Market Overview: DAX 40 Futures

DAX futures had a strong pullback end last week and went sideways with a bear doji. Friday was a strong reversal bar that hit bear targets. This is a weak bar for stop-entry traders. We will likely form a trading range around this price and 18000. It is strong enough for a second move sideways to down.

DAX 40 Futures

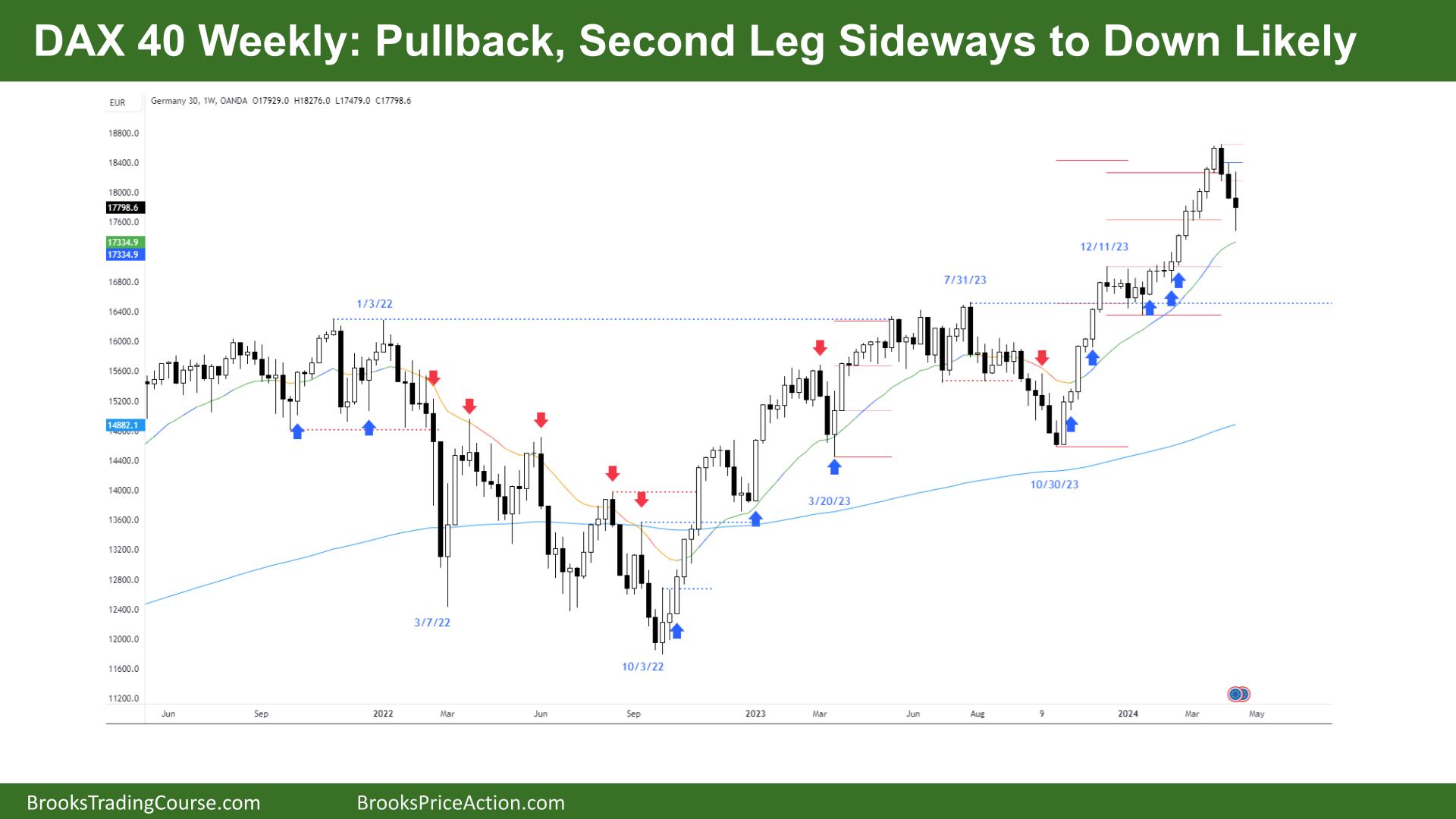

The Weekly DAX chart

- The DAX 40 futures went sideways to down last week with a pullback from measured move targets.

- The bulls see a bull spike and channel, two strong legs up, so two legs sideways to down before the final push is reasonable.

- The bears saw a buy-climax, and we overshot 18000. They were looking for a reason to fade back, and they took it. Now, they have hit a swing target.

- The bulls probably need another leg sideways to down to the MA for another buy signal, a high 2.

- Bears, I would only sell high if the follow-through has tails. Because it was so strong on the way up, I wouldn’t be too eager to bet against the bulls.

- It’s a weak sell signal, so more buyers are likely above fading the High 1.

- There may be buyers below that bar or near the MA, but because traders expect a second piece to the pullback, waiting for a signal to develop is better.

- Bulls have a vast bull breakout gap, so the bears can only turn it into a trading range even with a deep pullback.

- Bears need a lower high and a failed buy signal to get traction.

