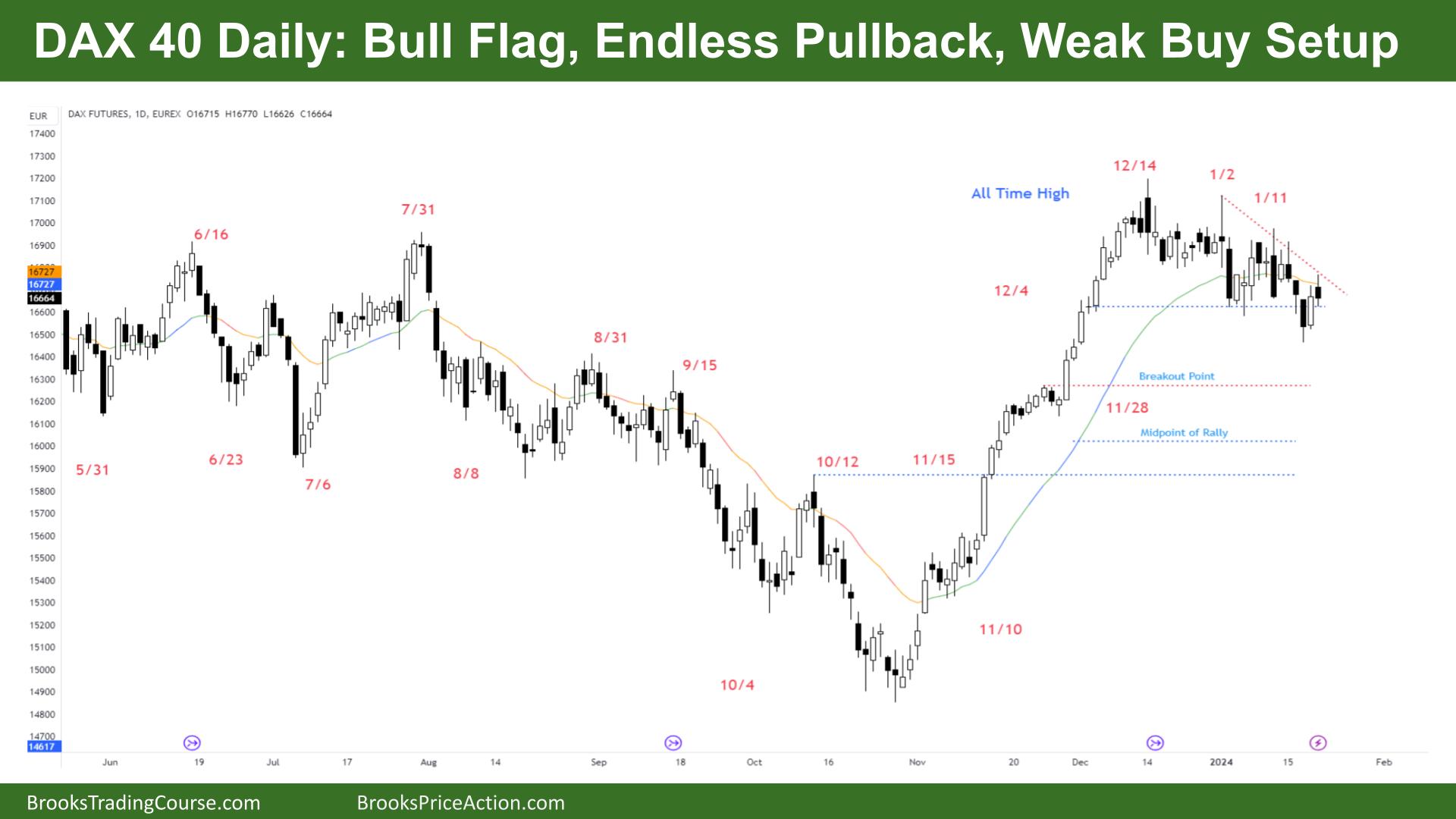

The Daily DAX chart

- The DAX 40 futures went sideways below the 20-bar moving average on Friday.

- Bulls see a big bull spike, and we are pulling back in a bull flag. But the bears see a bear channel gaining momentum below the MA.

- The bulls see a wedge bull flag setup, triggering the buy signal. But it is a bad location below the MA, so it is dangerous. It could fall quickly.

- The bears see a breakout below a double bottom, but they know the best they can get is a trading range, so they are still scalping and taking quick profits.

- The higher timeframe is likely to give the bulls what they want.

- Some bears are hoping to get back to close the breakout point gap below. They want to get to the midpoint of the whole rally eventually. But the bulls should get a chance to create a double top first.

- Some bears can say it is always in short below the MA. That is a change of character, and now they have a good sell signal for Monday.

- But there are no open gaps, so the bulls are keeping it as a trading range for now. They need a higher high to get it back to sideways.

- A few weeks ago, we said this doji would be a test target. A bad buy signal that led to a big breakout.

- Bears who faded that bar wanted to get back to it.

- The range is tight, and bars are overlapping, so stop order traders should be careful – scaling in is likely required.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.