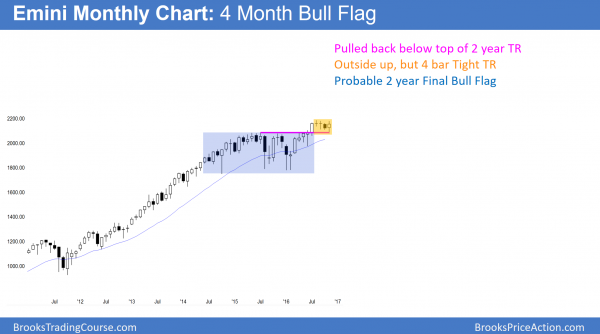

Monthly S&P500 Emini futures candlestick chart:

3 month bull flag

The monthly S&P500 Emini futures candlestick chart formed an outside up month after a 3 month pullback. Because there is a 4 bar tight trading range, it might continue sideways for another month or two.

The monthly S&P500 Emini futures candlestick chart has pulled back for 3 months since the August high. I said in August that August was the 7th consecutive bull trend bar on the monthly chart. In addition, there have never been 8 consecutive bull bars since the Emini began 18 years ago. Furthermore, after every time there were 7, the Emini corrected down about 100 points. I therefore said that the Emini was likely to pull back for about 100 points. It did this week.

Since 7 consecutive bull bars is a sign of strength, I said that the bulls would buy the 100 point pullback. They therefore saw the selloff as a bull flag instead of a bear trend reversal.

Closure of gap above July 2015 trading range

The Emini went sideways for about 4 months. During that time, I said that the gap above the top of the 2 year trading range had a 70% chance of closing. There, the strong July breakout above the range was more likely an exhaustion gap than a measuring gap. Because of that, I said that if the bulls broke to a new high, it would probably soon fail. This is because the magnetic pull of the July 2015 high was strong. The bulls were unlikely to be able to escape its pull.

Since there were probably sellers above the July to October trading range and buyers below the July 2015 high, traders could fade whichever came first. As a result, bulls bought below the July 2015 high, expecting the current rally to go to a new all-time high. While the Emini rallied strongly this week, there is still room to the all-time high of 2185.00.

Major reversal after new all-time high

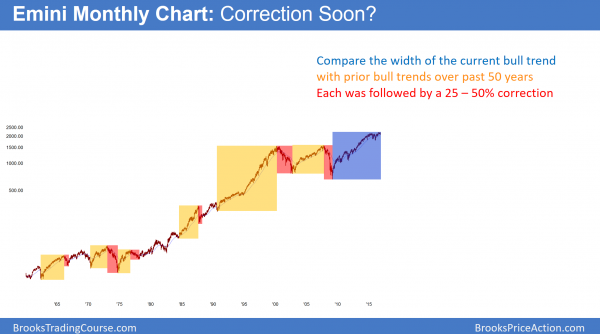

The rally has lasted 7 years on the monthly chart. There have been many other rallies in the past 50 years that have lasted 5 – 7 years. Each one was followed by a 25 – 50% correction of the rally. Therefore the same is likely this time.

How long can last week’s rally last if it leads to a new high? Maybe 5 – 10 bars. Since this is a monthly chart, that means the current rally might last all of 2017. Yet, the 2 year trading range will probably be the Final Bull Flag.

The bull trend began in March 2009 at 473.50. The current high is about 2100. That is about a 1600 point rally. A 50% correction would be 800 points. That is probably too much. However, a 25% correction would be 400 points. That would take the Emini down to 1700. It would therefore be below the 1800 low of the 2 year trading range.

In the current bull trend, the Emini broke above a double top at around 1500. Those highs were in 2000 and 2007. That is therefore a support area. If there is a repricing of the Emini, which is likely, that would be a logical magnet.

The importance of the bond market

The 30 year bond futures chart is reversing down from a nested wedge top on the monthly chart. This chart shows 15 years of a 30 year rally.

As a result of the nested wedge tops, this is probably the end of the 30 year bull trend. Therefore, interest rates will probably continue to rise for 10 – 20 years. Because of this, investors will begin to get good returns from CDs and other low risk interest rate investments. They therefore will transfer some of their portfolio from stocks to these safer alternatives. This selling of stocks will contribute to the stock market repricing.

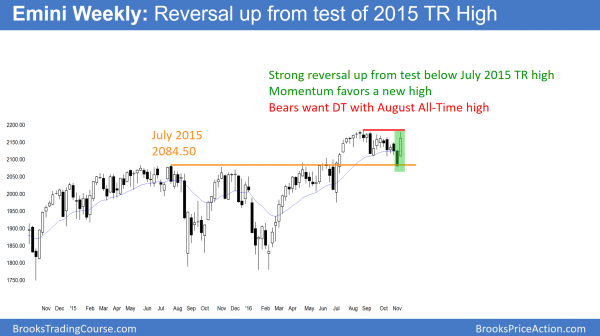

Weekly S&P500 Emini futures candlestick chart:

Strong bull breakout above a High 2 bull flag

The weekly S&P500 Emini futures candlestick chart dipped below the July 2015 high at the top of a 2 year trading range. After closing that gap, it reversed up strongly this week.

The weekly S&P500 Emini futures candlestick chart reversed up strongly this week after last week’s strong bear breakout. The bulls saw the selloff from the August all-time high as a big High 2 bull flag. Yet, this week’s candlestick had a big tail on top. Because it is stalling at the all-time high, it might go sideways for a week or two before breaking to a new high. Since the reversal up was so strong, the odds favor a new all-time high soon.

