Emini outside up day and micro double bottom I will update again at the end of the day. Pre-Open market analysis The Emini had a big outside up day yesterday. It formed a micro double bottom with Friday’s low, and it is therefore a buy signal bar for today. However, the 2 week selloff did […]

If you are not seeing the latest Weekly Report below, your PC/device browser is likely showing you an earlier page copy. Simply refresh your browser. For PCs you can use the F5 key, or Ctrl-F5, several times if needed.

Emini outside up day and micro double bottom

Emini weak breakout above 7 day bear micro channel

Intraday market update: Tuesday September 11, 2018

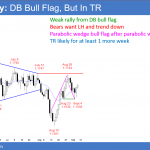

Emini weak breakout above 7 day bear micro channel I will update again at the end of the day. Pre-Open market analysis Yesterday was the 1st day in 7 days that traded above the prior day’s high. A 7 bar bear micro channel is a sign of strong bears. Therefore, there were more likely going […]

Emini testing bottom of bull channel at around 2860

Intraday market update: Monday September 10, 2018

Emini testing bottom of bull channel at around 2860 I will update again at the end of the day. Pre-Open market analysis The Emini has sold off without a pullback for 7 days. It is getting vacuumed down to the bottom of the bull channel. There are two bull trend lines. The 1st is just […]

Emini exhaustion gap but minor higher high reversal

Emini weekend update: September 8, 2018

Monthly S&P500 Emini futures candlestick chart:Stalling just above the January all-time high The candlestick so far this month on the monthly S&P500 Emini futures candlestick chart is a bear inside bar. While the bears want a reversal, the bull trend is strong. September is more likely a pause in the bull trend than a setup […]

Emini exhaustion gap and double top but minor reversal

Intraday market update: Friday September 7, 2018

Emini exhaustion gap and double top but minor reversal I will update again at the end of the day. Pre-Open market analysis The Emini sold off yesterday and closed the gap above the August 24 high. That is therefore now an exhaustion gap. If it gaps down any day within the next week, there will […]

Emini test of January high and bottom of gap

Intraday market update: Thursday September 6, 2018

Emini test of January high and bottom of gap I will update again at the end of the day. Pre-Open market analysis Yesterday, the Emini sold off to within 1 tick of the bottom of the gap on the daily chart. Furthermore, it reversed up from below the January high. Yesterday is therefore a breakout […]

Emini breakout test of January’s high and last week’s gap

Intraday market update: Wednesday September 5, 2018

Emini breakout test of January’s high and last week’s gap I will update again at the end of the day. Pre-Open market analysis Yesterday had several reversals and therefore was a trading range day. The Emini tested into the gap below last week’s low, but did not close the gap. Furthermore, it reversed up from […]

Emini possible island top on weekly and daily charts

Intraday market update: Tuesday September 4, 2018

Emini possible island top on weekly and daily charts I will update again at the end of the day. Pre-Open market analysis The Emini gapped up last week and closed just above the week’s midpoint. This is good for the bulls this week. But, if today gaps down, there will be a 1 bar island […]

Emini breakout to all-time high but September often weak

Emini weekend update: September 1, 2018

Monthly S&P500 Emini futures candlestick chart:Emini breakout to all-time high but September often weak The monthly S&P500 Emini futures candlestick chart had a bull trend bar in August. Furthermore, August closed near its high and above the January high. It is resuming its bull trend. The monthly S&P500 Emini futures candlestick chart has rallied for […]

Emini strong August close likely today

Intraday market update: Friday August 31, 2018

Emini strong August close likely today I will update again at the end of the day. Pre-Open market analysis Today is the last day of the week and of the month. The bulls want both to close on the high. That would increase the chance of higher prices next week and next month. The bears […]