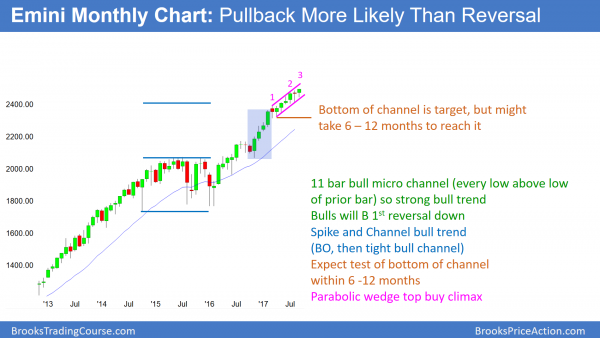

Monthly S&P500 Emini futures candlestick chart:

Parabolic wedge buy climax

Every bar for the past 10 months on the monthly S&P500 Emini futures candlestick chart has a low above the low of the prior bar. This is an 11 bar bull micro channel. The 4 month breakout through February is a spike in a spike and channel bull trend. The channel began with the bear doji in March, which was the 1st pause after the breakout.

The monthly S&P500 Emini futures candlestick chart is in a strong bull trend. Yet, a micro channel (every bar has a low that is above the low of the prior bar) is unsustainable. It is therefore a buy climax. However, there is no top yet. Furthermore, when a bull trend is this strong, the bulls will be eager to buy below the low of the prior month. Consequently, the best the bears can probably get is a 1 – 3 month pullback, maybe to the March low where the channel began. While that 200 point reversal would be a bear trend on the daily chart, it would be a bull flag on the monthly chart. Hence, the reversal will be a pullback instead of a bear trend. As a result, the downside risk over the next few months is small.

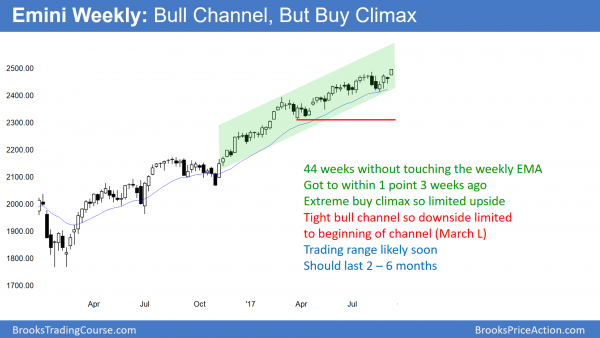

Weekly S&P500 Emini futures candlestick chart:

Tight bull channel, but climactic

The weekly S&P500 Emini futures candlestick chart is in a tight bull channel. It is therefore in a strong bull trend. Furthermore, it might gap above the 2500 Big Round Number next week. However, it has not touched the 20 week exponential moving average in 44 weeks. This is extreme behavior and therefore unsustainable and climactic.

The weekly Emini chart this week closed on its high at a new high, just below the 2500 Big Round Number. This increases the chances that Monday will gap above the 2500 resistance, creating a gap up on the weekly chart as well. The bulls would then try to keep the gap open and create another strong bull trend bar next week. If they can then get a follow-through strong bull trend bar on the week after next, they might get at least 2 legs up over the next several weeks.

The weekly S&P500 Emini futures candlestick chart has been in a tight bull channel for 44 weeks. That is a strong bull trend. Consequently, when the bears finally create a breakout below the bull trend line, the reversal will be minor. This means that is will become a bull flag or a trading range and not a bear trend.

Because the buy climax is so extreme, when there is a pullback, it might be deeper and last more bars than expected. For example, the Emini held above the weekly moving average for 50 bars in 2003. It then went sideways for about 10 months. In addition, the bottom of the trading range was about 10% below the high. If the current rally has a comparable pullback, the Emini could fall more than 200 points. Furthermore, the exhausted bulls might need 6 months or more before they would buy again for another leg up.

Whether or not the bulls get a gap up and strong bull trend next week, the bears will try to reverse the breakout down. However, they need to create either a big bear trend bar or a bear reversal bar over the next 2 weeks. Without that, the odds still favor higher prices.

Daily S&P500 Emini futures candlestick chart:

Broad bull channel

The daily S&P500 Emini futures candlestick chart has been in a broad bull channel since the March low. After 5 days closing on their highs, the odds favor higher prices next week.

The daily S&P500 Emini futures candlestick chart has been in a broad bull channel since March. While a channel can continue indefinitely, it usually evolves into a trading range after 3 – 5 legs up. The current rally is the 5th leg up. There is therefore an increased chance that the next leg down will break below the bottom of the channel.

Furthermore, once there is a break below a channel, the Emini usually eventually sells off to the start of the channel. That is the March low of 2314.00. Once there, the bulls usually return and the bears buy back their shorts. As a result of both the bulls and bears buying, the Emini usually rallies. At that point, traders will conclude that the bull channel had evolved into a trading range.

