Will the stock market bears get a black swan event? Updaated 6:51 a.m. The Emini gapped up and had consecutive bull bars. It is therefore Always In Long. Yet, most days over the past month have had a lot of trading range price action. The odds are that this will be the same for today. […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

Will the stock market bears get a black swan event?

Trump tax cut and Obamacare repeal as stock market catalysts

Emini weekend update: June 24, 2017

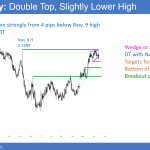

Monthly S&P500 Emini futures candlestick chart:Trump tax cut and Obamacare repeal as stock market catalysts in already strong bull trend The monthly S&P500 Emini futures candlestick chart has been in a strong bull trend for 18 months. It is at a measured move up from the 2014 – 2015 trading range, which will probably be […]

Emini ignoring Trump’s Obamacare repeal plan

Intraday market update: June 23, 2017

Emini ignoring Trump’s Obamacare repeal plan Updated 6:53 a.m. The Emini sold off below yesterday’s low on the open. The bulls want a reversal up. Yet, the channel down from yesterday’s high was tight. Therefore, the 1st rally will probably be minor. Hence, the odds are against a strong trend up for at least an […]

Emini awaiting Trump’s revision of Obamacare health care bill

Intraday market update: June 22, 2017

Emini awaiting Trump’s revision of Obamacare health care bill Updated 6:52 a.m. Today opened in yesterday’s tight trading range. The bulls need a break above a major lower high to convert the 2 day bear channel into a trading range. The bears want a strong break below yesterday’s low to create a measuring gap. They […]

Emini buy climax and failed breakout to new high

Intraday market update: June 21, 2017

Emini buy climax and failed breakout to new high Updated 7:00 a.m. Limit order bulls and bears both made money in the 1st 4 bars. This is an early sign of trading range price action. Furthermore, there were several reversals in the 1st 6 bars. Traders are deciding if the Emini will rally, or selloff […]

New S&P500 all time high, but Nasdaq divergence

Intraday market update: June 20, 2017

New S&P500 all time high, but Nasdaq divergence Updated 6:49 a.m. Yesterday was a spike and wedge channel bull trend. The odds favor a trading range. Furthermore, the odds favor disappointing follow-through for the bulls. Hence, today will probably close below its open and form a bear bar on the daily chart. Since today is […]

Emini bull flag in buy climax after FOMC Fed rate hike

Intraday market update: June 19, 2017

Emini bull flag in buy climax after FOMC Fed rate hike Updated 6:56 a.m. The Emini gapped up on the open to within 4 points of the all-time high. Yet, it formed a small bear doji bar. This one bar is enough to increase the odds of a lot of trading range price action today. […]

Mueller’s Trump investigation and correction from buy climax

Emini weekend update: June 17, 2017

Monthly S&P500 Emini futures candlestick chart:Strong bull trend The monthly S&P500 Emini futures candlestick chart had a doji buy signal bar in April. Furthermore, it followed a 4 bar buy climax. Finally, it was around a measured move up from the 2014 – 2015 trading range. Consequently, the odds are against a strong rally. Typically, […]

Emini buy climax and FOMC fed interest rate hike

Intraday market update: June 16, 2017

Emini buy climax and FOMC fed interest rate hike Updated 6:43 a.m. Today sold off on the open from yesterday’s high. It did not go above and trigger the buy signal yet, but it might later today. Since yesterday’s spike and channel bull trend will likely evolve into a trading range today, the odds are […]

Emini buy climax more important than FOMC interest rate hike

Intraday market update: June 15, 2017

Emini buy climax more important than FOMC interest rate hike Updated 6:45 a.m. The Emini gapped down, but formed consecutive bull bars on the open. But, unless it rallies strongly above the moving average, the bears will try to form an opening reversal down. They often form a double top or a wedge top. At […]