Monthly S&P500 Emini futures candlestick chart:Failed bull breakout The monthly S&P500 Emini futures candlestick chart has a bear body. It will probably have a bear body when the month closes because the rally has been climactic. The monthly S&P500 Emini futures candlestick chart had 7 consecutive bull trend bars as of last month. That is […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

September stock market crash is unlikely

Emini daily double top and weekly bull flag

Intraday market update: September 9, 2016

Emini daily double top and weekly bull flag Updated 6:55 a.m. The Emini opened with a big gap down and a pair of bear bars. Because the open is so far below the average price, many bears will wait to sell a rally or trading range that is closer to the moving average. While the […]

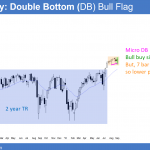

Emini weekly bull flag candlestick pattern

Intraday market update: September 8, 2016

Emini weekly bull flag candlestick pattern Posted 7:01 a.m. Like most days in the 2 month trading range, today had a limit order, trading range open. Both bulls and bears made money with limit orders in the first 5 bars. This reduces the chances of a strong trend day today up or down. Yesterday was […]

Emini weekly bull flag below all-time high

Intraday market update: September 7, 2016

Emini weekly bull flag below all-time high Updated 6:55 a.m. The Emini opened with a sideways series of bars that had prominent tails and small bodies. While it is Always In Long from yesterday, this is trading range price action. It therefore increases the chances of a lot more of it today. This is especially […]

September Emini 100 point correction

Intraday market update: September 6, 2016

September Emini 100 point correction Updated 6:55 a.m. The Emini gapped above Friday’s bull flag, but formed a tight trading range. This increased the chances for a lot of trading range price action today and reduced the chances for a strong trend up or down. Because the all-time high is only 10 points higher, the […]

September or October stock market correction

Emini weekend update: September 3, 2016

Monthly S&P500 Emini futures candlestick chart:September or October stock market correction The monthly S&P500 Emini futures candlestick chart had its 7th consecutive bull trend bar last month. Although today is early in the month, there is a 70% chance that September will close below its open. While the monthly S&P500 Emini candlestick chart in August […]

September unemployment jobs report breakout

Intraday market update: September 2, 2016

September unemployment jobs report breakout Updated 6:48 a.m. The Emini has sold off for 8 days and yesterday reversed up from the bottom of the month-long trading range. It also rallied on the unemployment report before the open today. While it gapped up on the open, it formed doji bars just below the August 29 […]

September unemployment report and Federal Reserve interest rate hike

Intraday market update: September 1, 2016

September unemployment report and Federal Reserve interest rate hike Updated 6:50 a.m. The Emini stalled at the 60 minute moving average and the top of yesterday’s tight trading range. This is trading range price action. Yesterday’s 3 hour bull channel is a bear flag. Therefore, there is only a 25% chance of a strong bull […]

September 2016 stock market correction

Intraday market update: August 31, 2016

September 2016 stock market correction Updated 6:56 a.m. The Emini opened with a tight trading range just above yesterday’s low and the open of the month. This is a breakout mode setup. Because the Emini was unable to reverse strongly above the open of the month yesterday and did not reach the open of the […]

End of month and unemployment report stock market catalysts

Intraday market update: August 30, 2016

End of month and unemployment report stock market catalysts Updated 6:57 a.m. Because today might be a 2nd inside day, traders sold the early test of yesterday’s high. This was a lower high major trend reversal, but there was no good sell signal bar and no strong bear breakout. The bulls want to get above […]