Market Overview: DAX 40 Futures

DAX futures was a big bull surprise bar on the monthly chart. Still always in long on this timeframe, and it looks like a leg in a trading range. It was a tight trading range to the left, so it was a magnet, and we might need to go sideways here while traders decide where we are heading. Bears need a strong double top sell signal here to attract short sellers.

DAX 40 Futures

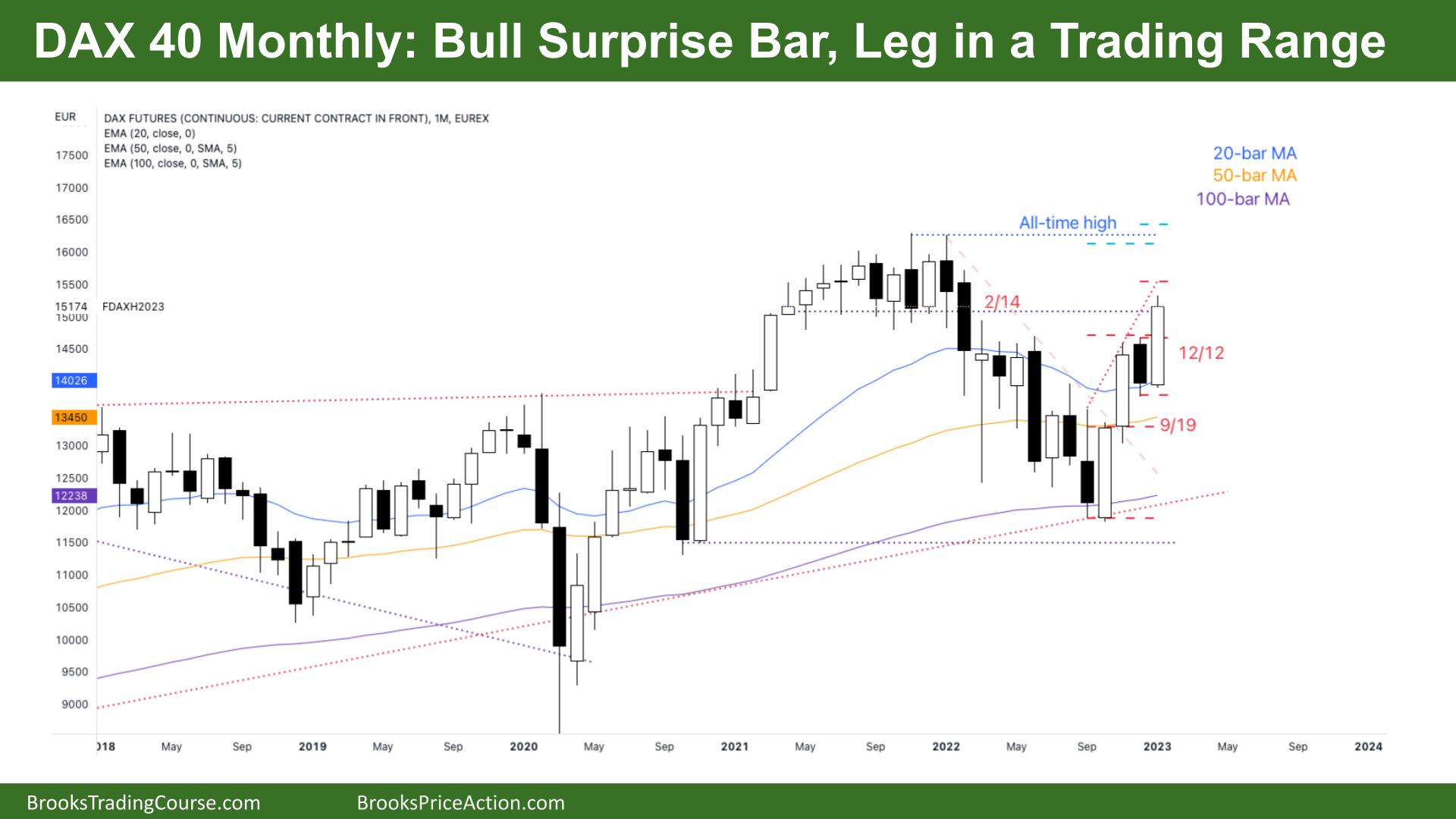

The Monthly DAX chart

- The DAX 40 futures was a big bull bar surprise bar closing on its high. We are likely always in long.

- The bulls see a tight bull channel after 3 pushes down to a wedge bottom. They see a trend resumption on the higher time frames and expected 2 legs sideways to up.

- We may have finished the second leg. But until a bar goes below a prior bar, most traders will stay long. A bull surprise bar often has follow-through, even if it is one bar.

- The bears see a trading range and possible double top. But there is no sell signal for the bears. The bears want a lower high, but with measured move targets above, we will likely go sideways to up next week.

- If the bulls can break out above the all-time high, they will look for a measured move of the range over the next few years.

- Trading ranges are full of disappointment, and we might go and test the highs and reverse back down. Trading ranges tend to overshoot swing points, so we might even get a new all-time high and pull back endlessly into the range again.

- If the bears can get a good sell signal next month, some will start to sell on a stop. Most traders selling in a trading range should wait for a second entry as it has a higher probability.

