posted 7:15 a.m.

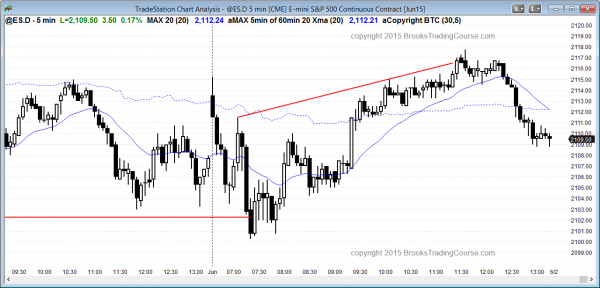

The Emini reversed down from the neckline of a double bottom from yesterday and sold off sharply to test yesterday’s low. The selloff was big enough to make a bull trend day unlikely, but since the Emini reversed up so strongly, a bear trend day is unlikely as well.

The reversal up was strong enough to make the Emini Always In Long and the odds are that the first selloff will be bought. The bulls are hoping for a reversal day and a bull close on the day, but realize that a strong bull trend day closing above yesterday’s high is less likely after such a deep initial sell off. The bears are hoping that the selloff was strong enough so that the best the bulls get is a trading range. The bears are hoping that since the rally stayed below the high of the day, the rally will be just a lower high in a bear trend. However, they need a strong breakout below yesterday’s low. Otherwise, the Emini will trade mostly sideways.

Updated 7:20 a.m.

The bear breakout was strong enough to reverse the Emini back to Always In Short, and they have a possible bear trend day, but need follow-through selling to make the bulls give up.

With these big reversals up and down, the odds favor a trading range day with bulls buying selloffs and bears selling rallies, and both scalping.

My thoughts before the open: Day trading strategies for possible trend resumption

The Emini is in a 3 day wedge bull flag and has a higher low. Wednesday’s rally was strong enough to have follow-through buying. The Emini had a bull breakout in the Globex session, although it has pulled back. The odds are that the bulls will try to rally today. The bears need a breakout below last week’s low (the bottom of Wednesday’s strong bull reversal). However, since the Emini is in a trading range, that breakout will need follow-through because most breakouts fail when the market is in a trading range. The day trading tip for today is to be ready for an attempt to resume up.

However, a trader learning how to become a day trader must always be prepared for the exact opposite, even if it is unlikely. If there is a strong bear breakout, high probability trading will be swing trading short positions.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini sold off sharply on the open, but reversed up from below yesterday’s low.

The S&P Emini futures contract sold off strongly on the open. When it sells off this much, a bull trend day is unlikely. However, a reversal day with a rally back to around the open is common, and that is what today’s price action did.

The bulls see today as a bull breakout of a 3 day wedge bull flag. The bears see it as a 2 day expanding triangle bear flag or wedge bear flag. The Emini is in a trading range, and trading ranges always contain both reasonable buy and sell setups. Although today sold off into the close, this is less important than the Emini being in a trading range for several days. The odds are that tomorrow will also have a lot of trading range price action as the market decides what to do with the higher time frame charts. There is about an 80% chance of a 10% pullback this year, but the bulls might be able to get one more new high and a possible buy climax first.

Best Forex trading strategies

There are no strong breakouts on the 5 minute chart at the moment.

The EURUSD is in a bear trend on the daily chart and in a trading range on the 60 minute chart. The bulls want the overnight rally to be the start of a Major Trend Reversal, but the rally will probably just be another bull leg in the trading range.

The USDJPY 60 minute chart is turning down from a Lower High Major Trend Reversal. The bear breakout on the 5 minute and 60 minute charts has had bad follow-through so far. Without the follow-through selling, this is just a bear leg in the trading range.

The most important price action pattern on the 60 minute chart of the USDCAD is a triangle in a bull trend. It is at the top of a 3rd leg up and it will probably pull back for a day or two. At that point, it will decide whether to breakout for a measured move up or down, or instead continue more sideways and form another Major Trend Reversal top and another Double Bottom Bull Flag.

The candlestick pattern on the 60 minute GBPUSD chart is a broad bear channel with many pushes down. Traders learning how to trade Forex markets for a living should realize that a bear channel is usually a bull flag. It often needs a bear breakout before the bull breakout, but the odds are about 75% that there will be a swing up on the 60 minute chart this week. The best Forex trading strategy is to look for a strong bull breakout today or tomorrow, and then expect at least a couple of legs and a couple of days up.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al and company–

I really like these occasional audio clips. keep ’em coming.

Thanks James. Plan is to do one per week if possible. Pleased to hear you enjoy them.