Trading Room: Friday June 12, 2020

Video duration: 2 hour 28 minutes.

Full recording of Al Brooks trading room. Periods of silence are automatically removed, including middle of the day when Al takes a break to relieve sore throat from talking for so long! During the break Al writes his bar-by-bar analysis report live. See sample of live notes below.

Video event timings:

- 00:12:00 Opening review

- 00:30:39 Bar 10 Open

- 00:54:40 Bar 18 Close

- 01:21:20 Bar 30 Open

- 01:37:00 Bar 38 – Al continues with bar-by-bar notes only (no talking).

- See sample of bar-by-bar notes typed live throughout the day.

- 01:37:05 Part 2 Spoken narrative resumes – Bar 61

- 01:53:25 Bar 72 close

- 01:59:00 End of Day chart review

- 02:11:25 Stop and limit order trades for the day

- 02:17:35 Q&A session – Q1: I know that on the open you are more resistant to taking limit order trades. Is there a specific time when you are more open to limit order trading?

- 02:20:08 Q&A session – Q2: What is your experience with drawdowns and how do you deal with them? Do you ever get more than a 1% drawdown?

- 02:25:45 Q&A session – Q3: On days when you are not in the trading room, and it gets quiet in the final hour, do you always wait until one o’clock, or do you just call it a day? Are there days when you just don’t trade at all?

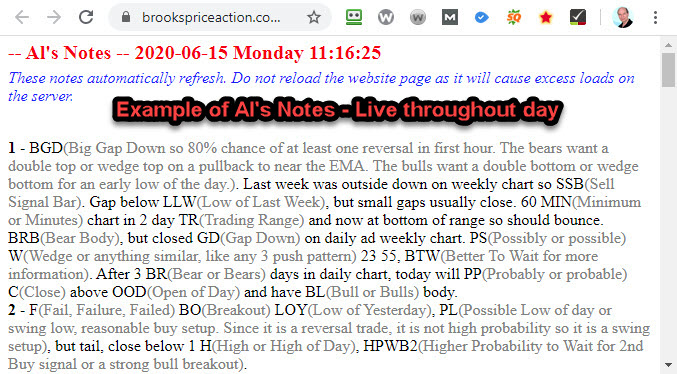

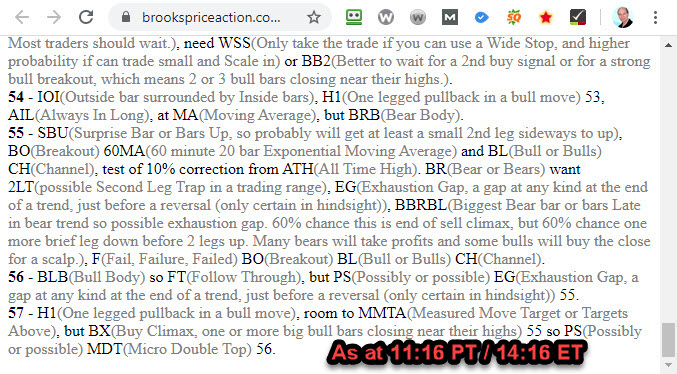

Live bar-by-bar notes sample

After 3 hours of live trading room talking, Al takes a break for 2 hours before resuming his talking for the final 2 hours. Throughout the trading day Al completes his bar-by-bar analysis live, with this continuing throughout the 2 hour middle of day break.

The trading room webinar chart remains on screen while traders view Al’s Notes in a separate browser window.

Here is an example of how Al’s Notes appear to all trading room attendees. These screenshots are from the next session on June 15, 2020. The final bar-by-bar analysis is available to traders on the BrooksPriceAction.com website where you can register for free.

The trading room is run from Al’s other website, and not managed from here. You can find all information and links to the trading room here: Trading Room Information Page.

My problem with the trading room is I’m not a full time trader yet so I can do a week here and a week there. The trading room Is not good value unless you buy a full month. if you buy only the last week of the month it still costs 75% of a full month as they make you take all the videos too….I don’t want the videos who’s got time to watch 20 hours of videos a week?

It’s the live sessions people want but it just isn’t cost effective unless you’re doing the full month.

Hi Kevin,

Some perspective might help here. For $99 you get 15 full trading days (each 7+hrs) of trading room commentary and notes. That works out at less than $1/hour. Compare that to the typical trading rooms out there that run for 2-3 hours only each day, with some costing hundreds and thousands of dollars!

I guess many traders who download the videos do not listen to the whole recording. By comparing with the Daily Setups chart you can identify those areas of interest. Many trades just listen to Al’s End of Day review and closing Q&A.

Just my 2 cents. If you know of other trading rooms out there that offer better value do let me know.

If you’ve got time to participate for a full month then its good value. For those who can’t participate full time the costs are actually as follows:

4 weeks – $99

3 weeks – $88

2 weeks – $75

1 week – $63

So as you can see the value for money drops. Unfortunately I just can’t justify $63 for one week which is 2-3 days of videos.

And I don’t need, want or have time to listen to the recorded videos for the full month.

I’m trapped out.

Fair comment Kevin, but if you are not actually trading yet, going through the videos will actually take less time then attending the actual room. So if you do not have time to watch the videos, how do you find the extra time to attend the trading room? Just like using market replay for learning.

Videos strip out non-speaking parts so about 2-3 hours which is a pretty good compression of the trading day. Al takes a 2 hour silent break in middle, so you would need to review Al’s Daily Update report on the Brooks Price Action website for the rundown of action in the middle of the day.

$63 for one week (2-3 days) of live attendance is equivalent to losing about 6 ticks on the ES. An insignificant compared to most losses in real world trading. 😉

I can trade full time for approx 1 week per month. I prefer to spend this time on the live market. I have other commitments for the other 3 weeks of the month – so just don’t have the time to watch the videos. I’d love to spend this time in the trading room with Al, but sometimes my trading week is at the start of the month and I’m paying $99 to get the full month when I am using just a week of usage. Sometimes my 1 week comes at the end of the month, I’m more willing too pay $63 in that case but it still feels unfair from my perspective.

Is there a price plan to only get those stripped out videos? I can’t follow Al live, but I can review it later.

Yes Edie, just $50 for all the previous month’s videos. Go to BrooksPriceAction.com to buy them, not here.

Hey Al, great video! I have a question. In the video you said that you could take that sell below 8. But it’s close to the bottom of the TR so you wouldn’t take that trade. In the BTC Daily Setups it’s written that it was a L2 top sell setup. If I would take that short, should I rely on my stop and wait for a MM down based on the top of the TR down? Or since I am a real begginer shoulnd’t take that trade and wait my entrance to be more clear like a buy above 24. One other question. I find myself leaving the trade before it hits my 2x profit. I always find reasons for that. Like DT, or DB, wedges, and then I get out. Is that ok, or should I wait and see what happens?

Hi Edie.

Al does not answer questions outside of his daily and weekly reports. Hope I can help.

Yes, you should take short and wait on MM down. As you note, the Daily Setup chart shows a good beginner swing trade. Al enjoys scalping so looks for high probability trades, hence he will often pass on such swing trades. Just personal preference.

Search “Walmart” on site to hear Al discuss his Walmart strategy in the video podcast with our Brazilian guy. This may help solve your problem getting out too early. Otherwise, try breaking your mental state by simply standing up and walking about a little. Distract yourself from those destructive, obsessive thoughts the trade is generating, pushing you to get out!! 😉

Fabulous! Very clear and instructive.

Much thanks for this video.. Really helpful..