Market Overview: Crude Oil Futures

Crude Oil stalled at the bull trend line in the last 2 weeks. The bears want at least another sideways to down leg, completing the third push down (wedge) with the first two legs being April 22 and May 8. The bulls want a reversal from a wedge (Apr 22, May 8, and May 15), a micro double bottom (May 8 and May 15) and a higher low.

Crude oil futures

The Weekly crude oil chart

- This week’s candlestick on the weekly Crude Oil chart was a bull bar closing near its high and closing above the 20-week EMA.

- Last week, we said that the market may still be in the sideways to down pullback phase. Traders will see if the bears can get a strong breakout below the bull trend line or will the market continue to stall around the current levels.

- The market traded lower midweek but reversed to close higher, stalling at the bull trend line area.

- The bears got a reversal from a wedge pattern (Dec 26, Jan 29, Apr 12) and an embedded wedge in the third leg up (Jan 3, Mar 19, and Apr 12).

- They see the last 2 weeks simply as a pullback and want at least another sideways to down leg, completing the third push down (wedge) with the first two legs being April 22 and May 8.

- The problem with the bear’s case is that they have not yet been able to create a strong breakout below the bear trend line and follow-through selling.

- They will need to create consecutive bear bars closing near their lows and far trading below the 20-week EMA and the bull trend line to convince traders that the bear leg is underway.

- If the market trades higher, the bears want the bear trend line to act as resistance.

- The bulls want a retest of the April 12 high after the current pullback.

- They want the 20-week EMA or the bull trend line to act as support. If the market trades lower, they want a failed breakout below the bull trend line. So far this is the case.

- They want a reversal from a wedge (Apr 22, May 8, and May 15), a micro double bottom (May 8 and May 15) and a higher low.

- They will need to create a follow-through bull bar following this week’s close above the 20-week EMA to increase the odds of a retest of the April high.

- Since this week’s candlestick is a bull bar closing near its high, it is a buy signal bar for next week.

- Odds slightly favor the market to trade at least a little higher.

- Traders will see if the bulls can create a follow-through bull bar following this week’s close above the 20-week EMA.

- Crude Oil is currently trading around the middle of the large trading range, which can be an area of balance.

- The market is in a large trading range (Trading range high: September 29, Trading range low: May 4).

- Traders will BLSH (Buy Low, Sell High) until there is a breakout from either direction with sustained follow-through buying/selling.

- Poor follow-through and reversals are hallmarks of a trading range.

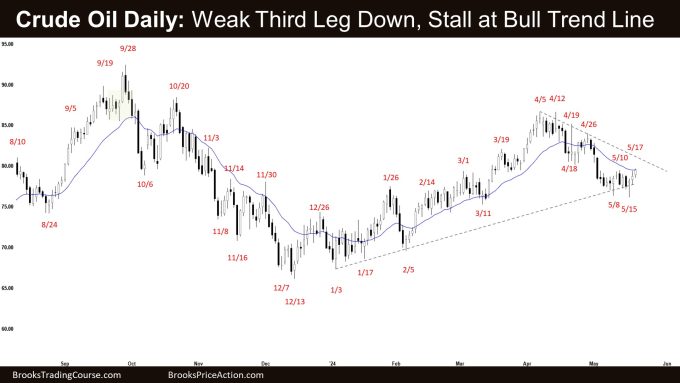

The Daily crude oil chart

- Crude Oil traded sideways to up for the week. Wednesday traded lower but reversed into a bull doji closing near its high with follow-through buying on Thursday and Friday.

- Last week, we said that the market may still be in the sideways to down leg. Traders will see if the bears can create sustained follow-through selling breaking below the bull trend line or will the market continue to stall around the May 8 area.

- So far, the market is stalling around the May 8 area.

- The bulls see the current move simply as a pullback and want the bull trend line to act as support.

- They want a reversal from a wedge bull flag (Apr 18, May 8, and May 15), a double bottom bull flag (Mar 11 and May 15) and a small double bottom (May 8 and May 15).

- The bulls will need to create consecutive bull bars closing near their highs and trading far above the 20-day EMA to increase the odds of a retest of the April 12 high.

- The bear got a two-legged pullback trading below the 20-day EMA.

- They want another leg down completing the wedge pattern with the first two legs being the April 18 and May 8 lows.

- The problem with the bear’s case is that they have not been able to create a strong breakout below the bull trend line.

- They hope that the last two weeks were simply a pullback forming a double top bear flag (May 10 and May 17).

- They want the 20-day EMA or the bear trend line to act as resistance. They need to break far below the bull trend line to increase the odds of lower prices.

- Since the market failed to push lower in the last 2 weeks, we may see the market attempt to push at least a little higher instead.

- Traders will see if the bulls can create consecutive bull bars trading far above the 20-day EMA.

- Or will the market trade slightly higher but stall (perhaps around the bear trend line area) and reverse back below the 20-day EMA?

- The market is trading around the middle of the large trading range which can be an area of balance.

- Poor follow-through and reversals are hallmarks of a trading range.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.