Weak Trump rally resumption after Fed interest rate hike

Updated 6:46 a.m.

The bears created a big bear trend bar on the open. This increased the chances that the Emini is beginning a 2nd leg down from Wednesday’s buy climax. Yet, the 60 minute moving average is strong support. The bears therefore need strong selling to create a bear trend day.

The size of the first bear bar was very big. This reduces the chances of a strong bull trend day. Because of the support from yesterday’s trading range and the 60 minute moving average, today will probably continue yesterday’s trading range trading for the 1st hour or two.

Since the 60 minute chart has a clear bull flag and a clear attempt at a 3rd leg up to a wedge top, traders have to assume that the probability of that is not as high as it appears. Whenever something looks unusually likely, it is less likely that it appears. Traders need to consider the possibility that it is a trap. Hence, there is an increased chance of a swing down for a 2nd leg down today.

Pre-Open market analysis

The Emini sold off yesterday after the FOMC buy climax. It reversed up from a 2 day wedge bull flag at the 60 minute moving average. In addition, the selloff held above the FOMC bull trend low. The odds favor higher prices today or early next week. The bulls will probably get a 3rd leg up on the 60 minute chart after yesterday’s pullback.

The Emini has been sideways for 3 weeks. Therefore, the 5 minute chart has had a lot of trading range days. Hence, that is likely to continue. Yet, traders should be ready for a swing down on the daily chart that could start at anytime. This 3 day rally is enough for the bears to see a small double top with the all-time high. They therefore have a better chance of a selloff than without this double top.

Bull trend on higher time frames

Since all higher time frames are still in bull trends, the odds still favor higher prices. In addition, the all-time high and 2400 are both magnets above. Yet, the high of the weekly chart is far above the weekly moving average. As a result, the odds are that the Emini will not go much higher without pulling back for several weeks. While a strong bull breakout above the old high is possible, it is not likely without more weeks of sideways to down trading.

Since the December close has not been tested, that is an important magnet below. There is a 60% chance of a test of that close within the next couple of months.

Friday, so weekly magnets important

Because today is Friday, weekly support and resistance are magnets, especially in the final hour. These include last week’s high, the all-time high, and this week’s open.

Overnight Emini Globex trading

The Emini is up 2 points in the Globex market. The bulls hope that yesterday ended a pullback on the 60 minute chart and began a 3rd leg up. They want a test of the March 1 buy climax high. In addition, they want a break above that high and a rally to a new all-time high above 2400.

The bears do not mind a 3rd leg up because a reversal down would then be from a wedge rally. That would be a potentially major top, and a possible start of a 5% correction.

The odds favor a rally to the March 1 high. Yet, yesterday’s reversal down was strong enough so that the Emini might have to go sideways to down for another day before the bull trend resumes. Less likely, Wednesday’s rally will be a lower high that begins a bear trend down to the December close. Hence, the odds favor either a trading range today or a rally.

EURUSD Forex market trading strategies

The EURUSD daily chart is in a trading range.

It therefore has both reasonable reasons to buy and sell. The bull have been rallying for 3 weeks, but because the rally continues to have deep pullbacks, it is weak. It therefore is still a bear leg in a trading range. Hence, they need a strong breakout above the wedge bear flag before traders will believe that this is the start of a bull trend. Without the breakout, the broad bear channel will resume down.

The wedge rally had a 2nd consecutive strong bull day yesterday. Hence, the bears will probably need at least a micro double top before they can begin a swing down. The EURUSD bears therefore probably need at least a couple sideways days to stop the bulls. They then would have a better chance of beginning a couple leds down. The bulls need to get big bull trend bars closing above the neck line of the head and shoulders bottom.

Since all financial markets are related, if the Emini begins its 5% correction in the next few weeks, the EURUSD market will also probably have a strong breakout. Yet, it is impossible to know the direction until the breakout begins.

Overnight EURUSD Forex trading

The EURUSD market turned down last night after 3 legs up on the 240 minute chart, but it has been in a 15 pip range for the past 2 hours. The market is deciding whether the bear reversal is the start of a selloff down to the higher lows in the wedge rally, or a bull flag that will lead to a strong breakout above the wedge top.

Because of yesterday’s rally and the overnight reversal, the 60 minute chart is in a Big Up, Bid Down, Big Confusion pattern. Hence, today will probably be a quiet trading range day. Yet, the wedge is complete. Therefore the odds favor a breakout up or down next week.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

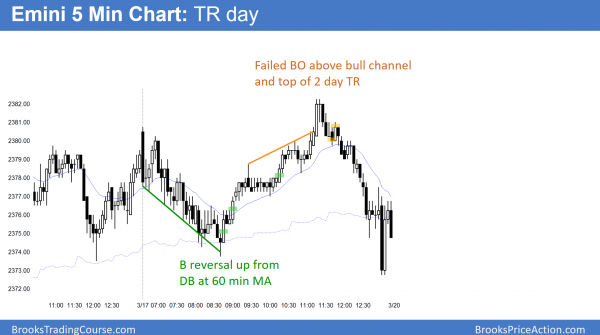

The Emini continued yesterday’s trading range,

and had weak legs up and down.

The Emini reversed a couple of times today and formed another trading range day. In addition, it was mostly within yesterday’s range. The bears want a 2nd leg down from Wednesday’s high, but the bulls want a test of the all-time high. The odds favor a test of the high next week, even if there is a deeper pullback first.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al, when there is a Bull BO of a Bull Channel, it is expected to fail within a few bars and then test the bottom of the channel. Does ” bottom ” mean a test of the Trend Line along the bottom of the channel, or a test of the Start of the Channel, which is quite a bit lower ? Thank you.

Michael,

Obviously I am not Al, but if I remember correctly from his trading room, A’ used to say “Bull breakout of bull channel, so 75% chance that price will pull back within the bull channel.”

The minimum goal is the trend line. The next support is any higher low in the channel, all the way to the 1st pullback that began the channel.