Emini buy vacuum test of July high and all-time high I will update again at the end of the day. Pre-Open market analysis Yesterday was the 3rd consecutive strong bull trend day. It broke above last week’s high and the July high. However, the 5 minute chart has been in a tight bull channel for […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

Emini buy vacuum test of July high and all-time high

Emini follow-through buying after consecutive outside day

Intraday market update: Monday August 6, 2018

Emini follow-through buying after consecutive outside day I will update again at the end of the day. Thursday was an outside up day after an outside down day on Wednesday. It was therefore a buy signal bar. Friday was the entry bar on the daily chart, and it provided reasonable follow-through buying. This increases the […]

Emini consecutive outside bars in a bull flag

Emini weekend update: August 4, 2018

Monthly S&P500 Emini futures candlestick chart:Strong test of all-time high The monthly S&P500 Emini futures candlestick chart is in a bull trend after a 3 month bull flag. A new all-time high is likely within a couple of months. The bears need a strong bear bar this month if they are going to get a […]

Emini buyers below last week’s sell signal bar

Intraday market update: Friday August 3, 2018

Emini buyers below last week’s sell signal bar I will update again at the end of the day. Pre-Open market analysis I have been saying for the past week that the bears would get a 50 – 100 point pullback over the next couple of weeks, and then the Emini would resume up to a […]

Emini 2nd leg down in early August after buy climax

Intraday market update: Thursday August 2, 2018

Emini 2nd leg down in early August after buy climax I will update again at the end of the day. Pre-Open market analysis The Emini sold off strongly yesterday and formed an outside down day prior to the 11 a.m. FOMC announcement. However, it closed above the low and the daily chart had a tail […]

Emini 50% retracement of 2 day selloff ahead of FOMC

Intraday market update: Wednesday August 1, 2018

Emini 50% retracement of 2 day selloff ahead of FOMC I will update again at the end of the day. Pre-Open market analysis Yesterday retraced about half of the 2 day selloff. The odds were that the Emini would bounce at the 20 day EMA and try to get more neutral ahead of today’s FOMC […]

Emini follow-through selling in sell climax down to 2800

Intraday market update: Tuesday July 31, 2018

Emini follow-through selling in sell climax down to 2800 I will update again at the end of the day. Pre-Open market analysis The bears got follow-through selling yesterday. However, the bulls rallied off the 20 day EMA, the 2800 Big Round Number, and the March high. After 2 days of climactic selling down to support, […]

Emini minor reversal down to below 2800 and the March high

Intraday market update: Monday July 30, 2018

Emini minor reversal down to below 2800 and the March high I will update again at the end of the day. Pre-Open market analysis The Emini sold off from above the 2 week bull channel on the 60 minute chart to below the bottom of the channel on Friday. The selling was strong enough to […]

Emini 100 point minor reversal down from buy climax

Emini weekend update: July 28, 2018

Monthly S&P500 Emini futures candlestick chart:Strong bull bar, testing the all-time high The monthly S&P500 Emini futures candlestick chart has a strong bull bar so far in July. Since there are only 2 trading days left to the month, the bar will probably remain strongly bullish. The monthly S&P500 Emini futures candlestick chart is in […]

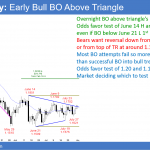

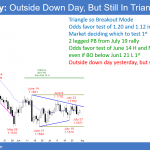

Emini pullback from Wednesday’s bull breakout

Intraday market update: Friday July 27, 2018

Emini pullback from Wednesday’s bull breakout I will update again at the end of the day. Pre-Open market analysis The Emini formed a small inside bull day yesterday after Wednesday’s late, strong rally. Yesterday is therefore a Breakout Mode bar on the daily chart. The bulls see it as a 1 day bull flag. However, […]