Futures trading strategies after a buy climax : Posted 7:02 a.m. The Emini opened around yesterday’s close and traded sideways with big bars and prominent tails. This is trading range price action. Although today is probably not going to be a bull trend day, it still might be a bear trend day. However, after such […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

Futures trading strategies after a buy climax

Day trading strategies after a sell climax

Intraday market update: June 29, 2016

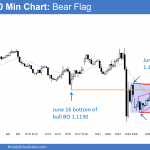

Day trading strategies after a sell climax: Updated 6:57 a.m. The Emini opened with a big gap up at a 50% retracement of the selloff and the June 16 low. The 5 minute chart is overbought. Hence, it is more likely to go sideways to down for the 1st hour or two. Also, whenever there […]

How to trade a big bear breakout

Intraday market update: June 28, 2016

How to trade a big bear breakout that is failing, posted 6:51 a.m. Yesterday was a big bear trend day. Today opened at yesterday’s high. There is the possibility that today could be a big bull trend day. This is a type of reversal pattern. There is a big bear day, and then a big […]

Brexit sell climax intraday trading techniques

Intraday market update: June 27, 2016

Brexit sell climax intraday trading techniques article, posted 7:05 a.m. While the Emini opened with a gap below Friday’s low, and the gap might stay open for years, that is unlikely. It broke below the 15 minute bear channel. In general, there would be a 75% chance of a reversal up withing 5 bars on […]

Emini weekend update: June 25, 2016:

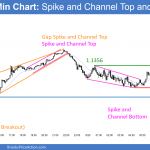

Online trading after the Brexit stock market crash

Monthly S&P500 Emini futures candlestick chart: Online trading after the Brexit stock market crash The monthly S&P500 Emini futures candlestick chart is forming a sell signal bar and a micro double top with the April high. Online trading after the Brexit stock market crash will be tricky until the charts provide more information. Friday’s big […]

Day trading the Brexit market crash

Intraday market update: June 24, 2016

Posted 6:46 a.m. Today opened with a big gap down, but it quickly traded back above the June 16 low. It will probably retrace 50% of the Globex range. The Emini is Always In Long. The 1st 3 bars were strong enough to make sideways to up likely for the 1st 2 hours and possibly […]

Day trading volatile price action

Intraday market update: June 23, 2016

Posted 7:01 a.m. Like yesterday, today began will small sideways bars with prominent tails. Limit order bulls and bears made money. This increases the chances for a lot of limit order, trading range price action today. While there will probably be a swing up and down, the odds are that the trend will not be […]

Day trading strategies before a catalyst

Intraday market update: June 22, 2016

Posted 6:53 a.m. Today opened with a continuation of yesterday’s trading range price action. It is giving traders a chance to practice Day trading strategies before a catalyst. Yesterday was a buy signal bar and the Emini is testing its high. Although the odds favor a move above yesterday’s high to trigger the buy, the […]

Bull flag candlestick pattern before Brexit vote

Intraday market update: June 21, 2016

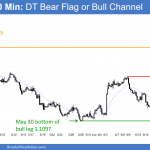

Posted 6:55 a.m. The Emini entered the day with a bull flag candlestick pattern before the Brexit vote. Limit order bulls and bears each made money on each of the 1st 3 bars. This increases the chances of trading range price action today. The Emini opened in the middle of yesterday’s sell climax at the […]

Trading Brexit price action

Intraday market update: June 20, 2016

Posted 6:49 a.m. The Emini had a big gap up and then a couple of bull trend bars. This reduces the chances of a bear trend day. The bears need a strong bear breakout with follow-through, and this is unlikely at the moment. The Emini will probably be mostly sideways to up for the 1st […]