The bears want this sharp rally to be a bull trap that creates a double top with the August all-time high. While this is possible, it is not likely. Yet, if the bears can prevent a new all-time high for several weeks, they could create a micro double top. This would increase the probability of a reversal down. Until there is a micro double top, the odds favor sideways to up over the next few weeks.

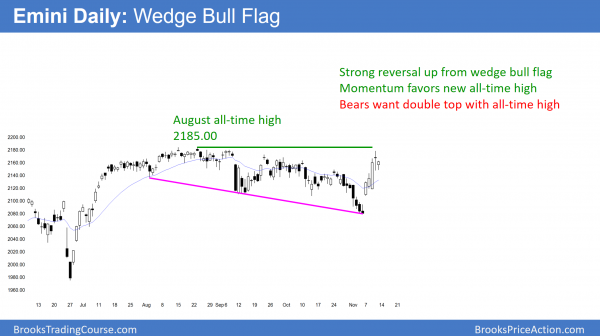

Daily S&P500 Emini futures candlestick chart:

Buy climax and test of the all-time high

The daily S&P500 Emini futures candlestick chart had huge bars this week, but was unable to break to a new all-time high. The bulls are exhausted. They therefore might need more bars before they begin to buy again. The bears want a double top with the August high.

The daily S&P500 Emini futures candlestick chart had a climactic reversal up this week. Yet, it failed to break above the 4 month trading range to a new all-time high. Since the rally covered 100 points in one week, which is unusual, the bulls are probably exhausted. As a result, many take partial windfall profits. Hence, they want to see if the bears can create a double top with the August all-time high.

Bull flag formation

If the bears are unable to turn the market down after 2 – 3 attempts, the bulls will conclude that the bears are weak. The bulls therefore buy the 2nd or 3rd reversal back up. Hence, they see the pullback as a High 2 bull flag, or a Triangle, or a Wedge bull flag. This is how these patterns typically form.

Yet, if the bears are able to get a strong bear breakout, the bulls will continue to wait. They want to see the selloff stall at some support level before buying again. Because the rally was so strong, the odds are that the bulls will buy the 1st reversal down. Hence, the 1st reversal will probably be minor. It therefore would more likely be a bear leg in a trading range than the start of a bear trend.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al, you have been arguing that the correction from the July 2015 high to the January 2016 low was not deep enough to offset the length of the prior bull trend. And that seems right, if we measure the bull trend from the 2009 low. In that case the July 2015 to January 2016 correction constitutes a mere 16.9% retracement of that trend. But technically, there was a six-month bear market in the Emini in 2011 (-23.7%). So doesn’t that mean we should measure the start of the current bull trend from the 2011 low? If so, then the July 2015 to January 2016 correction constitutes a much deeper (26.3%) retracement of the current bull trend. Isn’t that enough of a retracement to make it much less probable that the Emini is eventually going to revisit the 2000/2007 highs?

Al,

Thank you for the commentary,especially the historical overview.

I traded TNA last Tuesday. Purchased at 69.50, with a protective stop loss at 66.90. On Wednesday I changed the stop to 75.00, and it hit, and all shares sold.

On the daily chart, there are no pullbacks since the breakout, and the bull bars are huge, Thursday’s was a doji with large tails.If this breakout goes into a bull channel, is it probable that there is a swing trade, or has the run up been too climatic? Thank you.

While it is possible for the Emini to reach the monthly measured move target just below 2400, it maybe only 40% likely. More likely, the Emini is putting in a Final Flag top. It could easily run up another 100 points or more, but the top still might already be in with the August high (not likely). We need more information. What will the follow-through look like over the next couple of weeks?

do you trade live in the trading room? b\have been studying the course watched it twice already and has helped my trading thanks. Also there seems to be big moves overnight do you ever trade Europe open?

Thanks again

I mostly scalp and that makes it impossible to talk about 20 trades as I am making them and managing them. Too many little things for me to do in a brief time, and I don’t want to be distracted while doing them.

However, all day long, I talk about whether I am looking to buy or sell at the moment. I usually mention when a swing is underway, which means that the trend probably has more to do. I additionally talk about when a swing will likely stall or reverse. Finally, there is usually at least one good swing entry that is clear before it is complete. When I see those, I mention then in advance.

Hello Al,

Where you mention this below: what time frame do you mean with 2-3 attempts, 2-3 consecutive days weeks months

Bull flag formation

If the bears are unable to turn the market down after 2 – 3 attempts,

I found this weekend uppdate to be interesting.

Thank you

That’s true for all time frames. I wrote it in the Daily Charts section.

What an extraordinary reversal this week!

On Tuesday evening at around 9 pm EST I watched the election on TV and I noticed on my PC how the futures took a nose dive. It was almost as if the market already knew what was unfolding over the next 3 – 4 hours. On Wednesday morning I was staring at my platform gloom and doom, wondering if it’s time to pack my suitcase as an immigrant. However, at 9:30am I was surprised to see a developing huge bull bar, and I remember you saying when an unlikely event happens it can go far. So I traded small, bought 100 shares of the SPY, which is one third of my normal size. I set a wide stop, but didn’t program a profit target; then I had to teach a class, met with colleagues, took a visitor out to lunch, and totally forgot about the trade until I returned back to my office late in the afternoon: I was sitting on an open profit of almost $400!

I guess I can now afford taking my stingy brother-in-law out to Thai food when he is in town for his Harvard reunion with fellow economists. And who knows, maybe Donald will not be as bad to immigrants after all.