Posted 7:15 a.m.

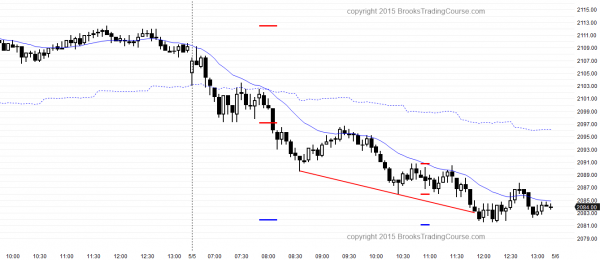

The Emini futures began with a trend from the open bear trend. Although some bars had tails, the selling was strong enough so that the first reversal up will probably be sold. The bulls hope to create an early trading range and then reverse the market up, like on April 30. However, the selling was strong enough so that the first reversal up will probably be sold and the best the bulls can expect over the next several bars is a trading range. If instead there is a strong reversal up like April 28, Emini traders will change their minds. Right now, a trading range is more likely than a bull trend, despite the strong bull bar at 7:10 a.m. The bears want a bear trend day, but most strong moves up and down over the past month have been just legs within a trading range, with limited follow-through.

At the moment, the Emini is Always In Short, but trying to reverse and form a low of the day at the bottom of a bear channel. They need a series of consecutive strong bull bars. Without that, any reversal up will probably become a trading range. Then, the market will decide between trend reversal up and trend resumption down.

My thoughts before the open: Trading markets at the top of a trading range

The 60 minute Emini Futures contract rallied in a tight wedge over the past few days and is likely to pull back for a day or two. The channel is so tight that the odds are that the selloff will be bought for a test back up. However, the bears want this rally to be a lower high major trend reversal. The bulls want a breakout above the ascending triangle on the daily chart.

Yesterday was a small day, but it gapped up. The Globex market is trading below yesterday’s low. This will probably lead to yesterday becoming another island top. Island tops and bottoms are common in trading ranges. The final top before the 10 – 20% correction might come from an island top, but most island tops fail. This one probably will as well.

With that being said, traders learning how to trade the markets need to be aware that the monthly chart is exceptionally overbought and the correction can start at any time. May is at the end of one of the strongest times of the year and therefore has a higher than average chance of creating the top. When the selloff begins, it might be very fast, so traders need to be able to quickly switch to swing trading, and try to hold at least a small position all day if there are big bear trend days.

So, what is the futures trading strategy today for online trading? Most days have had long tight trading ranges because the Emini is in a 6 month trading range that is getting tighter. The odds are that today will be like most others. If the bears get strong follow-through selling, daytraders will look for swing trades. If there is a gap down, one important trading strategy is to be ready for a reversal up and an early low of the day.

There have been many big breakout bars lately with bad follow-through. One of the hallmarks of a trend is that the price action is relentless…there are series of consecutive trend bars. If traders see that, they will swing trade. Without that, they will assume that any move up or down is just another leg withing the Emini trading range.

SForex trading strategies

The EURUSD had a buy climax on the daily chart and has been pulling back. A trading range is more likely than a reversal. The bears need to create more selling pressure before traders will trust a reversal. Traders looking to trade Forex for a living will pay attention to the reversal down in the USDJPY today and look to sell rallies as their Forex trading strategy. Most other Forex markets are in trading ranges on the 5 minute chart.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The S&P Emini futures contract was in a trend from the open bear trend, and it ended with a wedge bottom.

The S&P Emini futures contract was in a broad wedge channel. The bears kept selling rallies to the moving average. After the bear gap from 8:05 was not closed by the rally to 9:25, online daytraders decided that a bear breakout and a measured move down was likely.

Because the Emini today ended with a wedge bottom, the high probability trading strategy is to look for a couple of legs up, lasting at least a couple of hours, tomorrow. However, the Emini continues to fail at the top of a 7 month trading range and in an extremely overbought bull trend on the monthly chart. Traders learning how to trade the markets need to be prepared for a big move down. It will probably happen with no notice, and it will be easy to deny it. When it is happening, the best daytrading strategy will be to look to swing trade short positions because the moves down can be very big.

In the Forex markets, the USDJPY had a big move down after its pullback. Although I said that selling rallies was the best Forex strategy for the day, the move down was bigger than I thought was likely.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

I put everything on cash for several months. Risk of correction > upside move. No one knows when top will come. What to do in the mean time? Baffled.

I am in the same situation and am waiting for a 10 – 20% correction before buying. Since I believe there is an 80% chance of at least a 10% correction this year, I am confident that I will be able to buy for less the the current price. I think the risk of missing a big upside move from here is small (read my weekly blogs), and I think that buying now is not wise. If a trader is going to hold for years, it does not matter, but if he might take money out in a year or two, it makes more sense to wait to buy lower. I am not baffled!