Market Overview: Nifty 50 Futures

Nifty 50 tight bull channel on the weekly chart. Bulls were unable to create a strong follow-through above the big round number 18000, and bears on the weekly chart will stay away from selling until the market develops another strong bear bar. This week, the market formed a bear bar that closed near its bottom. On the daily chart, the Nifty 50 is trading inside a bull channel. A large head and shoulder bottom formation is also there, and the market has already showed the formation’s breakout.

Nifty 50 futures

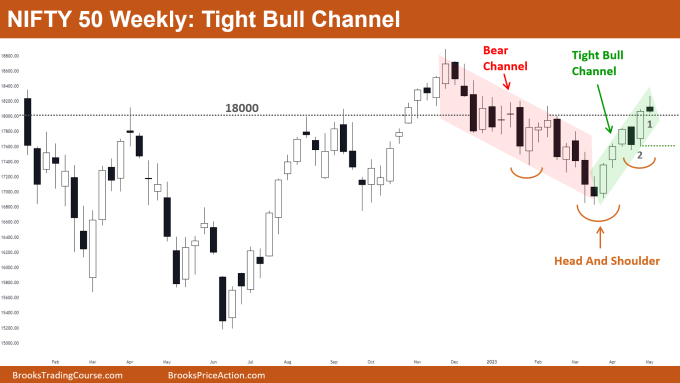

The Weekly Nifty 50 chart

- General Discussion

- Because the market is moving inside of a strong, tight bull channel, bears would refrain from selling on the bar-1 (in the chart above), which is a small bear bar.

- At the low of bar-2 and the bottom of the tight bull channel, bulls are likely to place buy limit orders.

- Bulls anticipate a rise to an all-time high, but if bears are successful in forming another bear bar, odds of a small trading range grow rather than a rise.

- Deeper into the price action

- When the market is close to a big round number, it typically trades at or near that level for a few bars.

- In other words, the likelihood of trading range price action for at least a few bars is higher when the market is close to a big round number.

- This is due to a number of factors that make a big round number operate like a magnet. The following could be one of the causes.

- If you’ve ever looked at the limit order book, you’ve probably observed that there are more orders transacted at or around big round numbers than there are at other price levels. Markets spend more time near large round numbers and operate like a magnet because they attempt to move in the direction of more trading.

- Patterns

- The market is developing a head and shoulders pattern; last week, the market created a strong breakout of this pattern, but bulls were unable to obtain a strong positive follow-through.

- Because the bull channel is so narrow, there is very little room for bears to profit. The only way bears can profit in a constrained bull channel is by scalping.

- A bear may sell in a tight bull channel by setting limit orders at or above the high of the bars and looking for an exit close to the bottom trend line of the channel.

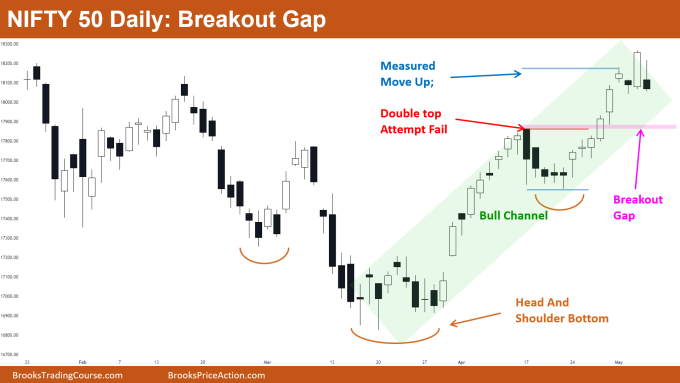

The Daily Nifty 50 chart

- General Discussion

- Although the market is moving inside of a strong bull channel, there is still room for bears to profit by selling near the channel’s upper trend line.

- Some bulls will be taking profits now that the market has achieved a measured move level and has finished two legs up inside the bull channel.

- Bear scalpers can sell and aim for the channel bottom. Bears interested in swing positions can wait for strong consecutive bear bars before selling.

- Deeper into price action

- It’s vital to keep in mind that whenever the market successfully breaks out of a swing high or swing low, it was a failed attempt to form a double top or double bottom; as a result, one should expect a measured move in that direction.

- If you look at the lower time frame, you will see that a double top was actually attempted there but failed.

- Patterns

- A breakout gap exists, which is still open and may act as a price magnet.

- The market has broken out of the large head and shoulder bottom, but bulls were unable to get good follow-through bars.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.