Monthly S&P500 Emini futures candlestick chart: Breakout is losing momentum The monthly S&P500 Emini futures candlestick chart has a small bull doji bar so far this month. December was also small and had a tail on top. Therefore, the 3 month breakout is losing momentum. The monthly S&P500 Emini futures candlestick chart is in a […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

President Trump and January Effect stock market rally

Trump rally above Dow 20,000 big round number

Intraday market update: January 20, 2017

Trump rally above Dow 20,000 big round number Updated 6:50 a.m. The Emini gapped up and formed 2 good bull bars. It was therefore Always In Long on the open. Yet, it is at the top of the 3 week tight trading range. This is therefore a test. The bulls want an early low of […]

Dow 20,000 buy climax at resistance

Intraday market update: January 19, 2017

Dow 20,000 buy climax at resistance Updated 6:54 a.m. The Emini reversed down from above yesterday’s high. Yet, both yesterday’s rally and today’s reversal were weak. This is still trading range price action, and it increases the odds of more throughout the day. Because yesterday was a small day, the 5 minute Emini chart is […]

Dow 20,000 Trump rally buy climax?

Intraday market update: January 18, 2017

Dow 20,000 Trump rally buy climax? Updated 6:47 a.m. The Emini began with a selloff from near yesterday’s high and then a rally from above yesterday’s low. Furthermore, it is also in the middle of a 5 week trading range. In addition, Friday was a Big Down, Big Up day. Hence, this is a trading […]

Stock Market Zero Sum Game and Eternal Bull Market: Weekend update: January 14, 2017

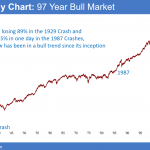

Stock Market Zero Sum Game and Eternal Bull Market? The Dow will break strongly above 20,000, even if it falls to 10,000 first! That is because the world creates more workers in an increasingly efficient world economy every day. As a result, the world’s wealth is steadily increasing. Since the stock market contains a big […]

Intraday market update: January 12, 2017

Updated 7:00 a.m. The Emini gapped below yesterday’s tight bull channel. Yet, the odds are that the early selling will lead to a trading range after yesterday’s channel. Furthermore, the Emini has been in a tight range for the past 7 days. In addition, that range is within a 2 week trading range. Hence the […]

Dow 20,000 double top major trend reversal

Intraday market update: January 11, 2017

Dow 20,000 double top major trend reversal Updated 7:08 a.m. The Emini reversed up from a breakout below yesterday; late major low. While the rally failed to break above the late lower high, it was strong enough for traders to see the market as Always In Long. Hence, the odds are greater that there are […]

President Trump and January effect stock market rally

Intraday market update: January 9, 2017

President Trump and January effect stock market rally Updated 6:49 a.m. While the Emini gapped down and had a bear bar, the 1st 2 bars had tails below. In addition, they were at the bull trend line and the 60 minute moving average. Furthermore, the selloff at the end of Friday was weak. Finally, limit […]

Stock market January Effect and Dow 20,000

Emini weekend update: January 7, 2017

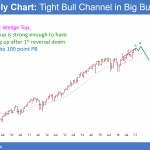

Monthly S&P500 Emini futures candlestick chart:Stock market January Effect and Dow 20,000 The monthly S&P500 Emini futures candlestick chart broke to a new all-time high on Friday. Hence, this is more follow-through buying after 2 bull bars. The monthly S&P500 Emini futures candlestick chart this month is a bull bar so far. Yet, last month […]

Trump rally stalling at Dow 20,000

Intraday market update: January 6, 2017

Trump rally stalling at Dow 20,000 Updated 6:51 a.m. The Emini reversed down from above yesterday’s high on the open. Yet, it then reversed up from the 60 minute moving average. The bars are big and limit order bulls and bears made money. In addition, it is in the trading range of 2 days ago. […]