Trump Presidential election stock market correction

Updated 7:13 a.m.

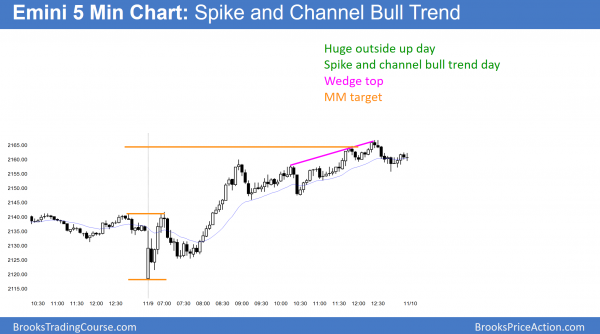

The Emini had a big reversal up from yesterday’s low. It then tested yesterday’s high and sold off. Because of the several reversals, today will probably be a trading range day. Since the bars are big, most traders should wait until they become smaller. At the moment, even with teh reversal down, the Emini is still Always In Long. Furthermore, there is a 70% chance that we’ve seen the low of the day. We might also have seen the high.

Pre-Open Market Analysis

While the Emini sold off 100 points on the election results, it rallied 75 points from the low. The Globex session traded below my 2040 – 2060 target for the pullback from the high. Yet, the day session might not get there before an end of the year rally begins.

Because last night reversed far above the midpoint of the selloff, it created confusion. That increases the chances of sideways trading for several days. Furthermore, the reversal up was so big that bulls will probably buy the 1st reversal back down. Hence, the odds favor at least a 2nd leg sideways to up on the 60 minute Globex chart. Since there are buyers below, the Emini day session might not reach my 2040 – 2060 target zone before testing the all-time high.

Most noteworthy is that the overnight range was over 100 points. As a result, today’s range will also probably be big. The bars will also therefore be big. Because this increases risk, traders need to trade small position sizes until the bars return to normal.

Forex: Best trading strategies

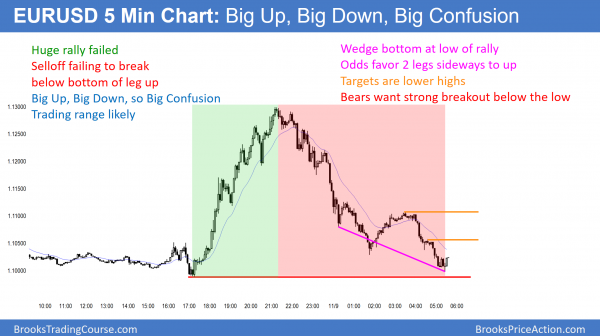

The EURUSD 5 minute Forex chart had a 200 point rally and then a 200 point selloff. It is forming a wedge bottom at the low of the rally. The odds favor 2 legs sideways to up and then a trading range.

The EURUSD rallied 2% on the news of a possible Trump victory. Yet, it then totally reversed down to below yesterday’s close. Furthermore, the reversal came from below the August major lower high. Therefore, the bear trend on the daily chart that began in May is still in effect. Yet, the chart is still within its 18 month trading range. It is therefore still in breakout mode.

The 5 minute chart sold off in 3 pushes. It is at the support of the low of the overnight session. Hence, it will probably try to reverse up from a wedge bottom today. If so, the bulls will try to get a two legged rally. While the target is the last lower high, that is 100 pips above. It therefore might be too far to reach today.

Confusion usually leads to sideways trading

The rally of the past 2 weeks was strong. Furthermore, the EURUSD is still far above the low. In addition, it is still above last night’s low. As bearish as a 200 pip sharp selloff is, it is stalling at the support of yesterday’s low and in the middle of the 2 week rally. Because this is confusing, it increases the chances of several sideways days.

Furthermore, it increases the odds of trading range trading on the 5 minute chart. Yet, because the range is so big, the legs will probably be big enough for swing trades.

Big bars so trade small

Especially relevant is that the overnight range was huge. It therefore had huge bars on the 5 minute chart. While the momentum down has slowed over the past 6 hours, the bars are still big. Forex day traders should trade smaller positions until the bars get back to normal size.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini rallied strongly today and formed an outside day.

Today quickly reversed up from below yesterday’s low and then broke above its high. Hence, it formed an outside up day. The context is good for the bulls. I have been saying since the 7 consecutive bull trend bars on the monthly chart that the odds were that the Emini would trade down about 100 points. In addition, I said it would close the gap below the July 2015 high. It accomplished both and now is reversing up strongly. Because it is at the top of the September trading range, it might go sideways for a few days. But, the odds still favor a test of the all-time high.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

I made a nice short on the Eur/Usd Lastnight as well as the first spike last evening on USDJPY. What a complete shock this was. History in the making. Thanks for all your advice Al. I believe I’m getting better day by day. Per your advice I am deciding to make MTR’s my primary strategy.

I would love to hear Al’s thoughts on Trump. Al, care to oblige? 🙂

I’ll be careful. Our antiquated system of government is unfortunately designed to get nothing done. It is also designed so that a person has to lie repeatedly to become president. The result is that most of our presidents are disappointing. Furthermore, the Eric Schmidts, Sheryl Sandbergs, Bill Gates, and Mike Bloombergs will not run because they know the system will prevent them from fixing anything.

As for the markets, they are telling us today that they don’t believe much of what Trump has said. Instead, nothing has changed. The test below the July 2015 high was likely to lead to a new all-time high, and that is still the case.

Thanks Al! Very interesting!

Hi Al,

When there is big up, big down move then is it ok to sell 1 pip below the low of bull spike as this probably form two bar reversal on higher time frame chart and might have stop losses below?

Many Thanks

There are 2 problems. First, the stop is far above so traders have to trade small. Second, the probability is about 50% when betting that a strong reversal down to the bottom of a bull trend will have a failed double bottom instead of a bounce and a trading range. The probability is higher if a trader waits to see a strong bear BO and then sells.