Trump, Comey, and Russia are minor compared to buy climax

Updated 6:53 a.m.

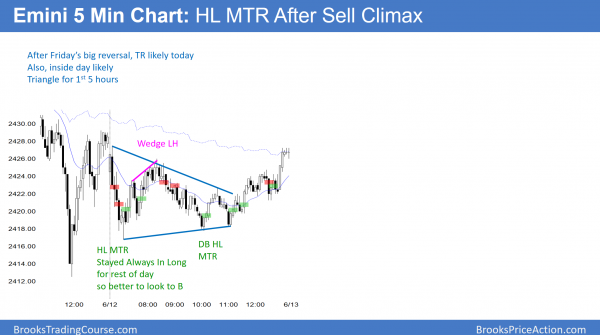

The Emini tested the top of Friday’s reversal up, which was a 50% pullback of the selloff, and stalled. This was likely because Big Down, Big Up creates Big Confusion. It therefore usually leads to a trading range. Today’s early selloff found some support at around a 50% pullback from Friday’s rally.

Since there was a reversal down and up after the 1st bar, the Emini is in breakout mode. Because today is in the middle of Friday, which was a big doji, today will probably be an inside day. Furthermore, after 5 consecutive dojis, there is an increased chance of another doji day. Hence, if the Emini trades away from the open, it will probably test the open later in the day.

The consecutive bear bars made the Emini Always In Short. Yet, the bears need to break strongly below Friday’s low to convince traders that today will be a bear day. More likely, the Emini will find buyers above yesterday’s low. Consequently, today will probably be a trading range day. Yet, the odds still favor a 100 point correction beginning at anytime soon. Therefore, there is an increased chance of a bear trend day.

Pre-Open market analysis

The bulls want the bull trend to resume up to a new all-time high. Yet, Friday was a big outside down day. Furthermore, it was also a doji.

While the rally on the daily chart is a nested wedge top and a probable bull leg in a trading range that began in February, there is no clear top yet. However, this rally probably will not continue much further before selling off about 100 points to below the weekly moving average. The bears want follow-through selling after Friday’s strong reversal down.

Overnight Emini Globex trading

The Emini is down 3 points in the Globex market. Since Friday had a big reversal back to the middle of the day’s range, the Emini is now confused. Furthermore, it is awaiting Wednesday’s FOMC announcement. The odds favor sideways trading into the report.

Yet, please read my weekend report. The daily chart has a wedge rally. Furthermore, it looks similar to the rally in the financial market that topped out in February. Since the weekly Emini chart is so extremely overbought, the odds still favor a 100 point selloff beginning at any time.

Trends resist change. The current bull trend on all higher time frames has had many reversal attempts. Yet, as was likely, all failed. Hence,Friday’s reversal probably will fail as well. However, one will eventually succeed, and Friday’s selloff was strong enough to make traders ready to look for a 2 month swing down.

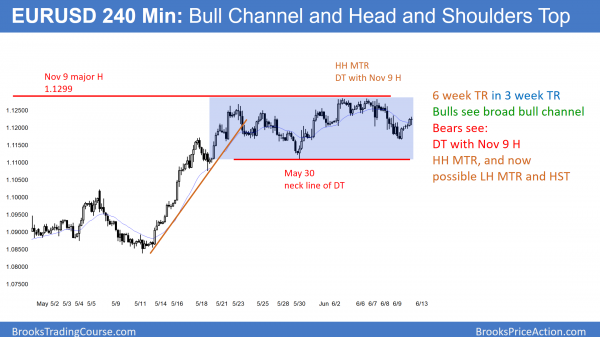

EURUSD Forex market trading strategies

The EURUSD 240 minute Forex chart is in a broad bull channel. Yet, there is a Higher High Major Trend Reversal and a possible Lower High Major Trend Reversal.

The EURUSD Forex market has rallied all year. The daily chart is now testing lower highs in the broad bull channel that began int August 2015. If it can rally above one or more of those highs, traders will see the 2 year pause in the bear trend as more of a trading range and less bearish. If instead the EURUSD market turns down from below the November 9 major lower high, traders will believe that the bear channel is intact. They therefore will be more confident of a break below the 2 year range and a test of par. At the moment, it is only slightly more likely that the 2 year range will have a bear breakout.

EURUSD Forex daily chart in Breakout Mode

The daily chart has been in a tight range for 4 weeks. It tested close to the daily moving average on Friday. Furthermore, the momentum up is strong enough to make a break above the November 9 lower high likely. However, because it has been sideways for 4 weeks, it might 1st sell off to below the May 30 low. Hence, that would trigger a double top with the May 23 high. Yet, because most trading range breakouts fail, the odds would still favor a break above the November 9 high within the next couple of months.

Will the EURUSD market break above its 2 year range? Since that range is still a bear flag on the monthly chart, the odds still favor an eventual bear breakout. However, it has been in a trading range for 2 years and there is no sign of a breakout up or down. This year long rally is simply a bull leg in that range. Because trading ranges disappoint bulls and bears, and since the momentum up over the past 3 months is strong, the odds still favor a break above the November 9 high before the current leg up ends.

Overnight EURUSD Forex trading

The EURUSD market has been in a 30 pip range for the past 6 hours. In addition, it is in the middle of a 4 week range. Finally, Wednesday’s FOMC meeting can produce a surprise. Hence, the market will try to stay neutral going into the announcement.

While there is a wedge bull flag on the 60 minute chart, the momentum up since Friday’s low has been weak. Furthermore, the daily chart has 3 consecutive bear bars. Therefore, the chart will probably test last week’s low before trying again to break above the November 9 lower high.

In the absence of momentum, the EURUSD 240 minute chart is neutral and likely to remain in its 4 week range for at least a couple more days. Consequently, day traders will continue to scalp.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

After Friday’s big reversal up from a sell climax, today was in a triangle for most of the day. Since it closed near the open, it was the 6th consecutive doji day in a tight range.

Friday had a Big Down, Big Up reversal. Therefore the market was confused. Consequently, it went sideways today.

With the uncertainty of Wednesday’s FOMC announcement, and 6 doji bars in a tight range on the daily chart, tomorrow will probably also be a trading range day,

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al, I don’t really get it why would you recommend to short 1 tick below the bear bar (the 1st short you show on the chart), it might have a potential to form DB since the price was near prior swing low and at 50% pullback of the prior bull leg, is that because of the strong reversal bear bar (2nd bar from opening)??

I think that it would be a difficult short for most traders because the bars are big and the odds favored the day staying above yesterday’s low. Therefore a trading range day was likely, and this was shorting at the current low. Yet, the bulls just got trapped when they bought above the strong bull bar on the 1st bar of the day. They would therefore exit below the low of the day (the 1st bar) or a strong bear bar. The 2nd bar was both.

Yesterday was a big outside day so today was likely to try to test yesterday’s H, L, or both. That 2nd bar made it clear the the bulls were failing to test yesterday’s high and therefore the bears would probably test yesterday’s low.

Al,

You ROCK!!! So glad to hear your insights every day. You stand alone as a learned voice in the confused environment of trading.