Emini island top reversal pattern Updated 6:59 a.m. The Emini opened with a Sell The Close selloff. The bears want to get below last week’s 2167.75 low, which would make this week an outside down week. The bulls always want the opposite and will buy above last week’s low. They therefore are trying to create […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

Emini island top reversal pattern

S&P500 testing 2200 big round number

Intraday market update: August 16, 2016

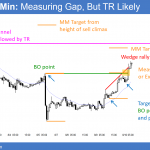

S&P500 testing 2200 big round number Updated 7:02 a.m. Today opened with a gap down. Yesterday therefore was a 1 day island top. While many tops and bottoms begin with island tops and bottoms, most island tops and bottoms become parts of a trading range. Hence, it is not strongly bearish. The 3 consecutive bear […]

S&P500 2,200 resistance

Intraday market update: August 15, 2016

S&P500 2,200 resistance Updated 7:00 a.m. The Emini gapped up and made a new all-time high on the open, and began with a Buy The Close rally. Yet, the 1st 3 bars had prominent tails, and limit order bears made money. While bullish, this is a sign that the bulls are not especially strong yet. […]

Stock market August correction

Emini weekend update: August 13, 2016

Monthly S&P500 Emini futures candlestick chart:Strong breakout, but possible stock market August correction The monthly S&P500 Emini futures candlestick chart has 7 consecutive bull trend bars. This is unusual on the monthly chart so the odds are that August will close below its open. It is too early to know if the rally will eventually […]

S&P500 Emini wedge top testing 2200

Intraday market update: August 12, 2016

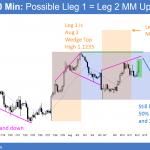

S&P500 Emini wedge top testing 2200 Updated 7:08 a.m. Yesterday was a Micro Double Top on the daily chart and therefore a sell signal bar for a failed breakout above the 3 month trading range. Yet, it had a bull body, which lowers the probability for bears selling below yesterday’s low. Today began with a […]

Emini nested top reversal down

Intraday market update: August 11, 2016

Emini nested top reversal down Updated 6:53 a.m. While the Emini gapped up and traded above yesterday’s high, the 1st several bars overlapped and had prominent tails. This trading range price action is similar to yesterday’s open, and it reduces the chances of a strong trend day. Yet, there will probably be at least one […]

Nested Emini final flag and expanding triangle top

Intraday market update: August 10, 2016

Nested Emini final flag and expanding triangle top Updated 6:52 a.m. The Emini again opened exactly in the middle of yesterday’s range. This increases the chances for a trading range day. This is especially likely since yesterday was a trading day and today opened in a tight trading range from yesterday’s close and in the […]

Nested expanding triangles and final flags

Intraday market update: August 9, 2016

Nested expanding triangles and final flags Updated 6:52 a.m. Yesterday was a bear channel, and therefore a bull flag. Yet, it was also a Spike and Channel Bear Trend, which usually evolves into a trading range. Two of the 1st 3 bars were dojis and today opened in yesterday’s range. This is consistent with the […]

August stock market correction not likely this week

Intraday market update: August 8, 2016

August stock market correction not likely this week I updated this at 6:59 a.m. The Emini gapped up to a new all-time high. The bulls wanted the gap to stay open and for today to be another Trend From the Open bull trend. Yet, Friday was a tight trading range and their breakouts usually do […]

August buy climax and correction

Emini weekend update: August 6, 2016

Monthly S&P500 Emini futures candlestick chart:Follow-through buying after last month’s breakout The monthly S&P500 Emini futures candlestick chart had 6 consecutive bull trend bars coming into this month. Last month was a strong bull breakout. The bulls want a bull trend bar this month to confirm last month’s breakout. Yet, 6 consecutive bull bars on […]