Market Overview: NASDAQ 100 Emini Futures

The NASDAQ Emini futures market had a weak doji sell signal pause after strong move up of last week.

Since this week is a bad signal bar, it will likely get bought. As last week’s report mentioned, there are targets above.

NASDAQ 100 Emini futures

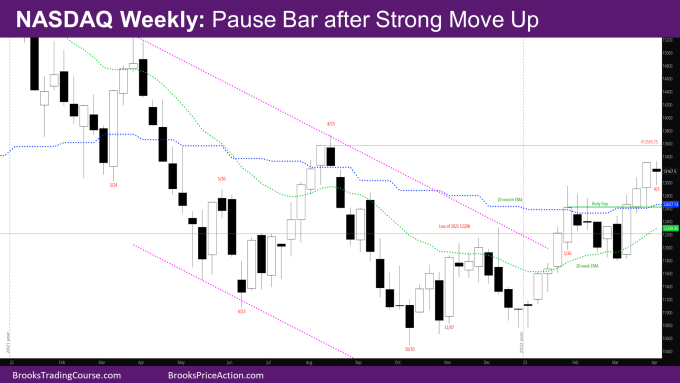

The Weekly NASDAQ chart

- This week’s candlestick is a doji sell signal bar with a long tail below.

- It represents a pause up in the 2nd leg up since March.

- The next bull target is the close of Week of 8/8 at 13569.75 – the last bull bar of the micro channel up in August. That was a reasonable buy the close bar, and there are trapped bulls up there.

- The market is close enough to this target that it should reach it.

- The 2nd leg up since March is also a 3 bar bull micro channel (low of each bar higher than prior bar low) which means there will likely be another leg up after a pullback even if for one bar.

- There is also a body gap created by the week of 1/30 – There has not been a bear close after the market broke above the close of 1/30 that overlaps with the body of 1/30.

- If the market goes sideways for a few weeks, bears will try to get a leg down like they did at the end of the first leg up in early February.

- As strong as the move up since October, since the reversal did not start with a bull signal bar, this is still likely a minor reversal, and the market may have to test back down again even if after 6-10 months.

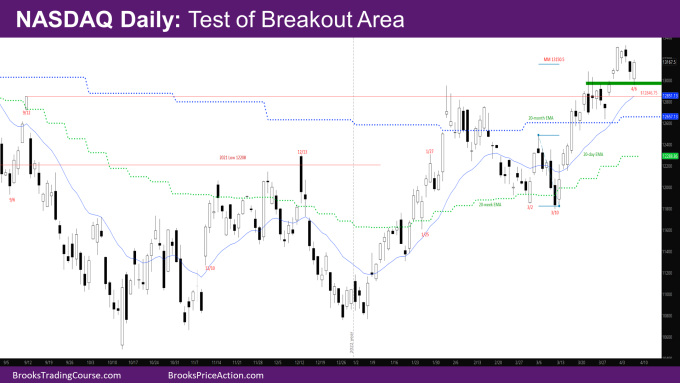

The Daily NASDAQ chart

- Friday was a trading holiday. Thursday’s NQ candlestick is a strong outside up bull bar with a tail below, closing below Wednesday’s high.

- Monday was a bull inside bar to last Friday. Tuesday and Wednesday were bear days although with tails below.

- Two weeks ago, the market was in breakout mode (BOM) on the daily chart and then last week the market broke above.

- Last week also reached the Measured Move (MM) target of 13150.5 shown on the chart.

- This week the market tested the breakout area and is trying to reverse.

- The breakout last week seemed more like a vacuum move up. Last week was the last week of the month, so it seemed like the buying was to make the month close strongly.

- The move up last week will likely produce another leg up.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Nicely done.

Thanks