Amazon and Google testing 1,000, lifting stock market Updated 6:54 a.m. The Emini gapped up to a new all-time high and above 2400 and the 2 month trading range. Yet, the 1st bar was a bear bar and the next was a doji. Furthermore, most days for the past week have had lots of reversals. […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

Amazon and Google testing 1,000, lifting stock market

Market ignoring London terror attack and Trump’s Russia Probe

Intraday market update: May 24, 2017

Market ignoring London terror attack and Trump’s Russia Probe Update 6:49 a.m. The day opened above yesterday’s high and 2400, and reversed down from a 3 hour expanding triangle top. The 1st 2 bars were bear bars and therefore the Emini is Always In Short. Yet, the bodies were small and both had prominent tails. […]

Trump’s Mideast trip will not prevent 100 point correction

Intraday market update: May 23, 2017

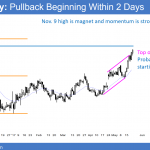

Trump’s Mideast trip will not prevent 100 point correction Updated 6:54 a.m. Today opened above yesterday’s high. Furthermore, the week will likely begin to test down today or tomorrow. In addition yesterday had a small range. Finally, the magnet of the 60 minute moving average is around yesterday’s low. These factors increase the chance of […]

Possible island bottom after Trump’s island top

Intraday market update: May 22, 2017

Possible island bottom after Trump’s island top Updated 6:50 a.m. The Emini broke above yesterday’s high with 3 bull bars on the open. Yet, the odds favor an inside week with a lot of trading range price action. This reduces the chances of a strong trend day up or down. The Emini is Always In […]

Trump, Russia, Comey, Mueller and a Emini buy climax

Emini weekend update: May 20, 2017

Monthly S&P500 Emini futures candlestick chart:Trump, Russia, Comey, Mueller and a Emini buy climax The monthly S&P500 Emini futures candlestick chart has a doji bar so far this month. Last month was a High 1 buy signal bar, and May triggered the buy by going above the April high. The monthly S&P500 Emini futures candlestick […]

Trump special counsel is catalyst for 100 point correction

Intraday market update: May 19, 2017

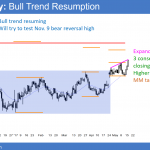

Trump special counsel is catalyst for 100 point correction Updated 6:58 a.m. The bulls got a trend from the open bull trend that rallied to last week’s low. Yet, the Emini stalled there. Therefore, last week’s low will be a magnet all day. Since there is a 3 day Big Down, Big Up pattern, a […]

Trump impeachment risk is catalyst for 5% correction

Intraday market update: May 18, 2017

Trump impeachment risk is catalyst for 5% correction Updated 6:48 a.m. The Emini reversed up from below yesterday’s low on the open. In addition, the 1st selloff failed and created a small double bottom. The bears want this reversal to fail, like yesterday. Yet, it is a reversal up from below a bear channel as […]

5 percent correction after Trump impeachment talks

Intraday market update: May 17, 2017

5 percent correction after Trump impeachment talks Updated 6:52 a.m. The Emini began with a big gap down to the bottom of the 3 week wedge rally. Yet, the 1st 2 bars were bull bars and the 1st one was strong. This therefore creates confusion. Hence, a trading range for the 1st hour or so […]

Trump rally breakout of 2400 should fail within 2 weeks

Intraday market update: May 16, 2017

Trump rally breakout of 2400 should fail within 2 weeks Updated 6:52 a.m. The Emini reversed down from above yesterday’s high and is Always In Short. Yet, the bulls want an opening reversal up from the moving average. They need a strong break to a new high of the day. At the moment, the best […]

Comey firing ending Trump rally around 2400 big round number

Intraday market update: May 15, 2017

Comey firing ending Trump rally around 2400 big round number Updated 6:53 a.m. The Emini gapped above Friday’s high and opened with a big bull trend bar. Yet, the second bar was a bear doji and therefore the follow-through buying was bad. Hence, this is a continuation of the 4 weeks of trading range price […]