President Trump Christmas rally resumed yesterday Updated 6:52 a.m. While the Emini rallied for the 1st bars, all were dojis. In addition, the stairs pattern from the last 2 hours of yesterday continued. The pullback fell below the breakout point. Therefore, limit order bears are continuing to make money by scaling in above highs. This […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

President Trump Christmas rally resumed yesterday

Trump rally resumption might form double top

Intraday market update: December 7, 2016

Trump rally resumption might form double top Updated 6:50 a.m. Yesterday had a wedge top. The bulls then got a climactic breakout of that top. This created consecutive wedge tops. The 60 minute chart has nested wedges. Furthermore, this is at the top of an 11 day trading range. This increases the chances of sideways […]

Emini trading range before FOMC Fed interest rate hike

Intraday market update: December 6, 2016

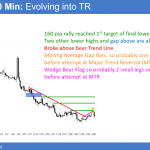

Emini trading range before FOMC Fed interest rate hike Updated 7:00 a.m. While the Emini sold off on the open and is Always In Short, the bulls bought after 4 bars. This is more likely a bear leg in a trading range than the start of a strong bear trend day. The 60 minute moving […]

Trump rally pausing before Fed interest rate announcement

Intraday market update: December 5, 2016

Trump rally pausing before Fed interest rate announcement Updated 6:55 a.m. While the Emini gapped above Friday’s high, which is the neck line of the 2 day double bottom, it failed to create bull bars on the 1st 2 bars. That lowered the probability of a trend from the open bull trend. The context is […]

Trump rally pausing before Fed FOMC interest rate hike

Emini weekend update: December 3, 2016

Monthly S&P500 Emini futures candlestick chart:Strong bull breakout, but possible exhaustion gap The monthly S&P500 Emini futures candlestick chart formed a big outside up month in November. It closed at a new all-time monthly high. Because of the 3 pushes up from February, bears will try to create a reversal down from a parabolic wedge […]

President Trump rally pulling back to August high breakout point

Intraday market update: December 2, 2016

President Trump rally pulling back to August high breakout point Updated 6:50 a.m. The Emini opened in the middle of the 60 minute moving average above and the August high below. Further more, it began with a bear doji, a rally, and reversal. It is therefore neutral and deciding whether to test support or resistance. […]

President Trump Christmas rally stalling before FOMC meeting

Intraday market update: December 1, 2016

President Trump Christmas rally stalling before FOMC meeting Updated 6:49 a.m. The Emini is having a trading range open. It tested the low of the 5 day trading range on the open. The bears see Tuesday’s low as the neck line of a double top. They therefore want a breakout and measured move down. Most […]

Limited resumption of the President Trump rally

Intraday market update: November 30, 2016

Limited resumption of the President Trump rally Updated 6:48 a.m. While the Emini gapped above yesterday’s high and broke to a new all-time high, the first bars were small. Furthermore, trend resumption up after a bear breakout below a protracted bull micro channel typically lasts 3 – 5 days. The odds are that the Emini […]

Christmas year end rally pullback

Intraday market update: November 29, 2016

Christmas year end rally pullback Updated 6:51 a.m. The bulls tried to rally from above yesterday’s low and the 60 minute moving average, but failed at the 5 minute moving average. The day began with limit order bull and bear scalpers making money. This looks like a continuation of the trading range trading of the […]

Stock market buy climax pullback

Intraday market update: November 28, 2016

Stock market buy climax pullback Updated 6:59 a.m. The Emini reversed up from below Friday’s low on the open. Hence, this is the 1st pullback in a 12 day bull micro channel. The bulls want an outside up day and therefore another new all-time high. Yet the rally was weak, as was the initial selloff. […]