- If you’re short, do you get out? I would watch for price action with a bar like Friday and get out above it. You could argue sellers there, but you took a low-probability trade, and it hit a target, so you’re hoping to get a second chance!

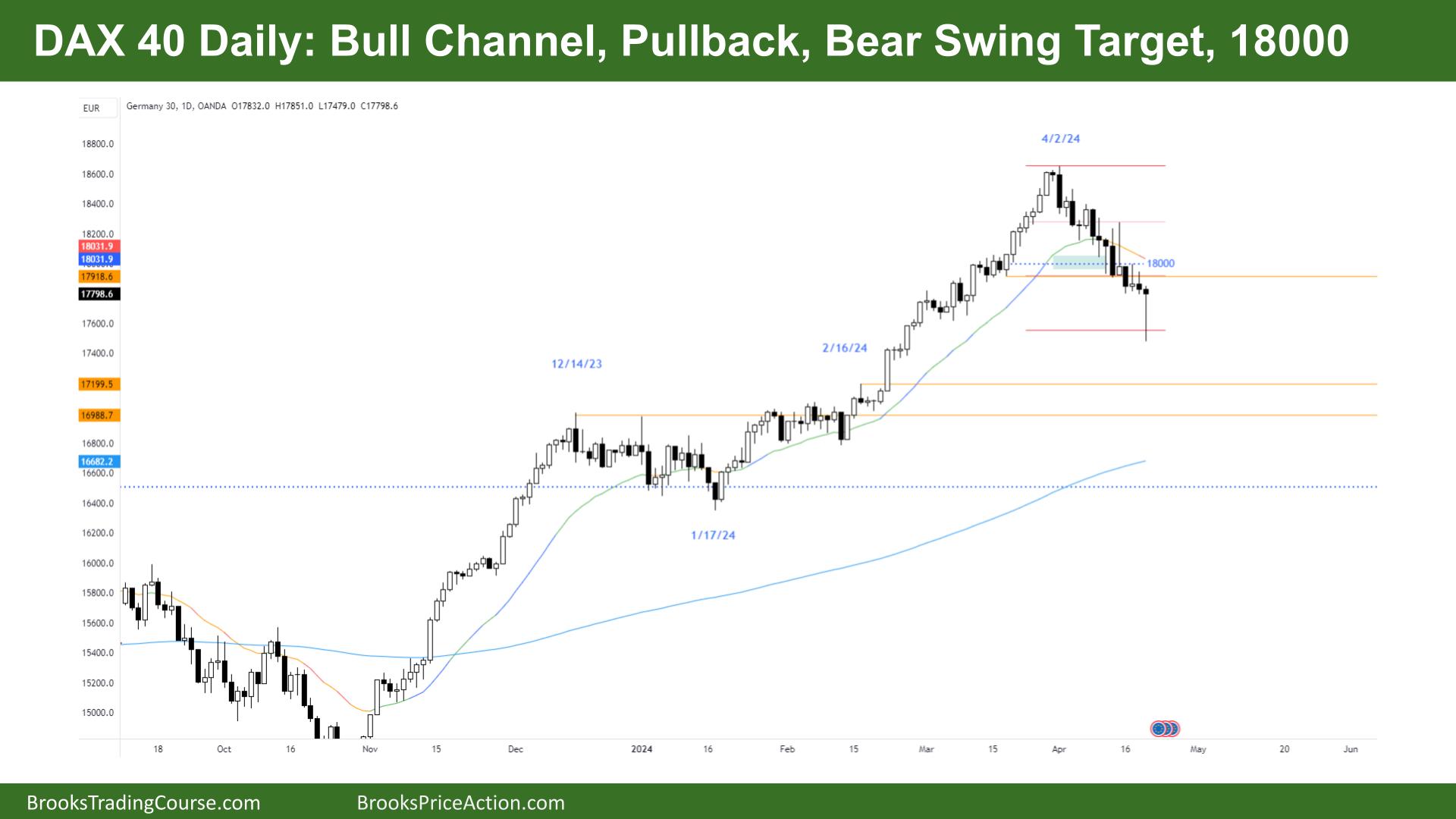

The Daily DAX chart

- The DAX 40 futures went down last week with a big bounce on Friday as the last of the sellers got out at their targets.

- Strong and tight bull channel, we broke a trend line but didn’t test it? Likely, we go back up higher.

- I think the bears need a double top to change this trend.

- You can see the lack of consecutive strong bear bars below the MA. Most traders were surprised by the pullback depth, but it should turn into a wedge bottom anyway.

- The bears did well to retrace the last leg of the push-up. They even got to the midpoint of this last rally. So that’s good.

- Bulls are looking for a higher low to form and a second entry long for a 3-push back up to one of those bull bars.

- The bear bar on Friday closed near its high, so it’s technically a bull bar. However, it’s a weak reversal bar, so follow-through will be important for bulls.

- How many legs down? You could argue that High 2 at the MA failed, and MM is down. That’s fair. But most bulls would not have bought above the High 2 without a good test of the MA, so they were likely bulls exiting who scaled in from longs above.

- The bulls are buying new lows, scaling in lower, and making money, so we should return to the MA soon.

- Are we always in short? Maybe. I would still trade it like a trading range and look to buy low and sell high, scalp and take quick profits.

- The next stop is likely MA, so next week expect sideways to up.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.