Market Overview: NASDAQ 100 Emini Futures

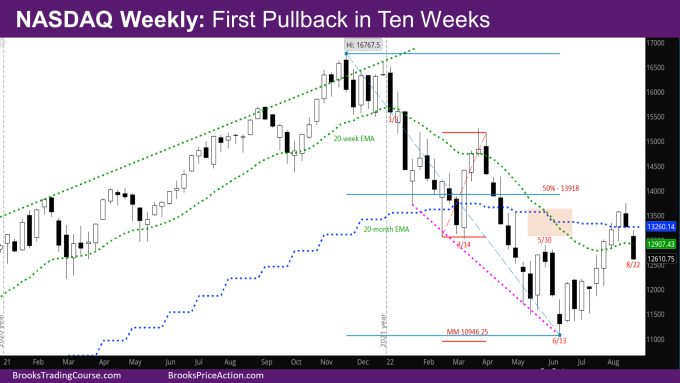

NASDAQ 100 below all EMAs, pulling back this week for the first time in the last ten weeks. A pullback was expected, although the bears have created consecutive good bear bars closing on their lows.

The market is also back below the daily, weekly, and monthly exponential moving average (EMA). Next week is important because it will determine the shape of the monthly bar. The bulls also don’t want a third consecutive bear bar.

So far, the monthly chart is a Low 1 bear bar with a big tail at the top. For the first half of next week, the open of the month at 12896.75 is an important magnet. Bulls want the close to be above the open of the month.

NASDAQ 100 Emini futures

The Weekly NASDAQ chart

- This week’s Nasdaq Emini candlestick is a bear trend bar closing on its low with a small tail at the top.

- The week gapped down below last week and closed far below the weekly EMA.

- Positives for the bulls so far:

- First pullback in 10 weeks after a nine-week bull micro channel. So likely there should be a 2nd leg up after the pullback.

- They have met all their recent targets – high of May month; having a close above the monthly EMA.

- Positives for the bears:

- Consecutive good bear bars closing on their lows.

- market is back below daily, weekly and monthly EMAs.

- Bears would like a re-test of the high of the week of 6/13 at 11794.25.

The Daily NASDAQ chart

- Friday’s NQ candlestick is a big bear bar closing on its low. It is the biggest bear bar since the bear bars in April.

- Friday looks similar to the bear bar on 4/21 in terms of its location in the market structure – with close much below EMA.

- Based on Friday’s bar size, there should be more selling, likely down to bottom of the bull channel that started 7/27 around 12300 (shown as the green horizontal bar in the chart)

- The market is back below the breakout point of 7/22 at 12698.5, so the measured move (MM) shown on the chart from a few weeks ago is less likely.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.