- Some bears will sell the highs and then scale-in higher, betting we return to test the all-time high again.

- Most bears seeing a bull surprise should exit short and wait for clearer price action.

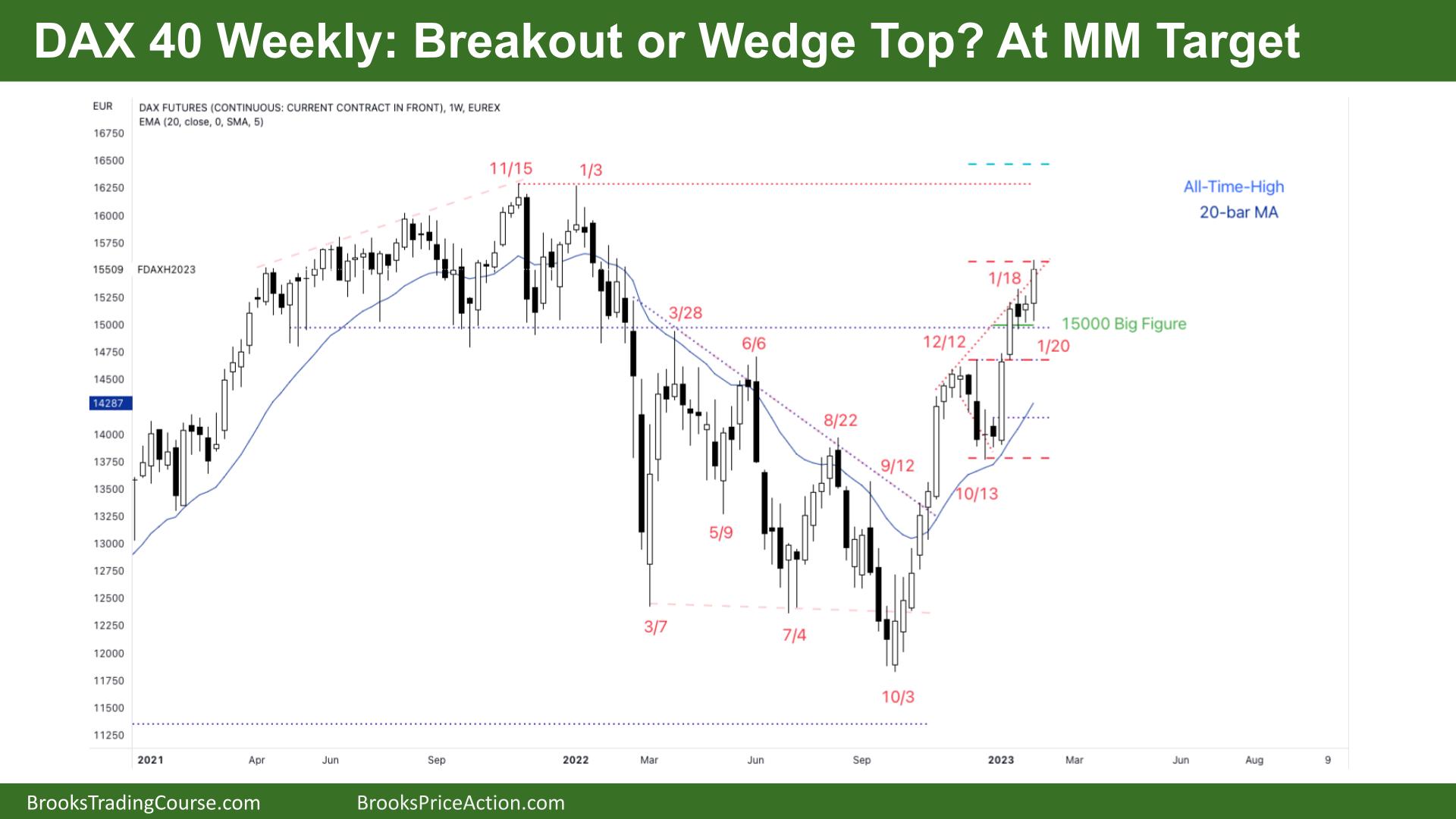

The Weekly DAX chart

- The DAX 40 futures was a bull bar closing near its high with a small tail above.

- It is consecutive bull bars and a 7-bar bull micro channel. Traders will likely buy the first bar to go below the low of a prior bar.

- The bulls see a strong second leg after a powerful first leg. Most traders expected this leg to go far, and it did. Traders see consecutive bull bars, so bears will exit, and bulls will add on.

- The bulls see a break back above the prior trading range and now will look to test the highs of the range. Probably with the third leg up.

- Bears see a trading range and a test of a prior breakout point. They will look to sell high in this trading range, but currently, there are no bear bars to sell.

- It was a High 1 buy for the bulls, and we didn’t pause at the 15000 big figure, so we might need to come and test it again before moving higher.

- Measured move targets can attract profit-taking, but most bulls will not exit until there is a reasonable sell signal bar.

- Bears need consecutive bear bars, or an outside down bar, to make traders believe it is a failed breakout above the prior range.

- Although we are at the channel line, with many gaps below, most bulls will be happy to scale-in lower.

- Traders should expect sideways to up next week and get long above a bull bar closing on its high. Most traders will use a stop further away than they like so they should trade a smaller size.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.