Stock market late October bullish seasonality

Updated 6:49 a.m.

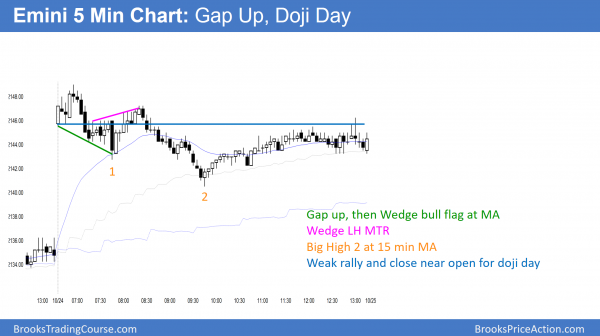

While today had a big gap up, the 1st bar was not big and the next bar was a bear doji. This is therefore a disappointing open for the bulls. Furthermore, the bear doji was not a strong sell signal. Disappointed bulls and bears increase the chances for a lot of trading range trading today.

Big gap up days often pull back for 5 – 10 bars until the Emini gets closer to the moving average. Then, the bulls look to buy a High 2 or Wedge bull flag for a possible low of the day. The early selloff therefore puts a tail on the bottom of the bull trend bar on the daily chart.

If there is an early reversal down, the bears want consecutive big bear bars, which they do not yet have. Therefore, the odds are against a strong bear trend day.

At the moment, the Emini is Always In Long. Yet, this is trading range price action. Therefore the odds are that the Emini will go mostly sideways to down for the 1st hour until it gets closer to the moving average. If so, traders will look to buy a reversal up. Because the 1st 4 bars were small, today probably will not be a strong trend day up or down. The bulls have a decent chance of a bull trend day, but it would probably not be a huge up day. The bears have a small chance of a bear trend day.

Pre-Open Market Analysis

The Emini has been in a tight trading range on the daily chart for 8 days. Furthermore, it has been within a tight trading range on the weekly chart for 7 weeks. It is therefore in breakout mode. While Friday closed on its high and is therefore a buy signal bar for today, ranges resists breakouts. Hence, 80% of breakout attempts fail.

Because the Emini rallies about 90% of the time in the end of October and the start of November, there is an increased chance of a bull breakout this week. Yet, until there is a breakout, there is no breakout. The breakout could be big and fast. This is especially true if the bears win because the Emini is in a bull trend. Traders will therefore be quick to exit. While a bull breakout could also be fast, it more likely would be in a small pullback bull trend. The bulls want a new all-time high.

In conclusion, the tight trading ranges will probably break out soon. The seasonality and the bull trend favor the bulls. The open gap above the July 2015 high favors the bears. The probability is about 50% for each.

Overnight Globex Trading

The Emini is up 10 points in the Globex session. It will therefore probably gap above Friday’s high, the 8 day trading range, and the daily moving average. This increases the chances that today will be a bull trend day.

If it is a big bull day closing on its high, traders would therefore look at it as a measuring gap. The 1st target would be a measured move up based on the 8 day range. That would also be a test of the September lower highs. If the bulls can get above those highs, they will probably then get a new all-time high. The bulls need more than a bull trend day. They need 2 – 3 consecutive bull trend days to convince traders that the trading range has ended and the bull trend has resumed.

Because most breakout attempts fail, traders should also be prepared for this breakout to reverse back down either today or soon. Look back at the daily chart over the past 4 months. There have been many big bull trend days. Yet, the follow-through has been bad, and the bears soon took control again, keeping the Emini sideways.

Forex: Best trading strategies

The EURUSD 60 minute Forex chart is in a Spike and Channel sell climax. While there is a double bottom, the pattern does not have enough bars for a major reversal. As a result, the overnight rally is probably part of a bear flag. Yet, there are gaps between the lows of bars and the moving average. That is a sign of strong bulls. Therefore, the next test down will probably lead to a major trend reversal attempt. If the bulls get a couple of legs up over several days, the targets are prior lower highs.

While the weekly chart last week had a bear follow-through bar after the breakout a week earlier, the 60 minute chart is late in a Spike and Channel bear trend. That is a climax pattern. As a result, the EURUSD 60 minute chart will probably soon go sideways to up for a few days. Yet, the strength of the selling on the weekly chart makes lower prices likely. Therefore, traders will see any rally this week as a bear flag.

While it is always possible that this sell climax could lead to a sharp reversal up into a bull trend, that would be unusual. Typically, a strong bear trend has to transition into a trading range before the bulls are able to create a bull trend. Hence, the best the bulls will probably get over the next week is a rally in a trading range.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

After a big gap up, the bulls failed to reverse up from the 5 minute moving average. Yet, they did create a low of the day at the 15 minute moving average.

Today broke above the 8 day trading range and daily moving average. Yet, it formed a bear doji. Hence, today was a weak entry bar on the daily chart. Therefore, unless tomorrow is a strong bull trend bar, today’s rally will simply be another leg in the 4 month trading range.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Do you think DXY has any place with trading Forex? or is that something I should stay away from.

I assume you are referring to either the dollar cash index or futures contract. I always treat the chart in front of me as the only thing that matters. Any trade I make is based entirely on what is on the chart that I am trading. I assume that all other factors have already been priced into the chart. Therefore, if I add something to my decision, I am double counting it and getting an inaccurate perspective.