Trump rally resumption might form double top

Updated 6:50 a.m.

Yesterday had a wedge top. The bulls then got a climactic breakout of that top. This created consecutive wedge tops. The 60 minute chart has nested wedges. Furthermore, this is at the top of an 11 day trading range. This increases the chances of sideways to down trading today, possibly to the 60 minute moving average.

While today is having a limit order open, the context favors a swing down. The bulls want the 3 day rally to continue. The price action is against a strong bull day. Because of so much trading range price action over the past few weeks, the upcoming FOMC meeting, and the 3 early dojis, today will probably not be a strong trend day. Yet, the odds favor at least one swing down.

Pre-Open Market Analysis

While the Emini rallied in a Small Pullback Bull Trend yesterday, the rally was weak. Furthermore, the Emini is at the top of its 10 day tight trading range. In addition, the rally had a wedge shape.

Everyone knows that the Fed will almost certainly raise interest rates next week. That news is therefore already factored into the current price. Although the odds still favor a trading range into the report, the great certainty increases the chances of a bull breakout beforehand.

Yesterday was a bull channel. A bull channel is a bear flag. Therefore there is a 75% chance of a bear breakout. Furthermore, if there is a bull breakout, there is a 75% chance that it will fail within 5 bars. Therefore the odds are that tomorrow will have at least a couple of hours of sideways to down trading. Furthermore, it will probably begin by the end of the 2nd hour.

Overnight Emini Globex trading

The Emini is down 2 points in the Globex session. The bulls see the 3 day rally as the start of a breakout to a new all-time high. Yet, next week’s Fed interest rate hike is a major catalyst for a big move up or down in all financial markets. As a result, the Emini will probably stay in its 11 day tight trading range.

The bears see the 3 day rally as a wedge and a double top on the 60 minute chart. They therefore expect a couple legs sideways to down today and tomorrow. While the bulls might break to a new all-time high before next week’s FOMC report, the odds are that any rally will be small. Traders will probably wait for the report before they create another big move up or down.

EURUSD Forex Market Trading Strategies

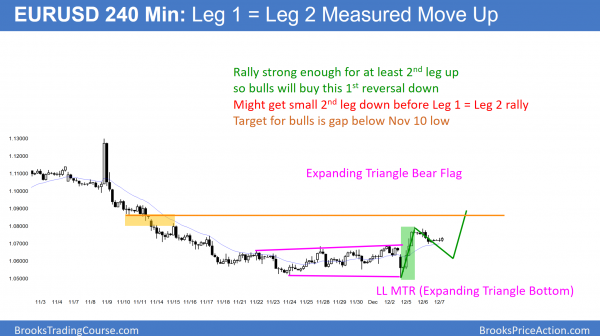

The 240 minute EURUSD Forex chart might have a small 2nd leg down before it tries for a Leg 1 = Leg 2 rally. The target is the test of the breakout point below the November 10 low. Less likely, the selloff will continue to a new low.

The EURUSD Forex chart yesterday pulled back from Monday’s strong reversal up from an Expanding Triangle bottom. The rally was strong enough so that a 2nd leg up is likely. That means the odds are that bulls will buy this pullback.

While the bears see the rally as the final leg up in an Expanding Triangle bear flag on the 240 minute chart, they only have a 40% chance of being right. They need a much stronger reversal down before traders will believe that the bears have taken control.

Because the FOMC meeting is only a week away, all financial markets might be mostly sideways until the report.

Overnight EURUSD Forex trading

The EURUSD Forex market traded in a 30 pip range overnight. In addition, next week’s FOMC Fed interest rate hike is a catalyst for a big move up or down. As a result, all financial markets might trade in a narrow range until the report.

The reversal up on Monday was strong enough to have a 2nd leg up. This reversal coming from a double bottom test of the major December 2015 low is especially relevant. It increases the chances of at least 2 legs up.

Yet, the bears see the past 3 weeks as an expanding triangle bear flag. While there might be a small 2nd leg down in this 2 day pullback, the odds still favor a Leg 1 = Leg 2 Measured Move up. That projection would therefore test the November 10 low. That is the breakout point on the 240 minute chart. In addition, it is around the bottom of the 4 month trading range on the daily chart.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

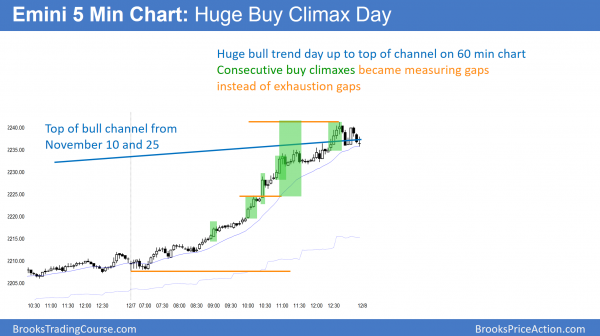

The Emini broke to a new all-time high with a series of buy climaxes. Instead of exhaustion gaps, they were measuring gaps.

Today was a Black Swan day. The odds were against a strong rally. Yet, the bulls broke far above the all-time high. Because of the consecutive buy climaxes, there is a 75% chance of at least a couple hours of sideways to down trading tomorrow.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.