Emini blow-off top leading to test of year’s open Updated 6:43 a.m. The Emini began with a trend from the open bull trend. This is a possible low of the day. However, a Buy The Close rally on the open usually does not last all day. It typically either becomes a big trading range, or […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

Emini blow-off top leading to test of year’s open

Emini possible blow-off top preceding congressional budget vote

Intraday market update: January 9, 2018

Emini possible blow-off top preceding congressional budget vote Updated 6:47 a.m. Today gapped up and began with a big bull bar. However, the 2nd bar was a bear bar, which is bad follow-through. It therefore increases the chances of an early swing down to yesterday’s high or close. The bears need 2 – 3 bear […]

2018 January barometer indicates Trump rally continuing

Intraday market update: January 8, 2018

2018 January barometer indicates Trump rally continuing Updated 6:47 a.m. Friday ended with a buy climax. There is therefore only a 25% chance of a strong bull trend today. Yet, there is a 50% chance of some follow-through buying in the 1st 2 hours. The buy climax was a spike and channel bull trend. It […]

Trump corporate tax cut rally might be January barometer

Emini weekend update: January 6, 2018

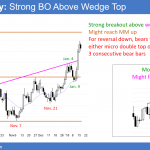

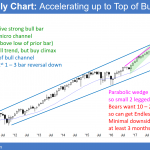

Monthly S&P500 Emini futures candlestick chart:Strong bull trend For the past 14 months, every bar on the monthly S&P500 Emini futures candlestick chart had a low above the low of the prior month. This is a very strong bull trend, but unsustainable and therefore climactic. A bull micro channel is a series of bars where […]

Emini nested parabolic wedge buy climaxes at measured move target

Intraday market update: January 5, 2018

Emini nested parabolic wedge buy climaxes at measured move target Updated 6:48 a.m. The Emini gapped up and had 2 big bear bars. This reduces the chances of a bull trend day. It reversed up strongly on the 3rd bar, which reduces the chances of a big bear day. There was a big gap up, […]

Emini January effect Trump tax cut rally continuing

Intraday market update: January 4, 2018

Emini January effect Trump tax cut rally continuing Updated 6:45 a.m. The Emini opened with a big gap up and consecutive big bull bars. In addition, it broke above yesterday’s bull channel. The measured move up from yesterday’s wedge top and from yesterday’s opening gap up are both around 2724. This is an extreme buy […]

Trump rally contributing to January barometer

Intraday market update: January 3, 2018

Trump rally contributing to January barometer Updated 6:44 a.m. The Emini had a small gap up and broke to a new all-time high. The 1st 2 bars were big bull bars closing near their highs. This makes either a bull trend day or a trading range day likely. If today is a trading range day, […]

Emini January effect and barometer are useless for traders

Intraday market update: January 2, 2018

Emini January effect and barometer are useless for traders Updated 6:44 a.m. The Emini opened with a big gap up. The day began with a big bear bar in the middle of Friday’s tight trading range. Since the risk for the bears was big and the probability low, the bulls bought below the bar. The […]

Trump Emini rally continuing in 2018, but more volatile

Emini weekend update: January 1, 2018

Monthly S&P500 Emini futures candlestick chart:Unprecedented rally The monthly S&P500 Emini futures candlestick chart has gone for an entire year with every low above the low of the prior month. December, in fact, is the 14th month in the streak. This month had a small bull body. This is a sign of loss of momentum. […]

Trump rally continuing into January 19 government shutdown vote

Intraday market update: December 28, 2017

Trump rally continuing into January 19 government shutdown vote Updated 6:46 a.m. The Emini opened with a big bear bar after yesterday’s strong, late rally. The bears want a parabolic wedge top. Yet, yesterday’s rally was strong enough to make either a trading range or bull trend more likely today. The bears therefore will need […]