Stock market rally off 50 day moving average

Updated 6:48 a.m.

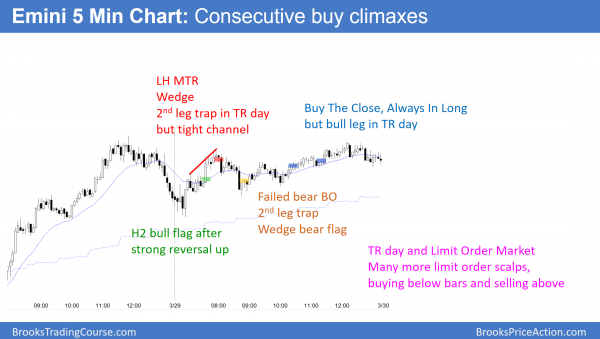

Because of yesterday’s late selloff, the bulls will probably need at least a small double bottom before getting a swing up. Yet, yesterday’s bull trend was strong. Therefore, the selloff is probably the start of a trading range and not a bear trend. The odds therefore favor a trading range for at least the 1st hour or two.

The Emini opened with 3 dojis, which is trading range price action. This is consistent with the Emini having an early trading range. In addition, it increases the odds of a trading range day. This is especially true after a Big Up, Big Down pattern. Support is at the 60 minute moving average, the bottom of the channel, a 50% pullback of yesterday’s rally, and the bottom of the 1st pullback after yesterday’s strong breakout.

Pre-Open market analysis

The Emini rallied strongly again yesterday and broke above last week’s lower high. It will therefore try to reach last week’s sell climax high. Yet, the bears will try to make yesterday’s bull breakout fail. Hence, they will try to create a double top bear flag on the daily chart. This is because last week’s selloff came from a measured move target on the monthly chart. The context and the selloff were good enough to make it likely that there will be at least one more leg down on the daily chart after this rally ends.

In addition, the weekly high was far above the weekly moving average. Therefore, the odds are that the 2 day rally is more likely a bear rally than a resumption of the bull trend.

While the 2 day rally is strong, the bulls need to get above last week’s sell climax high. Yet, the rally is strong enough for follow-through buying over the next 3 days. Because the buying has been climactic, there might be a deep pullback before the buying resumes. At a minimum, yesterday’s failed breakout above the 2 day channel should lead to a test of the bottom of the channel today. Regardless, the odds favor a lower high on the daily chart and then a 2nd leg down.

The monthly chart

This week is the end of the month. The bulls would therefore like to avoid a bear reversal bar on the monthly chart. In addition, they would like this month to be another bull bar. Hence, they would like Friday to close above the open of the month. While possible, the odds still favor a bear body once the month closes.

Overnight Emini Globex trading

The Emini is up 1 point in the Globex market. In addition, it traded in a narrow trading range overnight. Because of yesterday’s late strong reversal down after a buy climax, the Emini is in a Big Up, Big Down, Big Confusion environment. Since confusion is a hallmark of a trading range, the odds are that today will be a trading range day. The bottom of the range will probably be around the 60 minute moving average. In addition, the top of the range will probably be around either the top of yesterday’s strong reversal down or yesterday’s high.

The odds of another strong bull day are small. In addition, after such a strong rally in a tight bull channel, the odds of a big bear trend day are small as well.

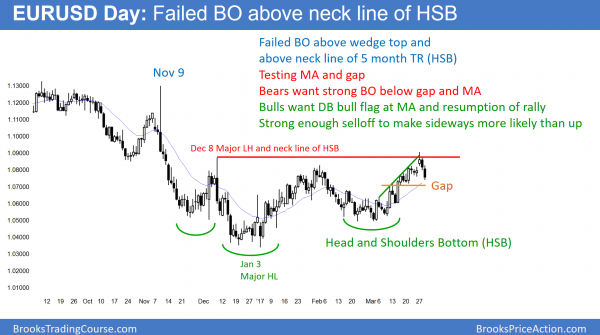

EURUSD Forex market trading strategies

The EURUSD daily Forex chart reversed down strongly after a 5 week wedge rally and a breakout above the neck line of a head and shoulders bottom. It is now testing the gap, the moving average, and a higher low in the wedge rally.

The bull breakout on the EURUSD daily chart failed. The 2 day reversal down was strong. While now testing support, the best the bulls can probably get over the next few days is a small trading range at support. They hope that this selloff is simply a breakout pullback down to support.

I said 2 days ago that most breakouts fail. In addition, I said that the breakout was weak and that the reversal down might test a higher low in the wedge rally. Furthermore, a reversal down from a wedge usually has a couple of legs. Since this is only the 1st leg, the odds are that bears will sell the 1st rally. Hence, the EURUSD will probably have to have a 2nd leg sideways to down. Therefore, most bulls will need at least a micro double bottom before they will buy again.

Small trading range likely

The bears want a collapse below this support. Because the EURUSD daily chart is still in a trading range, the bears will probably be disappointed. They need consecutive strong bear bars to convince traders that the 5 month trading range is evolving into a bear trend.

But, the odds are that the trading range will continue. Big Up, then Big Down creates Big Confusion, and therefore usually a trading range. Therefore, today will probably not be another strong bear trend day. Since bulls will not hold for a swing trade without a micro double bottom, the EURUSD daily chart will probably go sideways for a few days. Bulls and bears will scalp. The bounce might again test the neck line of the head and shoulders bottom. Hence, the developing range will probably be about 50 – 80 pips tall.

Overnight EURUSD Forex trading

While the EURUSD sold off strongly overnight, it is testing the bottom of the wedge channel after the strong March 15 breakout. Furthermore, it is back in the 6 day trading range that ended with Monday’s rally. This is strong support and therefore bears will take profits. In addition, bull scalpers will begin to buy. Hence, the EURUSD strong bear reversal will probably evolve into a trading range today.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

After 2 strong days up, today was a trading range day. Therefore, limit order traders had the most opportunities.

The Emini reversed up from yesterday’s late sell climax and formed a trading range day today. The bulls are still hoping for a 20 point rally into Friday’s close to turn the month into a bull trend bar on the monthly chart. Yet, the odds still are that the Emini will work down to the 2016 close, even if this rally continues up to the lower high on the daily chart.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al,

Black Rock just fired dozens of portfolio and fund managers because they are starting to bet on the robot with AI. I know that for decades institutions have been using program trading and the behavior of price actions haven’t changed since its existence. But I’m still a bit worried about the deep learning ability of these robots. They are different than programs. They are able to learn and simulate. Will there be any influences to us individual traders. Will we still be as profitable as it is before or will the behavior of price actions change even in the slightest bit? Thanks.

Julian

I have talked about this a few times. The robots are only doing what is rational. The markets have always been rational. The robots are just quicker and more consistent. The result is that the overall price action will always remain the same.

Humans refined their trading skills over thousands of years. When you have thousands of participants, the market is remarkably logical. Robots cannot make them much more logical. While minor things have changed, like more abrupt reversals and fewer strong signal bars, the fundamental concept is the same. Markets simply constantly probe for the best price, which constantly changes.

Hi AL,

Thank you so much for your thoughts. For quite a while trader has been among the most predicted professions that’s going to suffer major staff cuts in the coming era of artificial intelligence. I was a bit shocked that it’s coming this quick when I heard about Black Rock’s lay-offs. Thses fund managers are not in the strict sense traders. They are investors. They analyze economical cycles, industries and price companies. If these jobs are replaceable, I can’t imagine what jobs aren’t. But your logic makes sense. Market remains logical no matter how good the AI can be. Hearing it from you makes it more rest assured. Thanks again.