Posted 6:58 a.m. Yesterday spent a lot of time in tight trading ranges, and today began with limit orders bulls and bears making money. This is trading range price action, and it increases the chances of a lot of trading range price action for the rest of the day. Traders will be inclined to scalp […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

Intraday market update: June 7, 2016

Intraday market update: June 6, 2016

Price action traders will buy put options

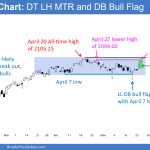

Posted 6:58 a.m. The Emini reached a new all-time high on the open in a Trend From The Open rally. The bulls hope for a bull trend day. The bears want the breakout to fail, but realize that the rally might last several hours before there is a reversal down. The rally is strong enough […]

Emini weekend update: June 4, 2016:

Trade breakout mode price action

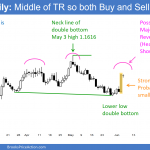

Monthly S&P500 Emini futures candlestick chart: Bull breakout of small pullback The monthly S&P500 Emini futures candlestick chart is breaking above a small bull flag at the top of a 2 year trading range. The monthly S&P500 Emini futures candlestick chart had May as a buy signal bar on the because it was a pullback […]

Intraday market update: June 3, 2016

Failed breakout price action for online day traders

Published 6:54 a.m. The Emini began with a trend from the open bear trend. The bears want to get 1 tick below yesterday’s low to trigger the sell signal. Since yesterday was a weak sell signal bar, there will probably be buyers below. The bulls are trying to prevent the sell signal from triggering They […]

Intraday market update: June 2, 2016

Emini price action still bullish for day traders

Posted 6:48 a.m. The Emini opened at the bottom of yesterday’s final bull channel, forming a double bottom at the 60 minute moving average. The first 3 bars formed a tight trading range, which increases the chances of more trading range price action today. Also, the bear breakout below yesterday’s bull channel increases the chances […]

Intraday market update: June 1, 2016

Learn how to trade bullish breakout price action

Posted 7:05 a.m. The Emini reversed up from below yesterday’s low, forming an expanding triangle bottom. However, the early bars were small and had prominent tails. This is trading range price action. The context is good for the bulls, but they need a strong bull reversal before they will swing trade. The bears see the […]

Intraday market update: May 31, 2016

Bullish price action and possible outside up candlestick pattern

Posted 6:58 a.m. The Emini opened with small bars and prominent tails at the 2100 resistance level. Bulls and bears made money in the 1st few bars. This is a limit order open, and the Emini might stay sideways for an hour or more while it waits for a breakout up or down. The Emini […]

Emini weekend update: May 28, 2016:

Price action shows bull trend resumption after small bull flag

Monthly S&P500 Emini futures candlestick chart: Strong reversal up from sell signal The monthly S&P500 Emini futures candlestick chart has one trading day left. The bulls have a 50% chance of turning May into an outside up month (with a low below April and a high above April) with a close at a new all-time […]

Intraday market update: May 26, 2016

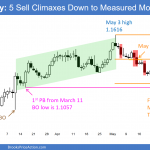

Day trading tip is buy pullback after bullish price action

I am on leave Thursday and Friday, and will not do an intraday update on Thursday. I am writing Wednesday night and the market might look very different once it opens on Thursday. Pre-Open Market Analysis S&P 500 Emini: Day trading tip is to buy a pullback after bullish price action Breakout of High 2 […]

Intraday market update: May 24, 2016

Learn how to trade second signal candlestick patterns

Posted 6:56 a.m. The Emini gapped above yesterday’s high and had a Trend From The Open Bull Trend for several bars. The rally was strong enough so that bulls will probably buy the 1st reversal down. It was also strong enough to make a bull trend day more likely than a bear trend day. Today […]