Monthly S&P500 Emini futures candlestick chart:Weak entry bar after 1 bar bull flag The monthly S&P500 Emini futures candlestick chart had a High 1 bull flag in April. May traded above the April high, and therefore triggered the buy signal. The monthly S&P500 Emini futures candlestick chart is a small doji bar so far this […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

Trump firing of Comey is catalyst for 5 percent correction

Emini exhaustive buy climax at 2400 big round number

Intraday market update: May 12, 2017

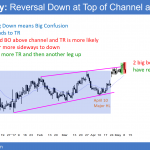

Emini exhaustive buy climax at 2400 big round number Updated 6:52 a.m. Since yesterday had a bull breakout around 9 a.m. and then a bull channel, it formed a spike and channel bull trend. Traders therefore expect that channel to evolve into a trading range. The bulls will try to reverse up from this area. […]

Emini all time high 2400 breakout despite Trump firing Comey

Intraday market update: May 11, 2017

Emini all time high 2400 breakout despite Trump firing Comey Updated 6:52 a.m. The Emini sold off in a series of strong bear bars on the open. It triggered the sell signal on the daily chart, and is Always In Short. The odds are that today will be a bear trend day. It probably will […]

Emini all time high and testing 2400 Big Round Number

Intraday market update: May 10, 2017

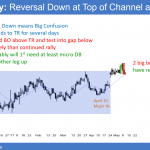

Emini all time high and testing 2400 Big Round Number Updated 6:52 a.m. Yesterday ended with a Big Down, Big up reversal after a wedge bear channel. The odds favor a breakout above that channel today and then either a trading range or a swing up. Because yesterday was a sell signal bar on the […]

Emini breakout above 2400 round number and all-time high

Intraday market update: May 9, 2017

Emini breakout above 2400 round number and all-time high Updated 6:49 a.m. The Emini broke to a new all-time high on the open. Yet, most of the past 10 days had an early selloff. Furthermore, most had early trading range price action and most were trading range days. Since the first several bars today look […]

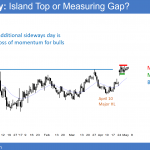

Breakout above April stock market high leading to correction

Intraday market update: May 8, 2017

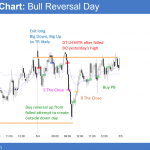

Breakout above April stock market high leading to correction Updated 6:47 a.m. The Emini reversed down from 1 tick below Friday’s high, which was a perfect double top with the March 1 all-time high. Friday’s rally was also parabolic. Yet today’s 1st bar created a Big Down move after a Big Up Move. This creates […]

Trump rally to new all time high leading to correction: Emini 2% up for 3 weeks, then 5% down for 2 months

Emini weekend update: May 6, 2017

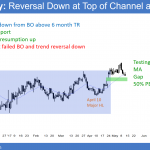

Monthly S&P500 Emini futures candlestick chart: Trump rally to new all time high leading to correction The monthly S&P500 Emini futures candlestick chart had a bull inside bar last month. It is therefore a buy signal bar in a strong bull trend. The bulls triggered the buy signal by breaking above the April high. The […]

Obamacare repeal is not cause of May June correction

Intraday market update: May 5, 2017

Obamacare repeal is not cause of May June correction Updated 6:55 a.m. While the Emini gapped above yesterday’s high, it sold off and closed the gap. In addition, the 1st several bars had bear bodies and prominent tails. But, the bears were unable to create consecutive big bear trend bars. The open therefore looks like […]

Trump rally buy climax breakout above final bull flag

Intraday market update: May 4, 2017

Trump rally buy climax breakout above final bull flag Update 6:51 a.m. The Emini gapped above yesterday’s high, but immediately reversed down and closed the gap. The bears therefore would like a bear trend day. In addition, they would like the selloff to fall below yesterday’s low and create an outside down day. While the […]

Stock market 5 percent correction regardless of earnings reports

Intraday market update: May 3, 2017

Stock market 5 percent correction regardless of earnings reports Updated 6:46 a.m. The Emini opened at yesterday’s low and the first 2 bars were small dojis. The bears were unable to create a big gap down, and the bulls were unable to create a strong reversal up. Hence, both feel that the price of the […]