FOMC report created failed bear flag I will update around 6:50 a.m. The Emini had a big gap up after yesterday’s buy climax. While it still might rally for about 10 bars in the 1st 2 hours, the odds are that by the end of the 2nd hour, it will have at least a couple […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

FOMC report created failed bear flag

Market breakout after September FOMC interest rate hike announcement

Intraday market update: September 21, 2016

Market breakout after September FOMC interest rate hike announcement Updated 6:49 a.m. While the Emini gapped up and began with 2 bull bars, both had tails on top. The Emini is Always In Long, but at resistance. Neither bar was big, and they could not break above yesterday’s high or the daily moving average. Whenever […]

September FOMC fed interest rate hike stock market breakout

Intraday market update: September 20, 2016

September FOMC fed interest rate hike stock market breakout Updated 6:52 a.m. The Emini gapped up and sold off on the open. Yet, there was a bull body after the 1st big bear bar. This therefore is a sign that the bears lack conviction. Hence, it increases the chances that the selloff is a bear […]

Trading range before Wednesday’s September FOMC announcement

Intraday market update: September 19, 2016

Trading range before Wednesday’s September FOMC announcement Updated 6:55 a.m. While the Emini gapped above Friday’s high and began with consecutive bull bars, limit order bears made money. This therefore reduces the chances of a strong bull trend day. The Emini is Always In Long, yet the rally has not been strong. While it might […]

September FOMC Fed rate hike

Emini weekend update: September 17, 2016

Monthly S&P500 Emini futures candlestick chart:Reversal down into a bull flag The monthly S&P500 Emini futures candlestick chart is pulling back into a bull flag. Less likely, this is the start of a major Final Bull Flag reversal. The monthly S&P500 Emini futures candlestick chart had 7 consecutive bull trend bars prior to this month. […]

Stock market rally before Fed’s FOMC interest rate announcement

Intraday market update: September 16, 2016

Stock market rally before Fed’s FOMC interest rate announcement Updated 6:52 a.m. The Emini gapped below the 60 minute moving average to around a 50% pullback of yesterday’s rally. This is therefore consistent with what I said yesterday about yesterday’s rally probably being a bull leg in a 5 day bear flag. The bulls want […]

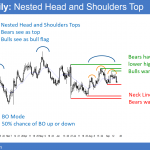

Breakout mode candlestick pattern

Intraday market update: September 15, 2016

Breakout mode candlestick pattern Updated 6:49 a.m. The Emini opened within the trading range at the end of yesterday. Since yesterday was a Spike and Channel bear trend, the odds favor a rally above the lower highs, and possibly to the 2130 top of the bear channel. That is also at the 60 minute moving […]

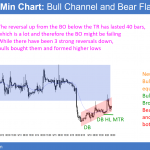

Increased volatility before FOMC announcement

Intraday market update: September 14, 2016

Increased volatility before FOMC announcement Updated 6:55 a.m. The Emini reversed up yesterday from a Higher Low Major Trend Reversal. Yet, it was in a trading range for 5 hours. While the Emini continued Always In Long from yesterday, day traders are waiting for a breakout. Because yesterday was an inside day and today is […]

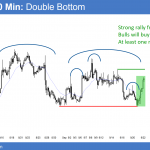

Emini sell climax and failed bear breakout

Intraday market update: September 13, 2016

Emini sell climax and failed bear breakout Updated 6:44 a.m. The Emini opened with a big gap down in the middle of yesterday’s range. Because of the confusion, from yesterday, today will probably be a trading range day. Since yesterday was a big day and the Emini is in its middle, today will probably be […]

September stock market crash unlikely

Intraday market update: September 12, 2016

September stock market crash Updated 6:43 a.m. The Emini gapped below yesterday’s low, yet reversed up sharply. The odds are that the 2 hours of sideways to up trading has begun. While there is always a 50% chance of follow-through selling in the 1st 2 hours after a sell climax day, this reversal up was […]