Emini sideways waiting for FOMC meeting Updated 6:54 a.m. Today opened with a doji bar in yesterday’s 4 hour tight trading range. This increased the chances that today will be another trading range day, like the past 2 days. While the bears got 2 strong bear bars on the open, the next bar was a […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

Emini sideways waiting for FOMC meeting

Trump firing special prosecutor is possible catalyst for climactic reversal

Emini weekend update: July 22, 2017

Monthly S&P500 Emini futures candlestick chart:Parabolic wedge buy climax The monthly S&P500 Emini futures candlestick chart has 4 consecutive bull trend bars in a tight 18 month bull channel. Yet, this is the 3rd leg up. Therefore, this is a parabolic wedge rally. However, there is no reversal yet. The monthly S&P500 Emini futures candlestick […]

Emini buy climax ignoring Trump, Russia, and healthcare

Intraday market update: July 21, 2017

Emini buy climax ignoring Trump, Russia, and healthcare Updated 6:48 a.m. The Emini broke below yesterday’s low. This therefore triggered the sell signal on the daily chart for the parabolic wedge top. Yet, the bears only got 2 dojis on the open. Hence, they were not strong. This reduces the chances of a strong bear […]

Trump rally testing bull channel top and measured move targets

Intraday market update: July 20, 2017

Trump rally testing bull channel top and measured move targets Updated 6:48 a.m. The Emini gapped above yesterday’s bull channel, but began with 2 bear bars. Since 75% of bull breakouts above bull channels fail, this one probably will as well. However, the initial target is the bottom of the channel. Since the channel is […]

Emini buy climax is ignoring Trump’s failed healthcare repeal

Intraday market update: July 19, 2017

Emini buy climax is ignoring Trump’s failed healthcare repeal Updated 6:46 a.m. While today began with consecutive bull bars, they were not strong. In addition, this is similar to the open on the past 5 days. Consequently, today will probably behave like those days. Although the Emini began Always In Long, it will probably soon […]

Trump buy climax rally is near 2500 S&P resistance

Intraday market update: July 18, 2017

Trump buy climax rally is near 2500 S&P resistance Updated 6:46 a.m. The Emini gapped down, but reversed up at the 60 minute moving average. The bulls see this as a High 2 pullback from Friday’s rally. Additionally, it is an Opening Reversal up from the 60 minute moving average. Their 1st goal is to […]

Trump rally targeting 2500 Big Round Number

Intraday market update: July 17, 2017

Trump rally targeting 2500 Big Round Number Updated 6:47 a.m. On the open, the Emini continued the 3 bar tight trading range from Friday’s close. This increases the chances of an attempt at trend resumption up and a test of Friday’s high. Yet, because of the Big Up, Big Down on Friday’s close, the odds […]

Trump’s healthcare and tax reform not obstacles to new high

Emini weekend update: July 15, 2017

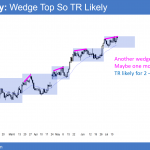

Monthly S&P500 Emini futures candlestick chart:Strong rally, but parabolic wedge top likely The monthly S&P500 Emini futures candlestick chart currently has 4 consecutive bull trend bars. However, the rally is also a parabolic wedge buy climax. The monthly S&P500 Emini futures candlestick chart is in a parabolic wedge buy climax. Yet, the momentum up is […]

Emini buy climax testing all time high and maybe 2500

Intraday market update: July 14, 2017

Emini buy climax testing all time high and maybe 2500 Updated 6:52 a.m. The Emini opened with a bull doji bar within yesterday’s range. This open is similar to yesterday. Hence it increases the odds of a lot of trading range trading again today. However, the magnet of the all-time high is strong. Therefore, there […]

Emini bull flag breakout near all time high

Intraday market update: July 13, 2017

Emini bull flag breakout near all time high Updated 6:47 a.m. Today opened with a big bull doji bar, which is a 1 bar trading range. In addition, it was in the middle of yesterday’s range. Furthermore, limit order bears made money scaling in above the high of the 1st bull bar. Finally, most days […]