Market Overview: DAX 40 Futures

DAX futures moved up last week with a bull outside bar and bull breakout, but the close was inside the prior range. Spike and channel bull trend, so bulls are perhaps buying lower and scaling out at new highs. Although with so little bear pressure, bulls will buy strong bull bars, closing on their highs in this second leg.

DAX 40 Futures

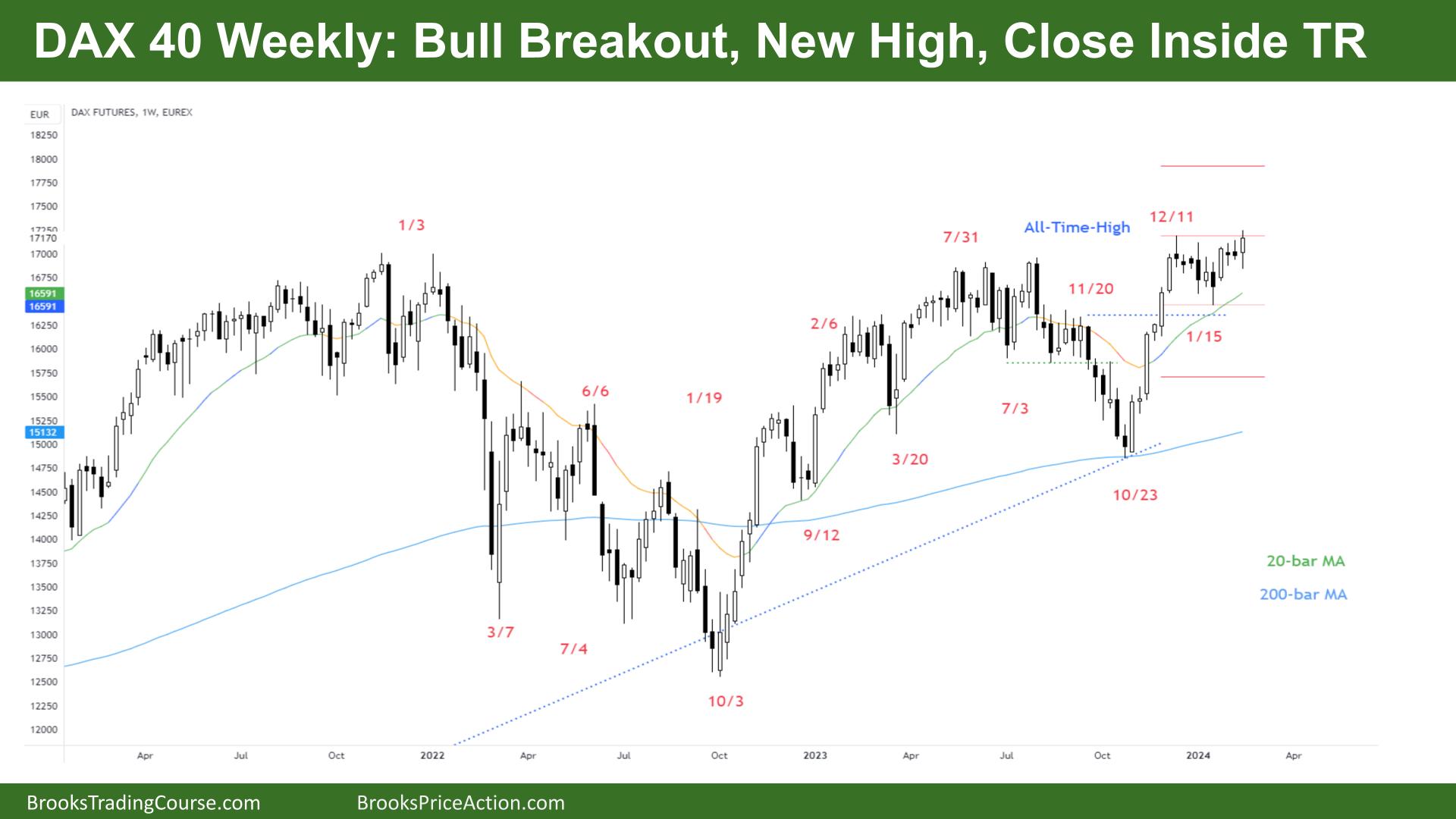

The Weekly DAX chart

- The DAX 40 futures moved up last week in a bull breakout and an attempt to break out of a small trading range in a bull channel.

- The bulls see more up after a strong spike. The sideways price action here is just profit-taking for another move.

- The bears see a double top high in a trading range, but the bulls just got a new high, so do you really want to be short yet?

- Traders expect a second leg after a strong spike. The bears had a couple of attempts to reverse it, but no strong sell signals followed by further strong selling.

- If bears don’t have stop entries, then we are at least in a bull channel.

- But can the bears use limit orders? We will see above this high. They will likely give up after the wedge and expect two legs up before selling again.

- Bulls see a micro wedge bear flag and a High 3 breakout pullback. They got a double-bottom test of the breakout point, but they need a good close on the RTH.

- There is a tight trading range, so it might be a lower probability setup to buy right now. But a follow-through bar would increase the probability for bulls.

