Posted 7:07 a.m.

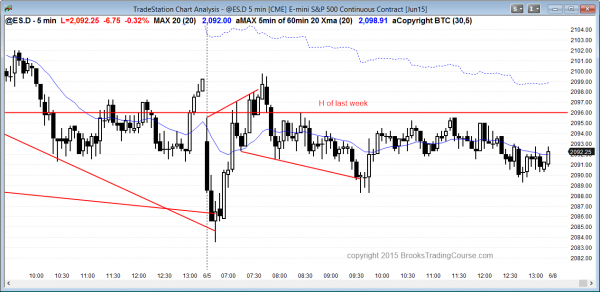

The Emini sold off strongly on the open, but the selloff tested the bottom of a possible 5 day expanding triangle. Also, yesterday’s late trading range is a possible final flag, and a smaller expanding triangle. The bulls are hoping for an early low of the day. The bears want any early reversal to fail at the moving average and form an opening reversal down for the high of the day.

At the moment, the reversal up was strong enough to make the Emini Always In long. A rally above yesterday’s trading range might go for a measured move up from the low to the open of the day, which would be at the 60 minute moving average. Because yesterday was in a trading range at this level for hours, the Emini might stall here, but traders will buy pullbacks.

The bears want a double top with the high of the first bar of the day. They will probably need many bars going sideways to create enough selling pressure to undo the bull reversal. The odds favor the bulls for the next hour or two, although the Emini might stall within yesterday’s trading range for a long time before deciding between rallying for a measured move up, and possibly even reversing back down.

My thoughts before the open: Trading price action after a big gap

The S&P Emini continues to slide down in a broad bear channel on the 60 minute chart. The bulls hope that it will become a bull flag. The bears hope that the bulls give up, leading to a strong bear breakout and bear trend. The Emini sold off on the report this morning, but had a strong bounce, and Big Down Big Up usually means Big Confusion and a trading range. If the day session opens here, it will gap down on the daily charts. As you know, I think that the Emini will correct at least 10% this year. However, all of the prior attempts to reverse down have failed. This one will as well unless the character of the market finally changes. The failures are caused by the lack of follow-through. Traders learning how to trade the markets need to see this as trading range behavior. The price action trading strategy is to assume that all breakouts fail until one finally begins to have strong follow-through. At that point, high probability trading is to bet on the bear trend. With this big gap down, there might be initial follow-through selling in the first hour on the daily chart, but the Emini usually has to get closer to the moving average before it decides whether to trend up or down. A big gap increases the chances of a trend day, and traders learning how to become a day trader need to be ready for a trend day, even if the Emini is in a trading range for an hour or two.

Today is Friday and weekly support and resistance is important. The weekly moving average has been great support for months, and it is currently around 2080. Last week’s low is 2096.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini reversed up from both 5 minute and 60 minute expanding triangle bottoms, but then spent the day sideways in a limit order market. It closed below last week’s low, but above yesterday’s low

This week had 5 doji bars on the daily chart, and it is slightly oversold. The selloff is more likely a bear leg in a trading range than in a bear trend, although the close was below last week’s low, creating a possible measuring gap. Also, the weekly moving average is just below this week’s low, and it is a magnet.

Best Forex trading strategies

The wedge top in the 60 minute EURUSD is having its 2nd leg down this morning, and this is a breakout below a lower high major trend reversal. The dollar became very strong on today’s unemployment report. However, the selloff in the EURUSD is now testing the bottom of the wedge at around 1.1080, and this is an area where it might bounce.

The selloff from a wedge top usually falls to around the start of the wedge and then it bounces there as bears take profits and bulls hope for a double bottom. As big as this selloff is, traders learning how to trade the markets must understand how candlestick patterns work. It is also helpful to understand how the bulls and bears view support and resistance. Forex strategies must include an understanding of sell vacuums and 2nd leg traps, and this strong selloff might be an example. The bears need follow-through. Until they get it, this strong leg down is still just a bear leg in a trading range on the 60 minute chart.

The bulls need a base on the 5 minute chart or a strong reversal up, which is less likely. The selloff was so strong that the first reversal up will probably fail and then test back down. If the bulls can prevent a channel down after this bear spike, they then can create a buy pattern, like a major trend reversal. The bears want a channel down and a measured move down after this bear spike (breakout). The odds are that the Forex market will go sideways for 20 or more bars as traders discover which alternative will win.

This same big breakout in favor of the dollar is present on all markets, and the same process applies. For example, the selloff in the AUDUSD is very strong, but the Forex market is now at the bottom of its 5 month trading range on the daily chart, and the bulls will try to create a double bottom over the next few days and then a major trend reversal. The bears need a strong bear breakout. Although they have one on the 60 minute chart, they do not have one on the daily chart.

The selloff on the 5 minute chart is strong enough to make lower prices likely, just like with the EURUSD, at least for a while today, but because the Forex markets are close to support and the dollar move was climactic, they will probably soon enter a trading range.

However, the first rally will probably be limited and the best the bulls (dollar bears) can hope for today is probably a trading range. The bears clearly have momentum and the odds favor continued trending after the breakout until the market enters a trading range that lasts at least 20 bars.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.