Presidential election stock market rally or correction

Updated 6:53 a.m.

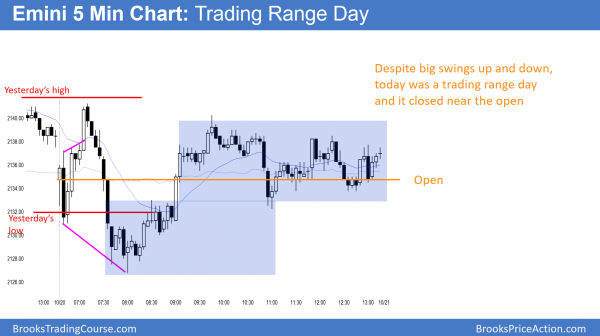

The Emini fell below yesterday’s low on the 2nd bar to trigger the low 2 short on the daily chart. Yet, it then reversed up on the 3rd bar and limit order bulls were able to make money. Therefore, the odds of a big bear trend day fell. Furthermore, the odds of another day with a lot of trading range price action increased.

At the moment, the micro double bottom up from yesterday’s low was strong enough to make the Emini Always In Long. Yet, limit order bears made money on the 5th bar of the day on a pullback from a new high. This increased the odds that today will have a lot of trading range price action, and it reduced the chances of a strong bull trend. Furthermore, it increased the chances of a trading range lasting 1 – 2 hours.

While the bears might still get a micro double top at the moving average and an early high of the day, the odds are that the best they will get over the next hour is a trading range.

Pre-Open Market Analysis

Tuesday was a sell signal bar on the daily chart. Yet, yesterday traded above its high. Because of the 4 month trading range, even if the bears got their sell signal, the odds were that the trading range would continue. While the bulls are still rallying up from their double bottom, the rally is weak. The Emini therefore remains in breakout mode.

Yesterday was another Low 2 sell signal bar. Yet, because of the tight trading range, it is more likely that there will be buyers below yesterday’s low.

Overnight Emini Globex session

The Emini is down 5 points in the Globex market. Because it is failing at the daily moving average and there is a Low 2 bear flag, traders should be ready for a possible bear trend day.

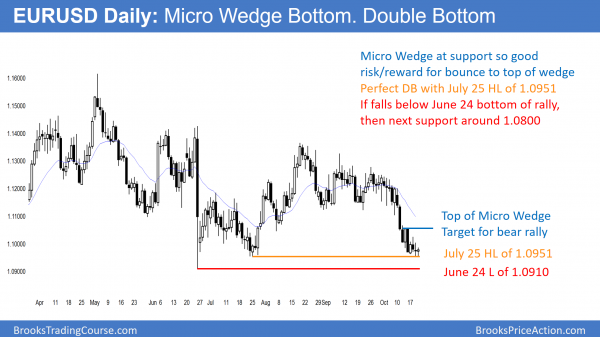

Forex: Best trading strategies

The daily chart of the EURUSD Forex market formed a double bottom with the July 25 higher low. It has also formed a Micro Wedge over the past 6 days.

Because the 240 minute EURUSD Forex chart stabilized yesterday after breaking to a new low, bulls are trying to create a Wedge Bottom reversal. Yet, they need a good buy signal bar or a strong bull breakout. Their 1st target is the top of the Wedge at 1.1050. Since the bears are losing momentum, it likely that the bulls will get a two legged rally over the next couple of days.

While the bears know that a strong breakout below the July and June lows in unlikely, they will continue to try until the bulls create a credible reversal. Yet, if the bears succeed, they will try to extend the breakout to below the December 2015 low of 1.0539.

Overnight EURUSD Forex sessions

The daily chart formed an exact double bottom with the July 25 low of 1.0951. The target for a bear rally is the top of the 6 day wedge at 1.1057. For those lucky enough to buy with a limit order a few pips above, they are now risking about 4 pips to make about 100 pips. While the probability is only about 40% if a trader puts his stop below the double bottom, that still creates a strong Trader’s Equation. If he uses a stop 10 – 20 pips below, his probability might be 50% or more.

What happens below the double bottom? There is a 50% chance of a breakout and swing down. Furthermore, there is a 50% chance of buyers below and then another bottom attempt.

Just having a Micro Double Bottom and a double bottom is not enough. The bulls need a strong reversal up. In the 7 hours since reversing up, the EURUSD is up only 17 pips. Hence, it is still in a bear channel on the lower time frames. Since the bulls have spent a long time overnight and have been unable to left strong up from support, the probability is that the EURUSD will fall below the double bottom. At that point, there would probably be either a strong move up or down.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Despite big swings up and down, today was a trading range day. Limit order traders who used wide stops and scaled in made money all day.

The Emini oscillated around the open, 60 minute moving average, and August 2 low all day. It was the 7th day in a tight trading range on the daily chart. It is still therefore in breakout mode.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al

I went short at 1.0972 (10mins after ECB news conference) expecting that buyers will have SL below 1.0974 and if my trade is triggered then it will be outside down bar (based on hourly chart). But sudden reversal up gave me almost no chance at all to tighten stop or even reverse it until it was too far where I did not want to buy.

Was it reasonable trade to go short at 1.0972?

Many Thanks

In general, if I think news will move a market, I usually wait at least 2 bars before entering because there is a 50% chance of a reversal, and the initial moves can be big, like today. Also, I don’t use fundamental information when I trade, although many traders do.