When a bull channel evolves into a trading range, the bear leg usually lasts at least half as long as the bull channel. Since the bull channel has lasted 7 months, once there is a selloff, it will probably last at least 3 months. This is consistent with the duration of the eventual pullbacks on the weekly and monthly charts.

Wednesday’s FOMC interest rate announcement is a catalyst

Most reversals begin with a news event. News surprises can come at any time, but some news events are predictable. For example, Wednesday’s FOMC meeting has the potential to surprise traders. If the Federal Reserve says something unexpected, that could lead to the start of a correction.

Since most reversals fail, the odds are that any reversal attempt over the next few weeks will lead to a small trading range and not the start of a 200 point correction. Yet, because the weekly and monthly charts are so extremely overbought, there is an increased risk of a correction at any time.

Bull breakout above bull channel is unlikely

Although most bull channels have bear breakouts, about 25% of them have strong bull breakouts. The most dramatic example is the monthly chart of the S&P cash index in 1995. When that happens, the market cycle starts over. The breakout eventually has a pullback. At that point, the strong bull trend enters a bull channel. Eventually the bull channel transitions into a trading range. Then, traders get ready for a new breakout up or down, which would start the market cycle over again.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al,

I’m trying to reconcile what I’ve learned in your course and books with the commentary here. The focus of these commentaries has been the looming pullback caused by an extreme buy climax. According to your awesome course, shouldn’t the focus be:

market cycle = bull trend so buy all two-legged pullbacks and failed breakouts of the trendline?

Thanks!

Dave

I agree with your comments. Let me try to clarify what I am saying.

All trends eventually transition into trading ranges. Once a trend has evidence of an extreme buy climax, like the monthly and weekly charts now have, traders can buy looking for a quick profit, but investors should wait because they will probably be able to buy for 10% less than the current price within 6 months or so. The odds of the trend continuing much higher are much less when there is a buy climax as extreme as this one is.

I have written every week for months that the bull trend is so strong that any reversal will probably be minor. This means that it will become either a bull flag or a trading range, and not a bear trend. In either case, traders will look to buy the reversal down. This is because the odds of a bear trend on the weekly and monthly charts are small when the trend is this strong. It is climactic, and therefore will probably need a pause.

However, a trend reversal usually needs a strong minor reversal down, and then an attempt to resume the bull trend. At that point, the bears will try to create a double top. They then would have a reasonable chance of an actual trend reversal into a bear trend. But, they don’t even have the minor reversal down yet. Therefore, the chance of more than a 10% correction over the next several months is small.

My understanding of what’s powering this bull market : “Cheap money”

(Obvious yes I know)

Plus the mere mention of more Q/E wiil make markets skyrocket once again.

The PB’s are all buying opportunities for the very rich. Traders are not moving the market here what so ever.

The rich are making as much as they can while it lasts, the M&A activity via cheap money as well as the share buy backs will continue to pump share prices.

Equties are the place for the investor not banks, not interest assets.

There fore all the poor ppl trying to short the market are getting creamed.

You can still go broke by being right BUT TOO early.

Everyone knows world debt is out of control so why do we continue the print new highs ?

Until this paradyme changes the market will continue higher

The only effective T/A tip off would be a simple weekly or monthly trendline break, this would be a starting point coupled with the news that either interest rates are on the rise or equities no longer give the ultra rich the return they desire.

What I’m describing here is more about the definite TREND change not PB’s or

small corrections these can PB’s happen when large long position holders want to cash in. You’ll know when the LARGE holders sell, that’s when blood runs down the street as they say.

Thanks, Al.

Can I ask you a question about 3-Push wedges?

Do you have any insight into the forces that cause them to typically come in 3s? I’ve combed through the chapters on wedges in particular, but haven’t been able to find anything specific. I know there’s certainly no “rule” mandating them, but I’m curious to understand why they happen so regularly. Any insight would be very appreciated.

And welcome back. I hope you’re enjoying your new life!

Brad

All markets are constantly probing to determine how far too far is. Normally, if a market makes 2 strong attempts one way and reverses strongly both times, the trend traders give up and the market tries the other direction. Sometimes, especially when the 1st or 2nd push is strong, the trend traders will try 3 times before giving up.

In addition, it takes 2 points to draw a line. Let’s say the market is rallying and has 2 reversals down. Traders can draw a line across the 2 highs. If the market hits the line again, it is hitting the top of the bull channel, where both bulls and bears will sell. If the bears sell strongly enough, they can create a strong enough minor reversal down to make at least one more leg down likely. The pullback from that 1st leg often becomes the 1st lower high in a new bear trend.