- The bears got a 2:1 on the very first reversal bar in December. They have been selling new highs, but most traders should be selling with stops in the direction of always in.

- Most bulls will buy here and scale in lower, betting that bears just failed before.

- After a serious double-bottom reversal attempt, that trade is a higher probability.

- Then, if the bears get a second entry short, you exit and look for the next trade.

- We are always in long, so traders should be long or flat.

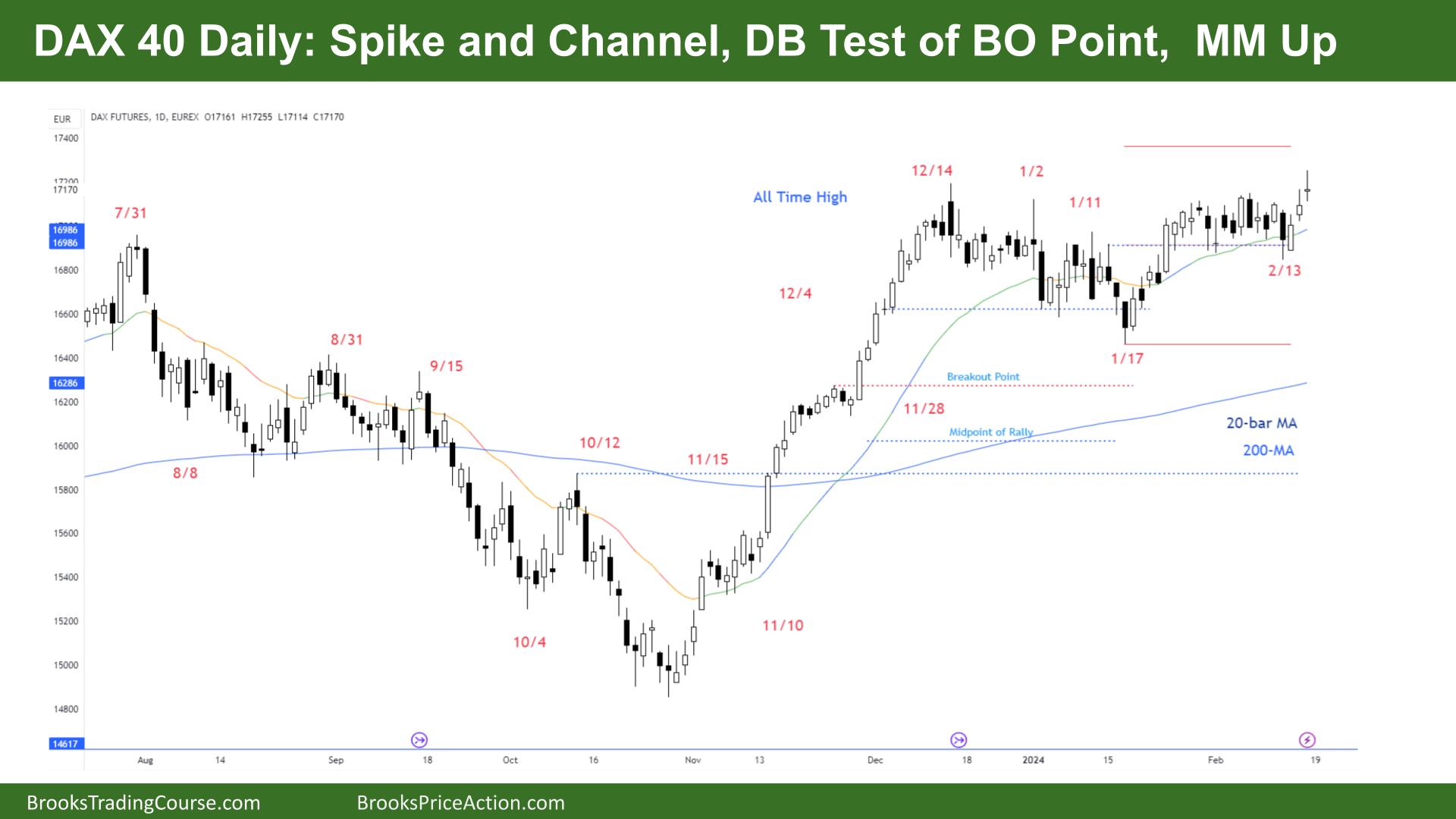

The Daily DAX chart

- The DAX 40 futures moved up on Friday with a small doji as bulls tried to break out of the trading range.

- The bulls see a spike and channel. A bull flag breakout and a double bottom test of the breakout point.

- Now, with consecutive bull bars above the MA again and a higher low, traders expect more up.

- The bears see a tight trading range, a possible final flag and are looking for a buy climax to start selling.

- But the bears have no sell signals. The bulls ran their stops, and now, many opposite bars will you keep scaling in?

- They also failed to get strong selling below the moving average.

- Bulls made new gaps, so if bears are in, they are stuck.

- Most traders should be long or flat, expecting new highs and exiting their positions when a second entry short sets up.

- There are measured move targets above, so we should go higher.

- The bears need a failed breakout above. Trapping bulls high. Then a deep selloff to turn it into a trading range.

- But the bears had a couple of chances to reverse it and failed. The best they can do right now is keep it into a broad bull channel.

- Expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.