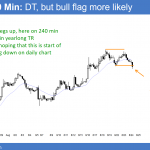

August bear reversal bar Updated 6:51 a.m. The Emini rallied on the open and broke above the 60 minute moving average and the 50% pullback level. Yet, the 1st 2 bars had prominent tails and the 3rd bar was a small bar. This reduces the chances of a big bull trend day. The bulls need […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

August bear reversal bar

Weekly chart outside down bar sell signal

Emini weekend update: August 27, 2016

Monthly S&P500 Emini futures candlestick chart: Probable bear month The monthly S&P500 Emini futures candlestick chart has 3 days left before the bar closes on Wednesday. It is now a doji candlestick pattern in a 7 bar bull micro channel. That is a buy climax and the odds favor a 1 – 3 bar (month) […]

Yellen Fed interest rate hike announcement

Intraday market update: August 26, 2016

Yellen Fed interest rate hike announcement Updated 7:11 a.m. The Emini broke above the 3 day tight bear channel on the open. It sold off sharply on Yellen’s remarks, and then reversed up to a new high of the day. This Big Up, Big Down, Big Up trading creates confusion. It therefore increases the chances […]

Emini double top at 2200 resistance

Intraday market update: August 25, 2016

Emini double top at 2200 resistance Updated 6:57 a.m. The Emini reversed up from below yesterday’s low and from 1 tick below the open of the month. Yet, because the 2 day selloff was in a tight bear channel, the odds are that this reversal up will be a bull leg in a trading range. […]

Greater fools theory crowded trade

Intraday market update: August 24, 2016

Greater fools theory crowded trade Because I will not be trading today, I will be unable to provide an update. Pre-Open Market Analysis The Emini made a new high again yesterday and formed a 5 day island bottom. However, there was no enthusiasm. The day was small and sideways. While yesterday was an entry bar […]

Emini island bottom bull breakout

Intraday market update: August 23, 2016

Emini island bottom bull breakout Updated 6:46 a.m. While the Emini gapped up to a new high and formed an island bottom, the breakout was weak. The Emini is Always In Long, and the bulls still want a bull trend day. Yet, these 1st few bars make a strong bull trend day less likely. More […]

S&P500 stock market wedge rally buy climax

Intraday market update: August 22, 2016

S&P500 stock market wedge rally buy climax Updated 6:56 a.m. The Emini sold of on the 1st bar to test yesterday’s low. Yet, this was followed by a pair of dojis and a 4 bar tight trading range. Limit order bulls and bears made money in the 1st few bars. Hence, these are signs that […]

Emini August buy climax

Emini weekend update: August 20, 2016

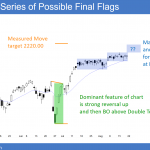

Monthly S&P500 Emini futures candlestick chart:Breakout and Emini August buy climax The Emini has had 7 consecutive bull trend bars on the monthly candlestick chart. While last month was a strong bull breakout, this month so far is a doji bar. That is therefore weak follow-through buying. Hence, it increases the chances of a pullback […]

Emini head and shoulders top

Intraday market update: August 19, 2016

S&P500 Emini head and shoulders top, but most tops fail Updated 6:54 a.m. While the Emini opened with strong bear bars and a breakout below yesterday’s double top, many days over the past 6 weeks have had similar opens that led to Opening Reversals. The bears want a close below last week’s low. Hence, this […]

S&P500 Emini head and shoulders top

Intraday market update: August 18, 2016

S&P500 Emini head and shoulders top Updated 6:56 a.m. Yesterday’s breakout was strong enough to have a 3rd push up today. While the pullback from the breakout overlapped the breakout point, the overlap was not too much. Therefore the gap might be a Negative Gap. Hence, it still might result in a Measured Move up. […]