Trump tax cut rally is buy climax at 2400 resistance Updated 6:57 a.m. The April high is a magnet just above, and the 60 minute moving average and yesterday’s low are support. At the moment, the Emini is Always In Short because of a pair of strong bear bars. The bears are trying to break […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

Trump tax cut rally is buy climax at 2400 resistance

Sell in May and go away, expecting 5 percent correction

Intraday market update: May 1, 2017

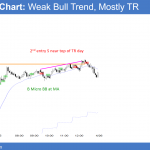

Sell in May and go away, expecting 5 percent correction Updated 6:49 a.m. Today opened with a pair of bear bars. Yet, last week’s high was the April high. Since April was a small bull flag, its high is a magnet. In addition, the bulls tried to reverse up on the 3rd bar, but the […]

Emini double top within 3 weeks, then 5 percent correction

Emini weekend update: May 1, 2017

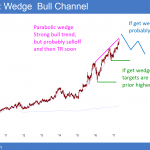

Monthly S&P500 Emini futures candlestick chart:Buy climax at measured move target April was a pullback in a 16 bar bull trend. Yet, because it is a doji after a buy climax and at resistance, the odds are that there will be sellers not far above. The monthly S&P500 Emini futures candlestick chart has a High […]

Correction after Trump tax cut and Obamacare repeal and replace

Intraday market update: April 28, 2017

Correction after Trump tax cut and Obamacare repeal and replace Updated 6:49 a.m. Yesterday reversed up strongly from a wedge bottom. Therefore, the odds favor a 2nd leg up today. Yet, today opened with 3 big bear bars within yesterday’s 4 hour trading range. Therefore, the bulls are hesitating. They want an opening reversal up […]

S&P500 double top at all time high causing 5 percent correction

Intraday market update: April 27, 2017

S&P500 double top at all time high causing 5 percent correction Updated 6:53 a.m. The Emini reversed up from above yesterday’s low without a strong buy signal bar. Since yesterday is a sell signal bar and the context is good, the odds are today will trade below its low. Furthermore, the 60 minute moving average […]

Trump rally resumption is likely bull trap at all time high

Intraday market update: April 26, 2017

Trump rally resumption is likely bull trap at all time high Updated 6:44 a.m. The Emini opened within yesterday’s tight range. In addition, the initial rally pulled back from the March 15 lower high. Furthermore, it failed at that price several times yesterday. These factors reduce the chance of a big bull trend day, despite […]

Emini buy climax creating great put buying opportunity

Intraday market update: April 25, 2017

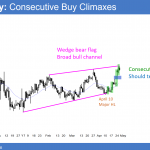

Emini buy climax creating great put buying opportunity Updated 6:50 a.m. The Emini gapped up and began with bull trend bars. This is therefore a trend from the open bull trend. Consequently, the bears therefore will probably need either a 2nd entry sell signal or a parabolic wedge before there is a reversal down. There […]

May correction will give back all 2017 stock market gains

Intraday market update: April 24, 2017

May correction will give back all 2017 stock market gains Updated 6:46 a.m. The Emini gapped up big, but formed a couple bear dojis. This is consistent with what I said about a trading range for 2 – 5 days. The odds are that the Emini will gap down within a week and selloff 5%. […]

Sell in May and go away means 5 percent correction

Emini weekend update: April 22, 2017

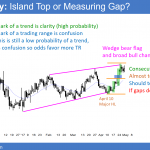

Monthly S&P500 Emini futures candlestick chart:Consecutive doji bars after buy climax The monthly S&P500 Emini futures candlestick chart has consecutive doji bars after a buy climax. Furthermore, it is at a measured move target based on the 2014 – 2015 trading range. In addition, that trading range was late in a bull trend. Hence, it […]

Trump bear rally resumption should fail around March 15 high

Intraday market update: April 21, 2017

Trump bear rally resumption should fail around March 15 high Updated 6:47 a.m. While the Emini tried to reverse up from a test of the neck line of the 4 day double bottom and a test of the bottom of yesterday’s trading range, the bear channel was tight. Consequently, the first reversal up will probably […]