Market Overview: DAX 40 Futures

DAX futures rocketed higher last week with a bull breakout, 5 bull days reaching a measured move target. It was 3 pushes down, a wedge bottom and a test of the swing low in a trading range. A type of double-bottom buy setup. But the failed sell signals on the daily made the move so strong and surprising. Bulls want this to get a few legs sideways to up for a test of the highs. The bears want it to go sideways at the prior breakout point and TTR.

DAX 40 Futures

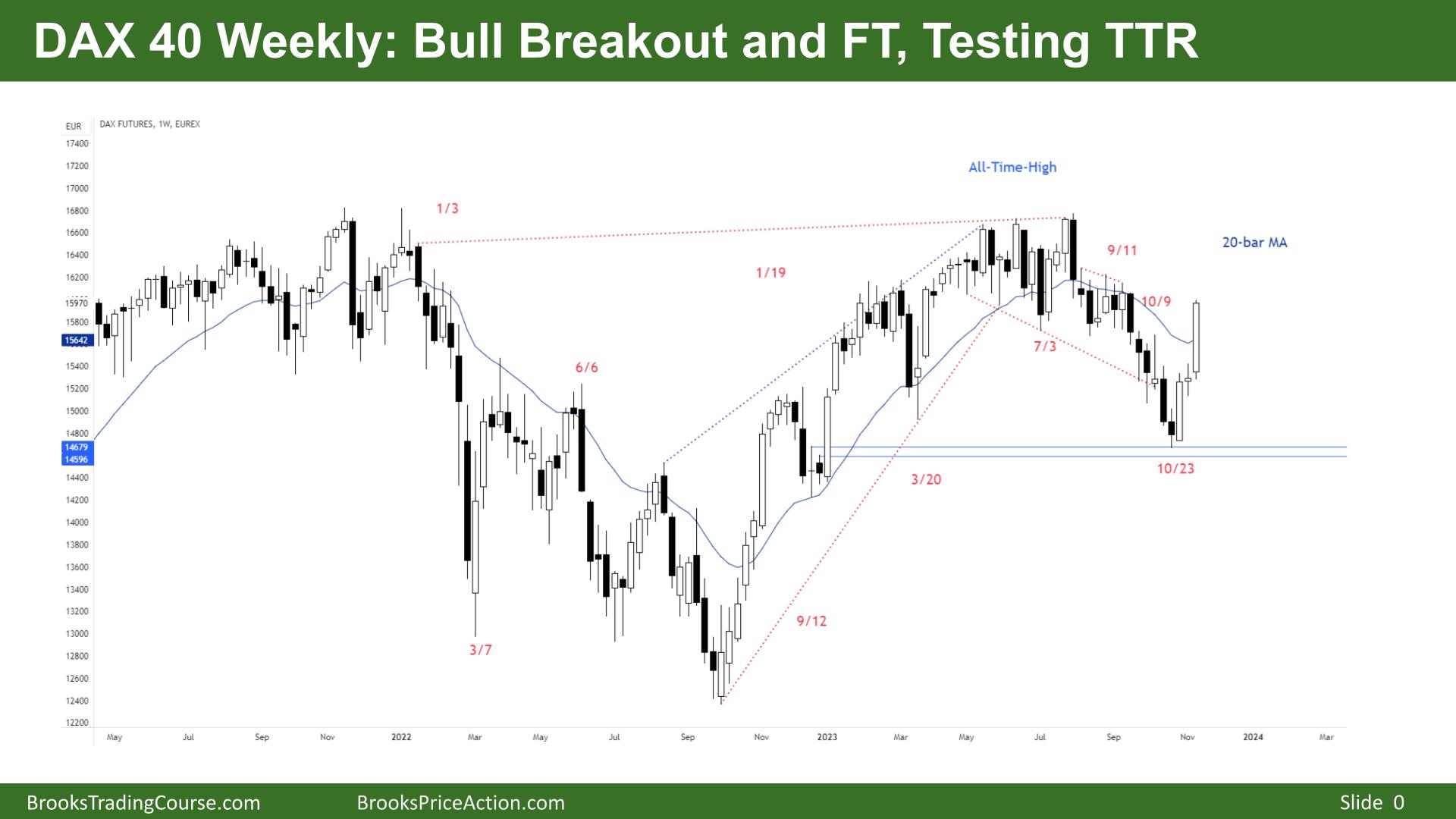

The Weekly DAX chart

- The DAX 40 futures market was a big bull bar closing on its high, so we might gap up on Monday.

- It is a strong bull breakout and follow-through, and we are back at the tight trading range (TTR) and the triangle’s apex.

- We have been in a trading range for several months, and they often have strong moves in both directions. They trap bears near the bottom and bulls near the top.

- The bulls see a strong bull trend and a pullback to above 50%. There were two key swing points below the bears wanted to test, and they did.

- It was unlikely to result in a strong bear trend down, so now we are back to the middle of a TR.

- It was a reasonable 2nd entry long at the MA for the bulls, and it failed. Two weeks later, after scaling in above the strong bull bar, they are now returning to their first entry.

- Reasonable entries like that have an 80% chance of breaking even.

- It is a strong leg, pause, strong leg pattern, which means next week is likely a pullback. But 3 consecutive bars is a strong move, and traders will expect at least another bar in that direction after that pullback.

- The bears saw a wedge breakout and expected a measured move down, which they reached. They were hoping for a double top and a sell signal at the MA but didn’t get it.

- Bears likely exited at the bull doji FT – if you get a surprise bar with FT against your position, it is usually better to exit.

- It was a weak signal bar for bulls, so that means there is a test target below. But no sell signal, so we are likely always in long and expect another leg up.

The Daily DAX chart

- The DAX 40 futures market is nearly at 16000 after a very strong bull breakout from 15000.

- We broke strongly out of a bear channel after several pushes down. It was low probability – 25% – but when low probability things happen, they happen bigger and faster.

- The bears expected a sell signal at the MA, a Low 2, but it failed last week with a measured move up.

- The bulls see a 6-bar bull microchannel and will expect a second leg sideways to up.

- We are back at the tight trading range from before and might go sideways here first.

- It was a reasonable wedge bottom setup but a classic swing with unclear signal bars. The market often does that, and the confusion can keep the move going much longer than anyone realises.

- The bulls are at a measured move swing target from the failed short at the MA and Low 2.

- The bulls all made 1:1 off the big bar and FT below.

- The stop is far away if you are buying here, which means you have probability but a big risk.

- Bulls will likely take some profits at the next pullback or wait for a higher low to move their stop up.

- Always in long, it’s better to be long or flat and expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.