Possible brief October stock market correction Updated 6:55 a.m. The Emini gapped up big, yet began with 2 bear bars. That reduced the chances of a bull trend for the 1st hour or two. While today still might be a bull trend day, the odds are that it will have to go sideways to down […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

Possible brief October stock market correction

Emini bear flag in October correction

Intraday market update: October 17, 2016

Emini bear flag in October correction Updated 6:46 a.m. While the Emini traded below Friday’s low and triggered the Low 1 sell signal on the daily chart, the odds are against a big bear trend day. Friday was a big day. Therefore, the stop is far above. This creates a big risk. Since the Emini […]

Weak October stock market rally

Emini weekend update: October 15 2016

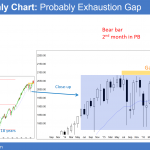

Monthly S&P500 Emini futures candlestick chart:Pullback for 2nd month The monthly S&P500 Emini futures candlestick chart traded below last month’s low and therefore has pulled back for 2 months. While the bears see August as a Low 2 sell signal bar, it was a doji. It was therefore a low probability sell. This is especially […]

September low double bottom for possible year end rally

Intraday market update: October 14, 2016

September low double bottom for possible year end rally Updated 6:46 a.m. The Emini gapped up and tested Wednesday’s high, the top of yesterday’s bull channel, and last week’s low. Yet, the 1st 2 bars were dojis. This increases the probability that the initial rally attempt will not get far before going sideways to down. […]

Failed bear breakout, but October selloff still possible

Intraday market update: October 13, 2016

Failed bear breakout, but October selloff still possible Updated 6:45 a.m. The Emini opened with a big gap down. Yet, the 1st bar was a doji and the 2nd and 3rd bars had tails below. Therefore there is no sense of urgency. Traders feel that the price is about right. This increases the chances of […]

Outside down week and bull trend line break

Intraday market update: October 12, 2016

Outside down week and bull trend line break Updated 6:55 a.m. While the Emini sold off on the 1st 3 bars, the bodies were shrinking. The bears therefore became less willing to sell lower. The bulls want a higher low major trend reversal. Yet, the 3 bear bars represent enough selling pressure so that the […]

Traders see third quarter earnings as catalyst for breakout

Intraday market update: October 11, 2016

Traders see third quarter earnings as catalyst for breakout Updated 6:50 a.m. The Emini broke strongly below the 60 minute moving average on the open. The weekly chart has an ii pattern and yesterday traded above last week’s high. Henc, the Emini might now trade below last week’s low and turn this week into an […]

Emini daily chart triangle

Intraday market update: October 10, 2016

Emini daily chart triangle Updated 6:50 a.m. While today began with a trend from the open bull trend, the initial bars were not especially big and the Emini is testing the top of the trading range. Because the rally is reasonably strong, the best the bears will probably get over the next hour is a […]

Brief October selloff then new all-time high

Emini weekend update: October 8, 2016

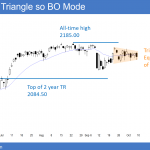

Monthly S&P500 Emini futures candlestick chart: Buy climax The monthly S&P500 Emini futures candlestick chart is forming its 3rd consecutive doji bar. While this is a small bull flag, it is a weak buy setup and there are probably sellers above. The monthly S&P500 Emini futures candlestick chart had 7 consecutive bull trend bars prior […]

Day trading the October unemployment jobs report

Intraday market update: October 7, 2016

Day trading the October unemployment jobs report Updated 6:55 a.m. The Emini reversed down from above the neck line of the 4 day head and shoulders bottom on the open. Furthermore, it had good follow-through selling. While it is possible that this bear breakout will fail, the odds are against that. The reversal down was […]