Market Overview: NASDAQ 100 Emini Futures

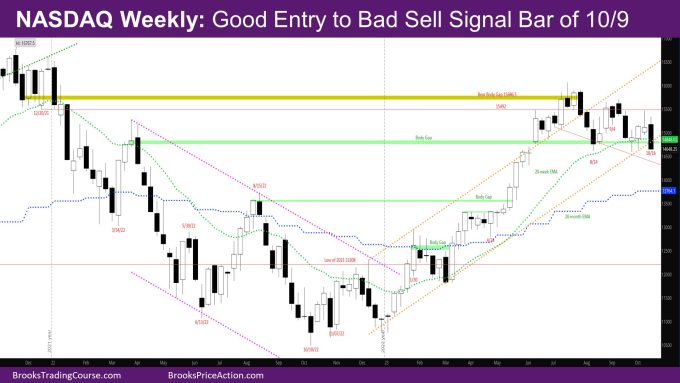

The NASDAQ Emini futures week is a bear trend bar closing on its low. It is a good entry to bad sell signal bar of 10/9.

On the daily chart, the week had strong bear bars in the second half of the week.

The monthly bar is an inside bar near the low of last month. There is a little over a week left in the month. The market should go below the low of last month, this month or next month.

NASDAQ 100 Emini futures

The Weekly NASDAQ chart

- The week is big trend bear bar closing on its low.

- Last week was a bad sell signal bar – a bull doji bar with a long tail above.

- As mentioned in prior reports, another leg down was likely.

- This week is a strong start to that leg down.

- Bears also have a close below the close of 8/14 – the low close of the 1st strong leg down.

- The market is also back in the area of the bull gap from March 2022.

- Bears now need a couple of good follow-through bars to convince sellers that they can possibly break below the trading range of past couple of months.

- Bulls want a bull bar or a doji bar to keep the bull gap open and show that this is still a leg in a trading range and start a leg up.

- Next week may end up being the opposite of last week, a bear doji with a long tail below.

- If bulls can go up from here, the body gap close with March 2022 would be a considered a negative gap – a small overlap, but trend resumption up.

- It looks like the market is in a trading range between the bear body gap from November 2021 and the bull body gap from March 2022, both shown in the chart.

The Daily NASDAQ chart

- Friday is a strong bear trend bar closing right back at the low of two weeks ago.

- Last week’s report had mentioned that the bulls got enough good bull bars last Monday-Wednesday in reaching the high of 9/20, that there should be another leg up.

- The 2nd leg up has not come so far. Instead, bears were able to close the breakout gap.

- Last week’s report also mentioned that the next couple of weeks look sideways to down, and this week was down.

- The market is back near the bottom of the trading range from June.

- Bears want to break strongly below the trading range for a Measured Move (MM) below.

- Bulls need to break above the high of 9/14 to not have lower highs.

- Since the market is back below the low of the big bull bar from the Friday of two weeks ago, there should be buyers here.

- So, there should be bull bars early next week. Instead, if bears can produce a bear breakout, those buyers would be trapped.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.