Island top still valid after FOMC announcement Updated 6:53 a.m. While the Emini reversed up from below yesterday’s low with 2 bull bars, the bars were not particularly big. Furthermore, they failed to get above the moving average. While this is enough to make the Emini Always In Long, it is probably a minor reversal. […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

Island top still valid after FOMC announcement

Breakout Mode before FOMC Fed interest rate hike announcement

Intraday market update: February 1, 2017

Breakout Mode before FOMC Fed interest rate hike announcement Updated 6:51 a.m. The Emini gapped up and formed an island bottom. Yet, it quickly formed doji bars. Hence, there is confusion. This increases the chances of an early trading range. While the early reversal attempt might be the high of the day, tight bull channels […]

FOMC Fed interest rate hike creating breakout mode

Intraday market update: January 31, 2017

FOMC Fed interest rate hike creating breakout mode Updated 6:51 a.m. The Emini opened with 4 dojis in the middle of yesterday’s 5 hour trading range. This neutral open increases the chances of a trading range day. Yesterday’s highs and lows are therefore targets. Because a strong trend day is unlikely at this point, the […]

Emini gap up means possible gap down and island top

Intraday market update: January 30, 2017

Emini gap up means possible gap down and island top Updated 6:47 a.m. The Emini gapped down and had a big bear trend bar and strong follow-through selling. Hence, the Emini is Always In Short. Yet, it is also a breakout test of the top of the 6 week trading range and a 50% pullback. […]

Possible Island Top and 5% stock market correction

Emini weekend update: January 28, 2017

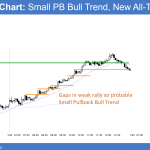

Monthly S&P500 Emini futures candlestick chart: Trump rally and January Effect continues The monthly S&P500 Emini futures candlestick chart has a bull body this month. This is the 3rd month in the breakout and there is no sign of a top yet.Yet the bodies are shrinking and therefore represent some loss of momentum. The monthly […]

Dow 20,000 big round number and January Effect

Intraday market update: January 27, 2017

Dow 20,000 big round number and January Effect | Brooks Trading Course Updated 6:44 a.m. Today opened in the middle of yesterday’s range and tested yesterday’s low. Yesterday was a sell signal bar on the daily chart for a failed breakout above a 6 week trading range. Yet, this week’s rally was strong. Therefore, the […]

Dow 20,000 January effect all-time high breakout

Intraday market update: January 26, 2017

Dow 20,000 January effect all-time high breakout Updated 6:55 a.m. The bears made money selling above highs yesterday. That therefore increases the chances that the bull trend will transition into a trading range. Because the bulls keep getting higher lows, the bull trend is still in effect. Therefore, the bears need to get below prior […]

S&P500 all time high and Dow 20,000 big round number

Intraday market update: January 25, 2017

S&P500 all time high and Dow 20,000 big round number Updated 6:49 a.m. The Emini opened with a big gap up and the Dow broke above 20,000. It is Always In Long. Yet, the 1st bar had a big bear body. While it is possibly the low of the day, it is more likely not. […]

Emini bull flag at daily chart exponential moving average

Intraday market update: January 24, 2017

Emini bull flag at daily chart exponential moving average updated 6:45 a.m. The day opened with trading range price action at the top of yesterday’s weak bull channel. The bears want this to be a test of yesterday’s high and an early high of the day. Yet, the early dojis make a limit order open […]

Dow 20,000 Trump rally, then 5% stock market correction

Intraday market update: January 23, 2017

Dow 20,000 Trump rally, then 5% stock market correction Updated 6:51 a.m. The Emini began with a limit order open within Friday’s 4 hour range. This increases the chances of a lot of trading range trading today. Yet the 4 hour range is tight. The odds are that there will be a breakout and measured […]