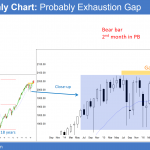

Monthly S&P500 Emini futures candlestick chart:Stock market presidential election pullback The monthly S&P500 Emini futures candlestick chart dipped below the September low. It is therefore the 2nd month of the pullback. Yet, it is a small bar following 2 dojis, and therefore neutral. The monthly S&P500 Emini futures candlestick chart is in a bull trend. […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

Presidential election stock market correction or rally

Emini bear flag pre-election breakout attempt

Intraday market update: October 28, 2016

Emini bear flag pre-election breakout attempt Updated 6:44 a.m. The Emini sold off on the open, but reversed up strongly. It is trying to form an early low of the day after yesterday’s big outside down day at the bottom of a 2 week trading range. Because yesterday’s bear channel was tight, this 1st reversal […]

Awaiting presidential election stock market correction or rally

Intraday market update: October 27, 2016

Awaiting presidential election stock market correction or rally Updated 6:52 a.m. The Emini reversed down strongly from above yesterday’s high and is Always In Short. It is testing the 60 minute moving average. The bulls therefore hope that this selloff will form an Opening Reversal up from support. Hence, they want an early low of […]

Donald Trump’s stock market effect

Intraday market update: October 26, 2016

Donald Trump’s stock market effect Updated 6:46 a.m. While the Emini opened with a big gap down, 2 of the first 3 bars were dojis. Therefore, there was no sense of urgency. Because this is a bear breakout below bear channel, there is a 75% chance of a sideways to up move to the top […]

Weak Emini head and shoulders bottom breakout

Intraday market update: October 25, 2016

Weak Emini head and shoulders bottom breakout Updated 6:52 a.m. The Emini reversed up from below yesterday’s low on the open. Since yesterday had a small range, the bulls have a reasonable chance of forming an outside up day today. The bears hope that the early rally is simply a pullback from the breakout below […]

Stock market late October bullish seasonality

Intraday market update: October 24, 2016

Stock market late October bullish seasonality Updated 6:49 a.m. While today had a big gap up, the 1st bar was not big and the next bar was a bear doji. This is therefore a disappointing open for the bulls. Furthermore, the bear doji was not a strong sell signal. Disappointed bulls and bears increase the […]

Presidential election stock market rally or reversal

Emini weekend update: October 22, 2016

Monthly S&P500 Emini futures candlestick chart:Continued pullback after buy climax The monthly S&P500 Emini futures candlestick chart has a small bear body after 2 dojis. This is weak follow-through buying after the July breakout above a 2 year trading range. The monthly S&P500 Emini futures candlestick chart has a bear doji so far this month. […]

No presidential debate stock market reaction

Intraday market update: October 21, 2016

No presidential debate stock market reaction Updated 6:50 a.m. While today gapped below yesterday’s low, the bulls closed the gap on the 1st bar. Yet, the bar had a tail on top. This bar disappointed both the bulls and the bears. It therefore increased the chances that today will be like most days over the […]

Presidential election stock market rally or correction

Intraday market update: October 20, 2016

Presidential election stock market rally or correction Updated 6:53 a.m. The Emini fell below yesterday’s low on the 2nd bar to trigger the low 2 short on the daily chart. Yet, it then reversed up on the 3rd bar and limit order bulls were able to make money. Therefore, the odds of a big bear […]

House and Senate Congressional elections causing stock market breakout

Intraday market update: October 19, 2016

House and Senate Congressional elections causing stock market breakout Updated 6:43 a.m. The Emini opened within yesterday’s 3 hour tight trading range, and the 1st bar had tails up and down. This initial trading range price action therefore increases the odds that today will be mostly a trading range day. While yesterday is a sell […]