Emini exhaustion gap and possible buy climax island top Updated 6:46 a.m. Despite Friday’s strong bull close, the Emini reversed down after testing Friday’s high. Since Friday’s rally was strong, this is probably a Big Up, Big Down, Big Confusion open. Hence, the Emini will probably go sideways around a 50% pullback from Friday’s rally. […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

Emini exhaustion gap and possible buy climax island top

Trump rally reversing into 5% 100 point March correction

Emini weekend update: February 25, 2017

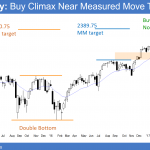

Monthly S&P500 Emini futures candlestick chart:Trump rally reversing into 5% 100 point March correction The monthly S&P500 Emini futures candlestick chart has a big bull trend bar so far in February. In addition, the rally is testing measured move targets. The monthly S&P500 Emini futures candlestick chart has a big bull trend bar so far […]

Trump rally stalling before possible FOMC March rate hike

Intraday market update: February 24, 2017

Trump rally stalling before possible FOMC March rate hike Updated 6:55 a.m. The Emini gapped down and created a 3 day island top. Yet, it immediately rallied above yesterday’s low and closed the gap. While there were consecutive bull bars, which made the Emini Always In Long, the bars were not especially big. Furthermore, the […]

Trump rally is exhaustive buy climax at measured move targets

Intraday market update: February 23, 2017

Trump rally is exhaustive buy climax at measured move targets Updated 6:45 a.m. While the Emini gapped up to a new all-time high, it sold off on the 1st 2 bars. Since this is a 3rd push up on the 60 minute chart, it is a wedge top. Yet, there is still room to the […]

Emini Trump rally buy climax testing 2400

Intraday market update: February 22, 2017

Emini Trump rally buy climax testing 2400 Updated 6:47 a.m. While the Emini continued yesterday’s selloff on the open, limit orders bulls made money. Since yesterday was a trading range day, the odds are that today will find support near yesterday’s low. Furthermore, the bull trend of the past 2 weeks will probably transition into […]

Emini ii final bull flag before pullback

Intraday market update: February 21, 2017

Emini ii final bull flag before pullback Updated 6:49 a.m. The Emini gapped up on the weekly chart. In addition, it is in a parabolic buy climax on the daily chart. The odds are that the breakout will lead to a trading range this week. The day began with a trend from the open bull […]

Trump rally buy climax near measured move targets

Emini weekend update: February 18, 2017

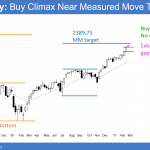

Monthly S&P500 Emini futures candlestick chart:Trump rally buy climax near measured move targets The monthly S&P500 Emini futures candlestick chart has a bigger bull bar this month. It is therefore accelerating up in a buy climax. The monthly S&P500 Emini futures candlestick chart is in a bull trend. Furthermore, it broke slightly above a measured […]

Emini bull flag, but buy climax at 2350 resistance

Intraday market update: February 17, 2017

Emini bull flag, but buy climax at 2350 resistance Updated 6:46 a.m. The Emini finally pulled back to the 60 minute moving average. The bulls wanted an Opening Reversal up from that average, but were unable to create strong buy signal bars. The bears want the second leg down, after yesterday’s strong selloff, to fall […]

Emini stock market parabolic buy climax near 2350 resistance

Intraday market update: February 16, 2017

Emini stock market parabolic buy climax near 2350 resistance Updated 6:50 a.m. The Emini began with small sideways bars. Hence, it tetsed yesterday’s high. The odds are that there will be at least 2 hours of sideways to down trading. Furthermore, there is better than a 50% chance that today will have a bear body […]

Emini all time high breakout is testing 2375 measured move target

Intraday market update: February 15, 2017

Emini all time high breakout is testing 2375 measured move target Updated 6:53 a.m. The gap down on the open created a Big Up, Big Down pattern with yesterday’s close. It therefore created confusion and it increased the odds of a trading range for the 1st hour or two. The bulls want to test yesterday’s […]