Market Overview: NASDAQ 100 Emini Futures

The NASDAQ Emini futures February monthly candlestick is a non-climactic bull trend bar. It is a new all-time high close, with a close above December 2021 close, the prior all-time high close.

The week is a bull trend bar with a bigger tail below and a smaller tail above.

NASDAQ 100 Emini futures

The Monthly NASDAQ chart

- The February month bar is a non-climactic bull trend bar closing near its high.

- Last month’s report had mentioned that bulls need a series of non-climactic bars closing above the December 2021 close, and this month is the first such bar.

- Next, bulls need another good monthly bar in March.

- Bears needed to prevent such a good bull bar after the doji bar last week.

- After the doji bar last month, this is likely the start of a channel.

- This month is another bar in the bull micro-channel since the move up that started in November 2023.

- This means that there are likely buyers below the bull bars. Hence, bulls may buy the close of February, knowing there are buyers below.

- Bears want to make this a trading range and likely sold the high of January and the February close for a scalp.

- The December 2021 close will be a magnet over the next several months. Bears want to close the body gap while bulls will want to keep the body gap open.

- If bulls can create good bull bars for the next couple of months, then bears will buy if the market retests the December 2021 close.

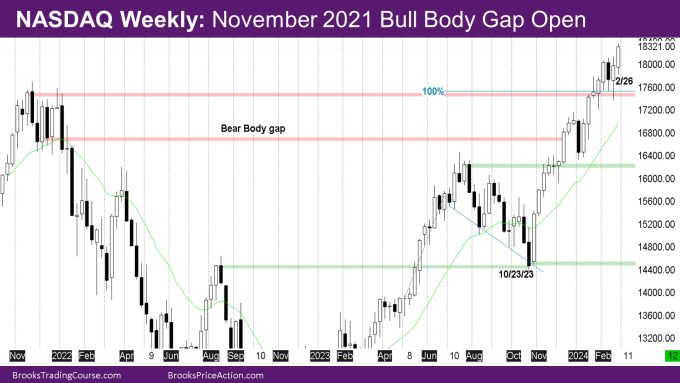

The Weekly NASDAQ chart

- The week is a bull trend bar with a bigger tail below and a smaller tail above.

- For the last month or so, the market has been trying to decide how to handle the November 2021 close.

- Bears tried a couple of times – near the end of January and couple of weeks ago to reverse, but bulls bought both times.

- Bulls are buying below prior bars like they were doing in the first half of 2023.

- Bears are not able to create good sell signal bars or consecutive bear bars.

- Bulls want to maintain the body gap with the November 2021 close. It looks like for the time-being, they will be successful.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

The Nas is back…! Thank you Rajesh!