Trump rally might end with March FOMC rate hike

Updated 6:55 a.m.

Last week was a High 1 buy signal bar on the weekly chart, and its high is only about 5 points above. The Emini will probably test above it this week, and possibly early today. After a 7 day bear micro channel on the daily chart, any rally will probably not last more than a day or two until the Emini goes sideways more.

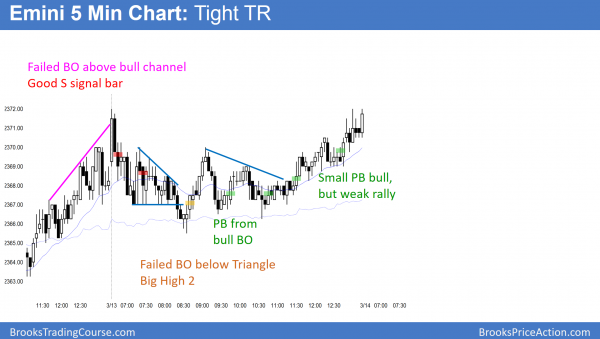

The Emini broke above Friday’s tight bull channel and reversed down. Because the channel was tight, the reversal down will probably be minor. While the 1st 2 bars were bear bars, they did not break below the channel. Yet, there is always at least a 20% chance that the 1st bar will be either the high or low of the day.

Since bull channels usually evolve into trading ranges, that is what is most likely over the next couple of hours. The early small sideways bars increase the chances of a trading range. While a strong breakout can come at anytime, the odds are that the 60 minute moving average will be support and last week’s high will be resistance. Therefore, the odds are for a trading range day.

The Emini is in a tight range and neutral at the moment. It is deciding on the direction of the 1st swing in what will probably be a trading range day.

Pre-Open market analysis

The Emini finally had a bear trend bar on the weekly chart last week. The weekly high is far above the weekly moving average. Hence, the odds are that the Emini will pull back to the moving average over the next month or two.

The daily chart had a 7 day bear micro channel. That is enough selling to confuse traders. Therefore, today and tomorrow will probably be within last week’s range. In addition, Wednesday’s FOMC report is a major catalyst. Hence, the stock market will probably stay neutral into the report. This means that today will probably not be a big day.

Overnight Emini Globex trading

The Emini is up 1 point in the Globex market. It is therefore still in the middle of the 7 day bear micro channel that formed after the high of 2 weeks ago. The 7 day pullback was relatively big. It therefore created a Big Up Big Down, Big Confusion pattern with the March 1 buy climax. Hence a trading range is likely. This is especially true because Wednesday’s March FOMC meeting will probably lead to a big move up or down over the next several weeks.

Since a trading range is likely for up to Wednesday’s 11 am Fed rate high announcement, the 5 minute charts will probably be mostly sideways. In addition, the range might be small. While a big trend can come at any time, the chance of one happening today or tomorrow is small.

EURUSD Forex market trading strategies

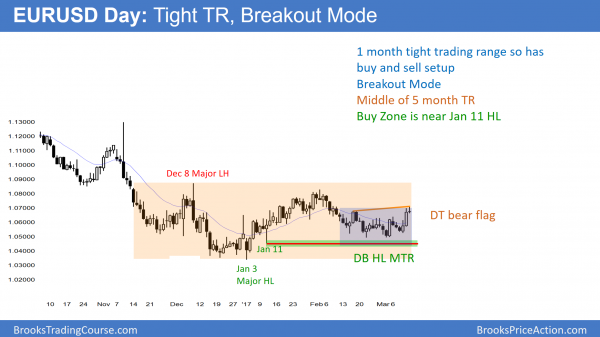

The EURUSD daily Forex chart has nested tight trading ranges going into the March FOMC meeting on Wednesday. It has broken above minor higher lows and high, but not above major reversals.

The daily EURUSD Forex chart has been within a tight trading range for a month. It is therefore in Breakout Mode, which means there is an equal chance of a successful bull or bear breakout. Since this range is in the middle of a larger 5 month range, it is a nested pattern. A breakout of the smaller range could lead to a breakout of the larger one. Hence, the EURUSD Forex market has an increased chance of a big move over the next few months.

Since the Fed might begin a series of interest rate hikes with this week’s March FOMC meeting, there is an obvious catalyst for a potential big change in relative value of all financial markets.

Overnight EURUSD Forex trading

The EURUSD Forex market has been in an unusually tight 15 pip range for he past 4 hours. This is too tight for traders to make even a minimal 10 pip scalps. They therefore should wait for the legs to get bigger before day trading today.

While the EURUSD broke above last week’s minor low highs and pulled back, it has not yet clearly reversed. Hence, it is equally likely that the reversal down might become a bull flag. If so, there might be at least one more minor new high before a reversal back down into the month long trading range. Traders need more information and bigger swings and should wait.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini was in a tight trading range today.

The Emini was in a tight trading range today. Last week was a bull signal bar on the weekly chart. Its high is within reach tomorrow. The Emini will probably have to test above last week’s high at some point this week. Because it was a weak bar after a buy climax, the odds are that there will be sellers above its high.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.