Market Overview: Nifty 50 Futures

Nifty 50 Near All-Time High. On the weekly chart, Nifty 50 produced an impressive bull close this week. The market is currently trading close to its all-time high, which may serve as a strong price resistance. The market is still moving inside the narrow bull channel, according to the weekly chart. The market is trading inside a small bull channel and is getting close to a cup and handle measured move target on the daily chart. The market is also getting close to the big round number 19000.

Nifty 50 futures

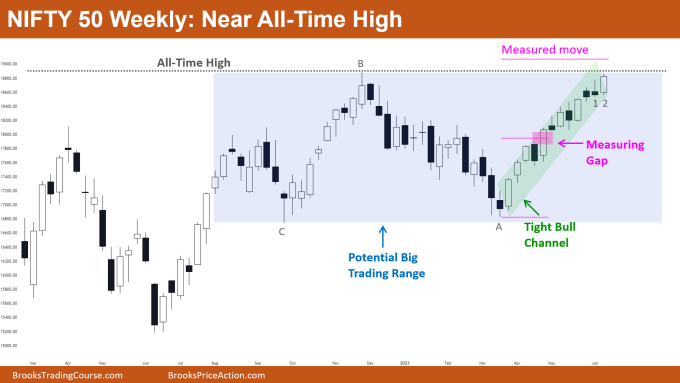

The Weekly Nifty 50 chart

- General Discussion

- Because the market is currently trading inside of a strong, tight bull channel, bears shouldn’t sell just yet. Bears should hold off on selling the market until a few solid bear bars that can confirm the trading range top.

- Bulls shouldn’t open a new long position, even if the market is trading inside a tight bull channel. This is so because the market is currently trading close to its all-time high and potential trading range (resistance).

- o Bulls who have already entered a long position may choose to close it out or wait for the market to reach the measured move target for the measuring gap.

- Deeper into the price action

- Whenever you want to trade a reversal you have to analyse a few things:

- How strong the trend is?

- How strong the reversal attempt is?

- How strong the follow-through bars of the reversal attempt are?

- How strong the trend is?

- Prior to trading a reversal, it is essential to assess the trend’s strength.

- The strength of the trend decides how much strong a reversal attempt needs be to reverse the trend.

- Strength of the trend is directly proportional to the strength of reversal it needs to reverse market.

- How strong the reversal is?

- How can you compare the strength of the trend and the reversal, then?

- Let’s use point A on the chart as an example to illustrate this.

- The bars to the left of A are clearly in a strong bear trend.

- Note that in the bear trend (on the left of A) the bear bars are closing near their lows and the bear bars are having big bodies.

- This tells us that we need strong bull bars with big bodies to reverse the market.

- And as you can see the immediate bar after A was strong enough to convince the bulls to buy and caused a reversal.

- How strong the follow-through bars of the reversal attempt are?

- If the follow-through bars are strong enough, a reversal can still occur even if the reversal itself is not strong.

- Take a look at Point B (on the chart), where a reversal was still caused even though the reversal bar was not particularly strong.

- The reason for this is that the follow-through bars (bars after B) were powerful bear bars that closed close to their lows, and these alone were sufficient to bring about a reversal.

- Given that you now understand how to trade reversals, what do you think about Bar 1 (shown on the chart) and its potential to reverse the current strong bull trend?

- What do you think of Bar 2 in terms of whether it is a good follow-through bar for Bar 1?

- Whenever you want to trade a reversal you have to analyse a few things:

- Patterns

- The market is currently trading close to its all-time high, and the big round number 19000 is also getting close to a target for a measured move.

- The likelihood of a trading range is higher if bulls are unable to achieve a strong breakout above the record high because all of these levels are accumulated above and will act as strong resistance.

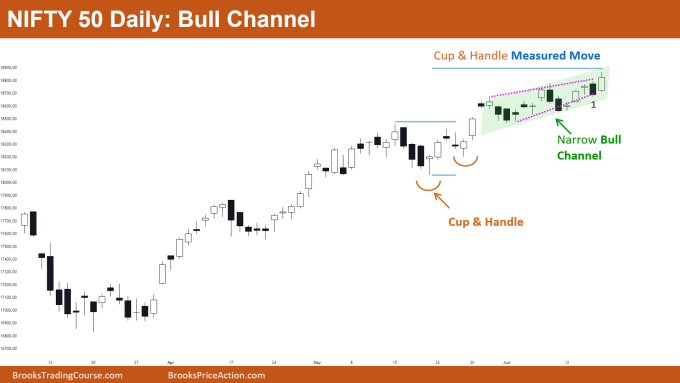

The Daily Nifty 50 chart

- General Discussion

- The market is in a strong bull trend on the daily chart, so bears should hold off on selling until they see a convincing attempt to reverse the trend.

- Bulls should prefer to wait before buying as the market is approaching the highs of the bull channel and the cup-and-handle measured move, both of which will act as resistance.

- Bulls who are long positions can sell at the cup and handle measured move target or hold the position until the market makes a strong attempt to reverse the trend.

- Deeper into price action

- As market is trading inside a narrow bull channel there is less room for the bears to make profit.

- Bear scalpers should be entering into a short position near the high of channel with limit orders.

- In a narrow bull channel, bulls can enter with either

- Buy limit orders – Placing at the low of weak bear bars or strong bull bars.

- Buy stop orders – Placing at the high of strong bull bars or weak bear bars.

- Patterns

- Market tried to reverse the trend by giving a bear breakout of the wedge top, but bears did not get a good follow-through after the breakout (on Bar-1), instead the breakout was followed by a bull bar.

- A large number of bulls will be selling off their long positions close to the cup and handle measured move target, which could result in a minor bear leg.

- Because the market is currently trading close to the significant round number 19000, traders should be prepared for a week of trading range price action.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.